After a 2 Years of Consolidation, It’s time to put Target Corp. (TGT) in Your Sights

Target Corp. (TGT) is a very large general merchandise retailer many of us visit from time to time to buy anything from food to pharmaceuticals, technology products to sporting good equipment, and home furnishings to kitchenware. The company operates about 1,800 stores in the United States. In the last 12 months, the company earned $3.3 billion (4.75/share) on 70.4 billion of revenue.

The retail environment is pretty tough these days. The SPDR S&P Retail ETF (XRT) is down about 9% since it peaked on December 8, 2016. At the same time, the S&P 500 found a way to inch up at the margin. Retailers like Kohl’s and Bed, Bath & Beyond fell much harder, down 31% and 20% from their recent peaks respectively due to poor financial performance. Over the past 4 years, TGT has not had any revenue or EPS growth. This is reflected in the company’s share price performance…

For the past 2 years, the company has traded within a trading range of $67.50 on the low side. and $82.50 on the high side. Interestingly, the share price currently trades marginally above the high touched 3.5 years ago in Q2-1013. This sideways action has weighted on the bulls and the sentiment has become quite negative as a result. We see this in recent articles in the financial press. These articles resurrect past sins, such as the customer credit-card data breach in 2013, or the failure to compete successfully in Canada. (TGT closed their Canadian operation in 2015.) When investors dwell on past issues, it’s a sign their emotions are getting to a pessimistic extreme.

Investors want top and bottom line growth and since that has been flat for a number of years now, there is reason to be cautious. Critics like to point to the fact that only 5% of the company’s revenues comes from online sales. They look past the fact there is a 26% uptick in those sales YOY in Q3-2016. TGT is proving it can compete in the online space. Frustrated bulls are simply impatient.

We think the financial performance and negative sentiment is more than priced into the company’s share price. TGT trades at a 15 times trailing earnings and enterprise value to operation cash flow (EV to EBITDA) is just 6.4. In our view, these valuation multiples fully discount a no growth with the possibility of negative growth over the next year. We like situations like this as because any growth either as a growth in market share or macro economic expansion would be a positive surprise that would probably lead to higher prices.

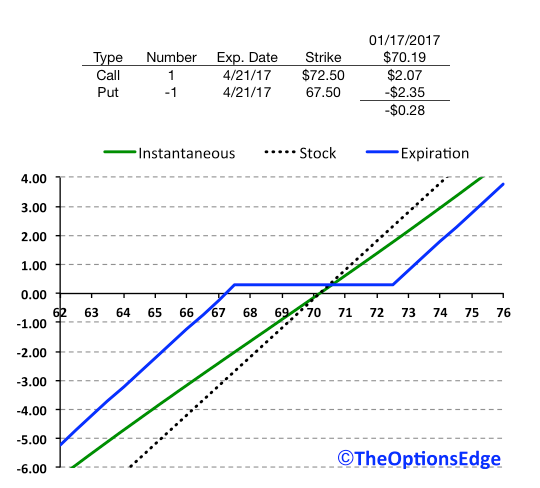

In the final analysis, we think there is more upside risk to the share price than downside risk, giving investors a buying opportunity. Investors that agree with this thesis might consider shares of this stock if it helps diversify their portfolio and fits with their longer-term strategy. Since the stock is in trading at the lower end of a wide trading band, the share price could pop at any time. By the same token, they could fall all the way to the lower trend line before moving higher. If you believe the share might trade lower first but do not want to miss out should they trade higher right away, bullish investors might consider a risk-reversal as a stock replacement strategy. With the share price trading at $70.19, the following structure makes sense:

When placing the trade at the indicated levels, the investor collects $28 per risk reversal up front. Working with the April expiration should allow enough time for the trade to work out even if the stock trades down modestly near term. The effective price where you would be put the stock is $67.22, about 4% lower than the current price, allowing for some margin of error. It is important to recognize this margin of error comes with a cost. The big gains on this structure will not kick in until the share price breaks above the strike price of the call or $72.50, which is about 3% above the current share price. I between those two levels you are neither long nor short the stock on April expiration, and you simply collect the .28 credit.

A random walk suggests there is a 62% chance this trade succeeds. Since TGT trades at a significant discount to the market PE multiple and the share price is approaching trend-line support, we think the odds of success are better than a random walk, and there is more upside potential than downside risk.