Event: Disney (DIS) reports their fiscal Q1 tonight after the close. The options market is implying about a 3.5% one move tomorrow in either direction, which is a tad rich to the average one day move of about 4% over the last 4 quarters, and in line with the 10 year one day post earnings average of about 3.4%.

Shares of DIS are up 4.5% year to date, and up about 25% from its 52 week lows made about year ago, the stock might find mild technical support at $106.75, the early Jan breakout level to new 52 week highs, but on a miss and guide down the stock likely trades back to $100 in the coming days/weeks:

The 5 year chart highlights long term support very near its 200 day moving average (yellow line) at $99/$100, also the gap level in early 2015, while the obvious upside target is the Aug 2015 all time high of $122:

Shares of DIS trade at 18x expected fiscal 2017 eps that consensus has growing 4% year over year, its lowest eps growth rate since its 2009 decline, and on expected sales growth of 3%, its lowest growth rate since 2012.

Wall Street analysts remain mixed on the stock with 22 Buy ratings, 11 Holds and 3 Sells with an average 12 month price target of only $115, about 5.5% from current levels, and 5.5% below the prior all time high.

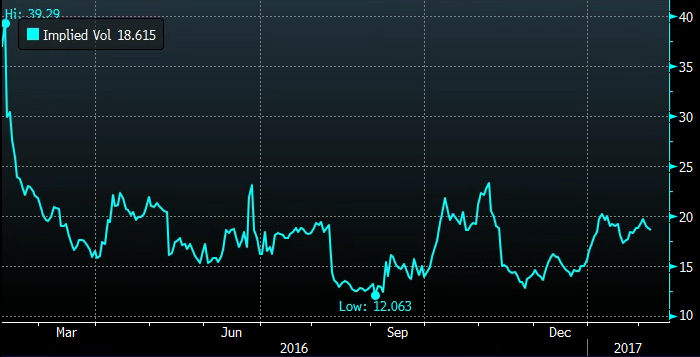

My view into the print: DIS could pull an Apple (AAPL) meaning a quarter that is good enough, and an outlook that is not as bad as expected, and shareholders pile back in attempting to get the stock back to its 2015 all time highs. But given the stock’s recent strength, any outlook worse than expected would clearly have fast money coming out of the stock. Regardless of your view into the print, short dated options prices are fairly reasonable, making hedging strategies for long holders or long premium directional strategies fairly attractive into the print, especially if you felt the implied move was reasonable to cheap. 30 day at the money implied volatility (the price of options – blue line below)at 18.6% is very near the mid point of the 11 month range (ex-out the early 2016 vol spike) and likely sees prices drop to mid to low teens following the print:

So what’s the trade?

For those that are long stock, you might consider a short dated put spread to protect against a move lower in line with the implied move:

Hedge/Bearish

vs 100 shares of DIS (109.40) Buy the Feb 108/103 put spread for 1.00

- Buy 1 Feb 108 put for 1.20

- Sell 1 Feb 103 put at .20

Rationale – This costs just 1.00 and protects up to 4.00 on a move lower. The ideal situation is for the stock to be higher by more than 1.00 on the event… on its way to previous highs. If the stock does disappoint you have protection down to 103 and no protection below. As an outright trade for bearish positioning this is pretty binary and turning it into a fly could make sense, or tightening up the lower put to reduce premium at risk as it could be pretty worthless on a move higher on earnings.

or

For those long stock who are worried about a greater than expected move to the downside, but still want the ability to participate on potential upside over the next month or so, you might consider a near the money defined risk stock replacement:

Stock Alternative/ Replacement

in lieu of 100 shares of DIS (109.40) Buy the March 110/120 call spread for 2.05

- Buy 1 March 110 call for 2.25

- Sell 1 March 120 call at .20

Rationale – This trade participates in upside to the previous highs with a breakeven of 112.05. It can be worth 10 at or above 120. the key to this is that if DIS pulls back significantly on this earnings or over the next month the most that can be lost is 2.05, or less than 2% of the underlying. Compare that to the 3.5% implied move on the event itself and your risk is defined. The worst case scenario for this trade is if the stock goes nowhere and is unable to get above the breakeven of 112.05. In that case, following earnings it would make sense to roll and re-establish harder deltas to duplicate stock, but still with defined risk.