Good Morning, Guy and I are back with our weekly Set-Up, looking at the week ahead and discussing single stock and macro stories that will drive the market action this week. Watch below and see my notes below the video.

Buffett likes…..GOLD!

The S&P 500 (SPX) threatening a breakout:

Despite treasury yields firming a tad,

The U.S. Dollar can’t seem to find a bottom:

And I am a little surprised that Crude Oil doesn’t act better as it seems flatlined around $40 for two months, just below its 200-day moving average and above its 50-day:

I highlight this because back in 2013-2014 when rates had a little taper tantrum, quickly moving the 10-year treasury yield to 3%, the dollar rallied like a boss and started a massive decline in crude…

Our friend Tom Lee from Fundstrat had this comment in his morning note about high yield bond issuance:

Despite the concerns about progress around new fiscal stimulus from Washington and the rise of bond yields, demand for high-yield bonds remains very strong. High-yield bond issuance issued $19.9 billion in bonds, which is the 4th largest on record and follows the week prior with $22.2 billion, the 3rd largest on record. According to JPMorgan, HY bond issuance in August MTD is the most active August on record.

Here are some top tech stories from the weekend that my friend Jared Weisfeld Tech Specialist at Jefferies highlighted in his morning note… notice a theme?

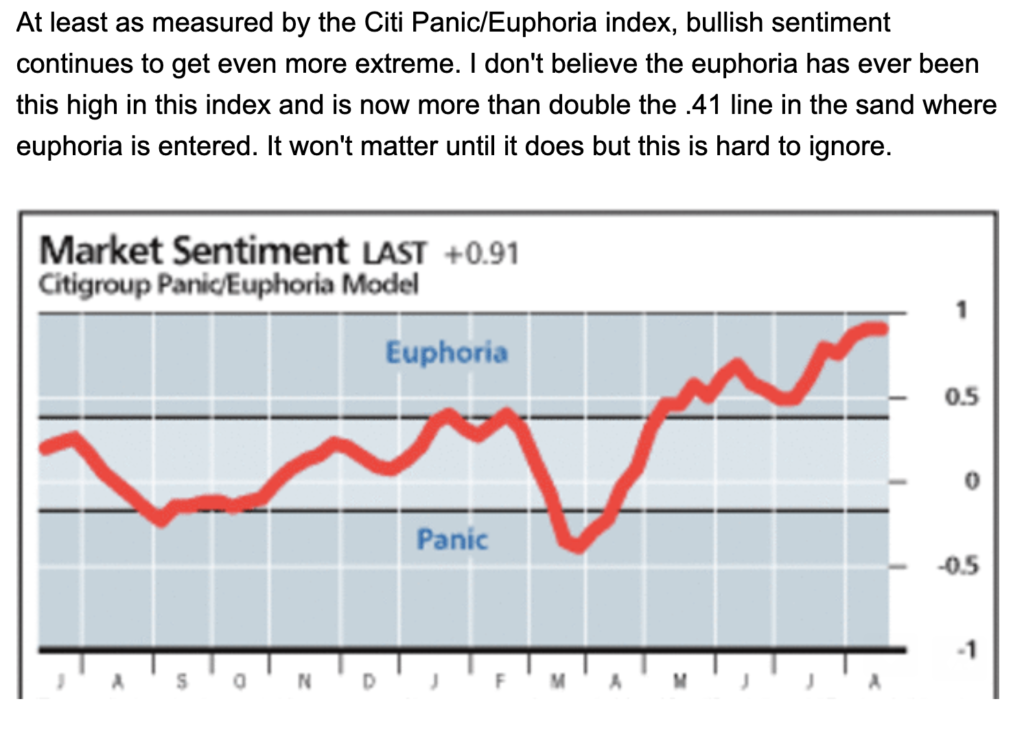

And my friend Peter Boockvar of Bleakley Advisors points to a sentiment gauge that is getting a little frothy.

Retail earnings are the main event this week…with a little Tech sprinkled in…

Tomorrow (Tuesday) before the open we will have earnings from Walmart (WMT), The Home Depot (HD), and Kohls (KSS)…

WMT: the implied earnings move in the options market is about 4% which is rich to its 2.5% average one-day post-earnings move over the last four quarters. Shares of WMT are up 11.5% on the year, trading very near its all-time high, with all of those gains coming this summer since the announcement of their Walmart+ service to compete with Amazon Prime…WMT is trading at 26x the current fiscal year’s earnings, a new 15-year high.

HD: the implied earnings move in the options market is about 4.1% which is rich to its 3.5% average one-day post-earnings move over the last four quarters. Shares of HD are up a whopping 28.5% on the year, and up 85% from its March lows. The stock is up 12% on a runaway breakout since the start of July, trading 27x current fiscal year earnings, a new 20-year high. The breakout level near $250 should serve as healthy technical support:

KSS: the implied move in the options market is about 12% vs the average one-day post-earnings move of 9.25% over the last four quarters (all to the downside). To suggest KSS has been volatile this year and that it has massively underperformed year-to-date would be an understatement. Despite having rallied 115% from its early April low, the stock is still down 54% on the year and down 73% from its all-time high made in late 2018. The early March breakdown level near $33.50 should serve as staunch technical resistance for some time:

Wednesday before the open we have three more retail earnings reports, Target (TGT), Lowe’s (LOW) and TJ Maxx (TJX):

TGT: the implied earnings move in the options market is about 5% which is shy to its 10% average one-day post-earnings move over the last four quarters. Despite being up 60% from its March lows, shares of TGT are up only 6.5% on the year but have recently brokering out to a new all-time high. $130 should serve as near-term technical support. Trading 26x current year’s eps is a new 15-year high:

LOW: the implied earnings move in the options market is about 4.5% which is shy to its 5% average one-day post-earnings move over the last four quarters. Shares of LOW are up nearly 30% on the year, much like HD, on a runaway breakout since making new highs in early July and up a whopping 155% from its March lows. The breakout level near $125 should serve as massive technical support for the time being. LOW’s trades at a considerable discount on a price to earnings ratio vs HD at just 21.5x:

TJX: the implied earnings move in the options market is about 5% which is rich to its of about 4% average one-day post-earnings move over the last four quarters. Shares of TJX have come a long way since its March lows, up about 77%, but still down 5% on the year, and about 11% from its all-time high made in February. The stock is up 12% this month, bouncing off of its uptrend from the March lows, now threatening to break out above its June high and its early March breakdown level just below $60

There is a big one in tech this week…. and that is Nvidia (NVDA)… reports Wednesday after the close. The options market is implying about 7.5% weekly move, or about $35. Over the last four quarters, the stock has moved about 5% the day after earnings. Shares of NVDA have nearly doubled in 2020, up 155% from their March lows, and have been making new all-time highs what feels like daily for the last few weeks. Investors are expecting continued upside from the “stay at home trade” as NVDA’s exposure to gaining should help. At 56x fiscal 2021 and 46x next fiscal year, the stock is trading as investors are expecting beat and raise.

Thursday before the open Alibaba (BABA) will report its earnings. The options market is implying about a 5% one day move which is rich to its 4% average over the last four quarters. Shares of BABA are up nearly 20% on the year, and since its early July breakout to new highs, the stock has been range-bound, but its breakout level near $230 should serve as formidable near-term technical support:

Friday before the open Deere (DE) will report its fiscal Q3 earnings. The options market is implying about a 4% one-day post-earnings move which is basically inline its average over the last four earnings reports. Shares of DE are up 10% on the year, up 85% from its March lows, and having just recently broken out to a new all-time high. $130 should serve as near-term technical support. EPS is expected to drop 38% this year on a nearly 20% revenue drop with analysts not expecting the company to get above its 2019 peak until 2022.