Event: Pepsico (PEP) is scheduled to report fQ4 results tomorrow morning before the open. The options market is implying a one day post earnings move of about 1.7%, which is rich to the average one day post earnings move of only 1% over the last 4 quarters, but a tad shy of the 10 year average one day post earnings move of about 2%.

Price Action / Techncials: despite under-performing the broad market massively since the election in early November, shares of PEP are up about 1% on the year, a couple percent from its Nov 8th, 2016 close, PEP has massively out-performed Coca-Cola (KO), which is down nearly 6% from its Nov 8th close, and down nearly 15% from its 52 week highs made last April and less than 2% from its 52 week lows made in early December.

While shares of PEP are well off of their Dec lows, about 7%, near term the stock appears to be approaching some technical resistance at the convergence of the downtrend from its 52 week highs from May 2016 high, and the breakdown level from early November:

Talking a longer term view, the stock has held its long term uptrend like a boss (aside from the August 2015 flash-crash) with overhead resistance at the 2016 all time high from May near $111:

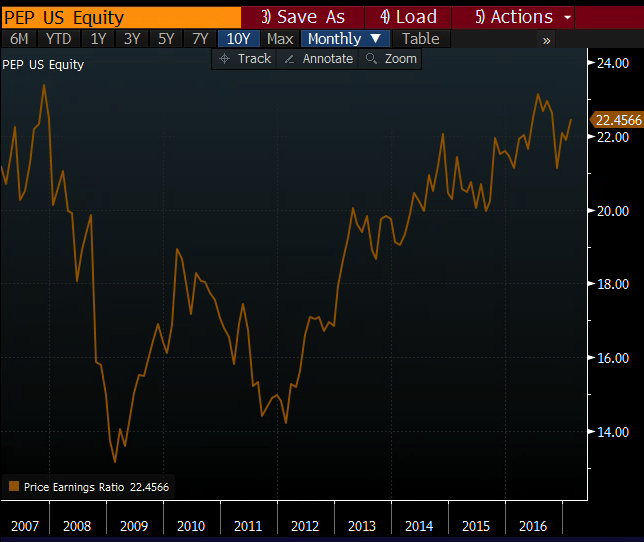

Shares of PEP traded about 21x expected 2017 eps growth of 8%, above 2016 eps growth of what should be 5%, with a expected 3% sales growth. On a trailing P/E basis PEP is getting very near its 10 year high:

Calls on the upside are dollar cheap, so not a lot of great ones to sell (e.g the March 110 calls are .36) so those looking to add some yeild to an existing position don’t have anything really meaty. The same goes for selling an upside call to finance a put spread. The options market is not expecting fireworks. Adding leverage to an existing long also isn’t that exciting. The Feb 108/109 1×2 call spread is even and could provide up to an additional 1 dollar in leverage if the stock goes higher but it’s effectively selling the stock at 110 if PEP is above 109 on Friday. The best hedge on the board is probably a simple Feb 105 put buy for .35, but that’s only for those long and willing to lose that on a small move lower or a move higher. It would protect below 104.65 if the earnings were disastrous.