Over the weekend I got a question from a viewer/reader that I thought might be helpful for me to share my answer with many of you who might be wondering the same thing. I want to preface the answer by saying that, for the most part, all trade ideas that I detail on RiskReversal, CNBC and Fidelity’s In The Money I do with the idea of offering an alternative to buying or selling the underlying stock or etf, with defined risk and with a close eye on the probability of likely outcomes. All of the above feeds into the main reasons I often detail vertical call or put spreads so that the reader/viewer can best get their head around risk vs reward.

View – Alex:

You always construct bullish spreads with Calls and bearish spreads with Puts. What’s the difference between a bullish call spread and a bullish put spread?

My Answer:

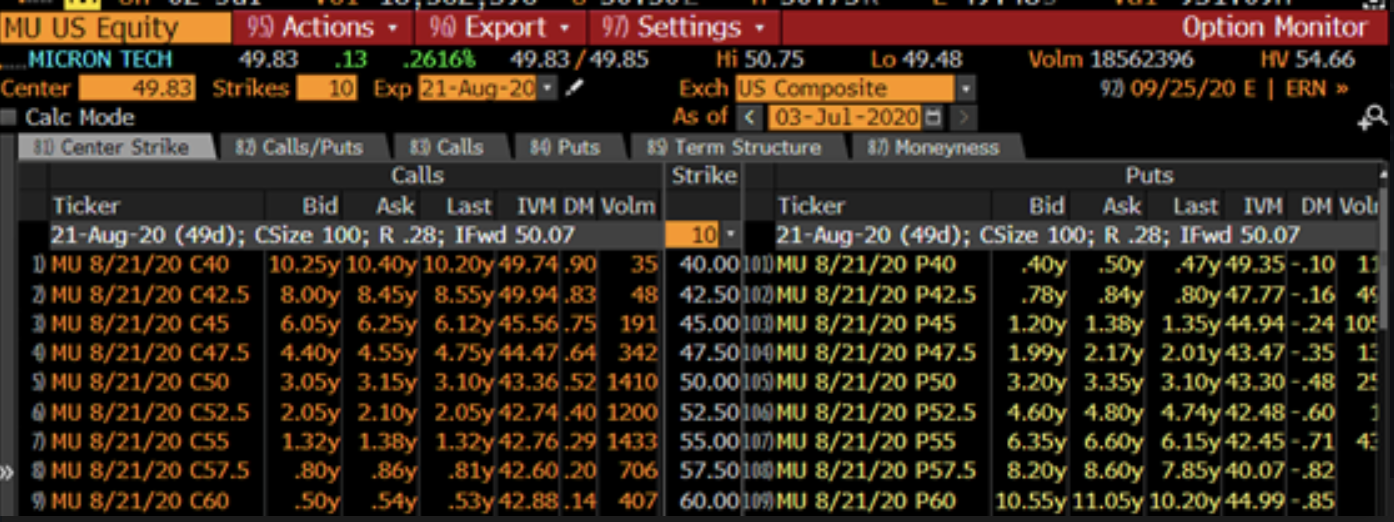

Alex, thanks for the question, and it is a very good one… Let’s look at Micron (MU), August expiration options chain.

To your question, a lot of it has to do what you are willing to risk vs your potential reward.

If I am bullish, and targeting $60 over the next nearly two months, and I want to express this view using options with DEFINED RISK, I can buy a call, call spread (or other complicated strategies like butterflies), or sell a put (which defines risk to a certain point) or sell a put spread. Let’s focus on the spreads to answer your question.

Call Spread with the stock closing yesterday at essentially at $50, the Aug 50 – 60 call spread costs $2.60 (buying 1 Aug 50 call for 3.10 & selling 1 Aug 60 call at 50 cents). The trade breaks even at $52.60, up 5%, has a profit potential of up to $7.40, or up to 15% of the stock price with a max potential gain of $7.40 if MU is $60 or higher on Aug expiation, up 20%. So I would be risking 5% of the stock price, for a break-even up 5%, with a max potential gain of 15% if the stock is up 20% on Aug expiration. The options market is saying there is about a 40% probability of break-even on Aug expiration, about a 30% probability that the stock will be at $55 on Aug expiration, at which point the trade would be worth $5, or nearly a double, a 20% probability that the stock will be at $57.50 and be worth $7.50 and only a 15% probability that the stock will be at $60 and be worth $10 nearly 3x the premium at risk. I can figure this out be looking at the delta of each option right now. The delta will change as the stock price moves in and out of the money of the strikes, in the case of calls, they will be worth more as they go greater in the money and less as they go further out of the money. The opposite for puts.

Let’s look at selling a put spread, If I were to SELL the Aug 50 – 40 put spread I would receive $2.60 (selling 1 Aug 50 put at $3.10 and buying 1 Aug 40 put for 50 cents). This trade only has a profit potential of $2.60, or about 5% of the stock price, but has risks of losses up to $7.40, the difference between the short premium received and the rest of the width of the $10 wide put spread, so in this case compared to above, rather than risking $2.60 to possibly make up to $2.60, but risks losing up to $7.40. Now the major difference is that the probability of making the whole $2.60 is much higher than the probability of breaking even on the upside of the call spread. For instance, on Aug expiration if the stock is $50.01 then the seller of this put spread would receive the entire premium, with the stock near $50 this has a nearly 50% probability, basically, it is a coin flip. The delta on the Aug 47.50 put is about 35, suggesting that there is about a 35% probability that this trade is about break-even on Aug expiration, be below that the odds of losses greater than the LONG call spread start to decrease, there is about 25% chance the stock is at $45 which would equal a $2.40 loss on Aug expiration, a 15% chance of the stock being at $42.50 for a $4.90 loss and a 10% probability that the stock is at $40, down 20% for a $7.40 loss on Aug expiration.

So the major difference is that the long call spread has a high probability of a small loss, while a short put spread has a high probability of a small gain. While the long call spread has a low probability of a large gain, the short put spread only has the possibility of a 5% gain under the best-case scenario, so it really comes down to one’s conviction level and risk tolerance.