I hope you had a great weekend. Guy Adami and I are back with The Set-Up…what we will be watching this week and likely discussing each night on Fast Money:

The big story from last week was the rotation out of mega-cap tech stocks into small-caps, cyclicals, and stocks hard hit by the lockdowns like hospitality and transportation. As Guy and I discussed Friday on Straight Talk, we have seen these sorts of rotations over the last few months, in hindsight, it appears that these stocks were merely catching their collective breaths before they staged another leg higher. Something felt different to me last week, like a sort of fever broke… Something felt different last week, with AMZN closing near the lows of the week, down nearly 12% from its opening gap Monday morning which was a new all-time high round-tripping the move from the prior week:

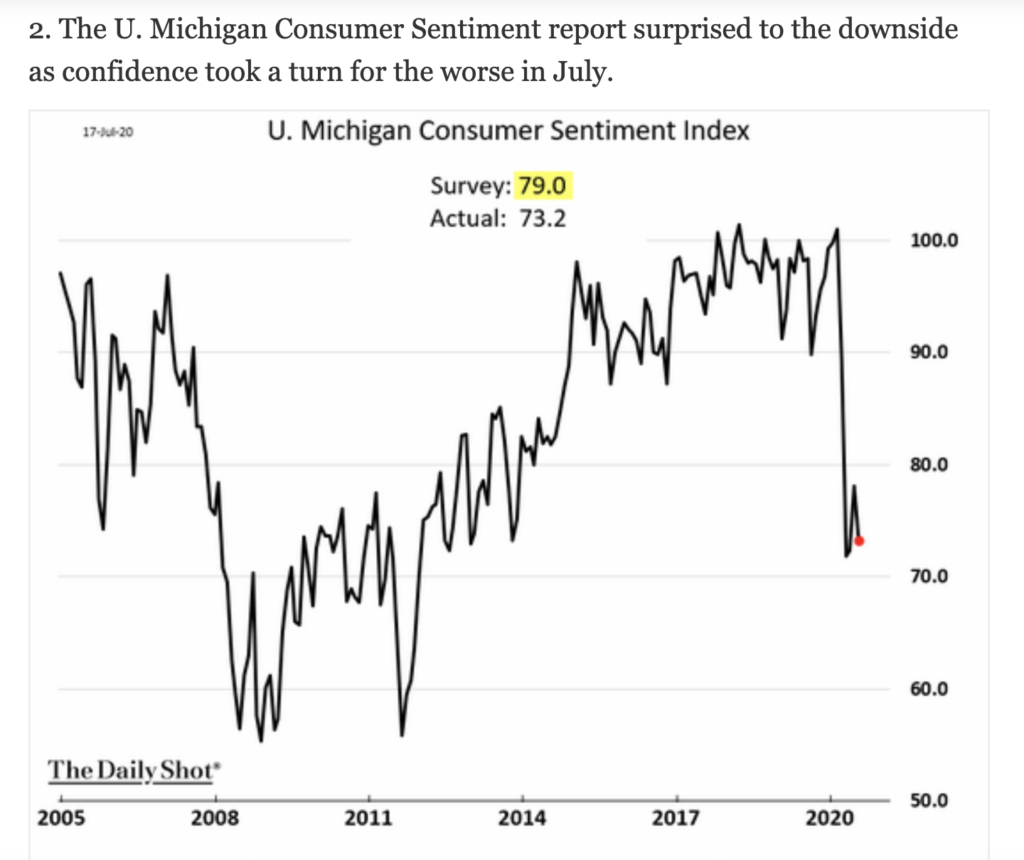

Consumer Confidence has dipped in July, I suspect the unemployment benefit cliff is starting to weigh on those with job or wage insecurity:

We spent some time talking about the commentary from the CEOs of U.S. banks, it does not paint too rosy of a picture for the recovery in the back half of the year.

This week the main event will be earnings once again (after market close unless noted bmo) and implied moves in the options market:

Monday:

IBM – implied move ~$7 or 5.5% vs 4% average one-day move over the last four quarters.

Tuesday:

KO (bmo) – implied move ~3.5% vs 3.5% average one-day move over the last four quarters.

SNAP – implied move ~14.5% vs 19% average one-day move over the last four quarters.

TXN – implied move ~5.5% vs 5.15% average one-day move over the last four quarters.

UAL – implied move ~8% vs 4% average one-day move over the last four quarters.

Wednesday:

MSFT – implied move $11.30 or ~5.5% vs ~1.5% average one-day move over the last four quarters.

TSLA – implied move $223 or ~15% vs ~11% average one-day move over the last four quarters.

BIIB – implied move ~6% vs ~10.75% average one-day move over the last four quarters.

Thursday:

T (bmo) – implied move 3.2% vs ~3.35% average one-day move over the last four quarters.

INTC – implied move ~5.5% vs ~4.5% average one-day move over the last four quarters.

TWTR – implied move ~11% vs ~13% average one-day move over the last four quarters.

LUV (bmo) – implied move ~6% vs ~3% average one-day move over the last four quarters.

FCX (bmo) – implied move ~5% vs ~4% average one-day move over the last four quarters.

Friday:

VZ (bmo) – implied move ~2% vs ~1% average one-day move over the last four quarters.

SLB (bmo) – implied move ~4.5% vs ~2.5% average one-day move over the last four quarters.

AXP (bmo) – implied move ~3.5% vs ~2% average one-day move over the last four quarters.