In case you missed it on Tuesday, Carter Worth, technician extraordinaire from Cornerstone Macro Research, and my Options Action Co-panelist made a compelling case to take profits in the bank stocks as they have shown very poor relative performance to the broad market in 2017, watch here:

The Chart Master Carter Worth makes a contrarian call on the banks $XLF pic.twitter.com/KG2v33BH1q

— CNBC’s Fast Money (@CNBCFastMoney) March 14, 2017

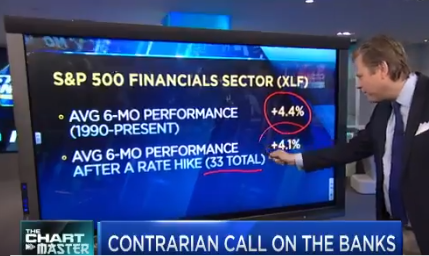

Carter goes on to make the case that bank stocks since 1990 actually don’t outperform in the six months after a rate hike:

If you agree with Carter, and want to fade the bank stock rally you might want to first consider the disparate performance among the three largest moneycenter banks here in the U.S., JP Morgan (JPM) which is up nearly 13% ytd, and 30% since Nov 8th, Bank of America (BAC) which is up 6% ytd, and up 46% since Nov 8th and Citigroup (C) which is up only 2% ytd and up 21% since Nov 8th.

Let’s pick on the underperformer. Citi is scheduled to report Q1 results April 13th, prior to the open. With the stock at $60.50, the at the money April 13th weekly 60.50 straddle (the call premium + the put premium) is offered at $2.80, implying a 4.6% move in either direction between now and then.

If you are inclined to pick a direction, you can get near the money participation for far less. Taking a quick look at the one year chart, $60 appears to be healthy near-term support, while the low made in Feb, the low for the year so far seems like a fairly reasonable downside target if the yield curve continues to flatten and forward guidance reflects the uncertainty of the pace of rate hikes and deregulation, two of the main drivers of the sector’s performance since the election.

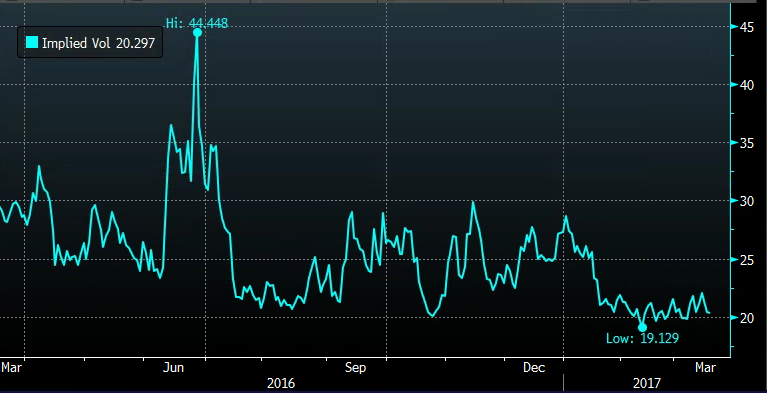

Short-dated options prices are cheap as chips, with 30 day at the money implied volatility very near 52 week and multi-year lows, just above 20%:

So what’s the trade?

C ($60.70) Buy April 60 / 55 put spread for $1

- Buy 1 April 60 put for 1.15

- Sell 1 April 55 put at 15 cents

Break-Even on April Expiration:

Profits: up to 4 between 59 and 55 with the max gain of 4 below 55

Losses: up to 1 between 59 and 60 with max loss of 1 above 60

Rationale – close to the money bearish positioning with a 4 to 1 potential payout. A 50% premium stop on the upside makes sense and patince could pay off if the stock heads lower as 55 is easily identifiable support.