This morning in my post about The Set-Up video where Guy Adami and I discussed Apple’s World Wide Developer’s Conference which starts today we highlighted the potential for Apple to announce the long-rumored news that they will be using their own developed chips in place of Intels in their upcoming Macs:

Despite being a software event, the company often talks about or introduces new hardware, extrapolating a bit the company has been rumored to announce their own chip to go into Mac’s, displacing Intel… here is what my friend and Fast Money guest Jared Weisfeld, Tech Specialist extraordinaire at Jeffries had to say on the topic in a note to clients this morning:

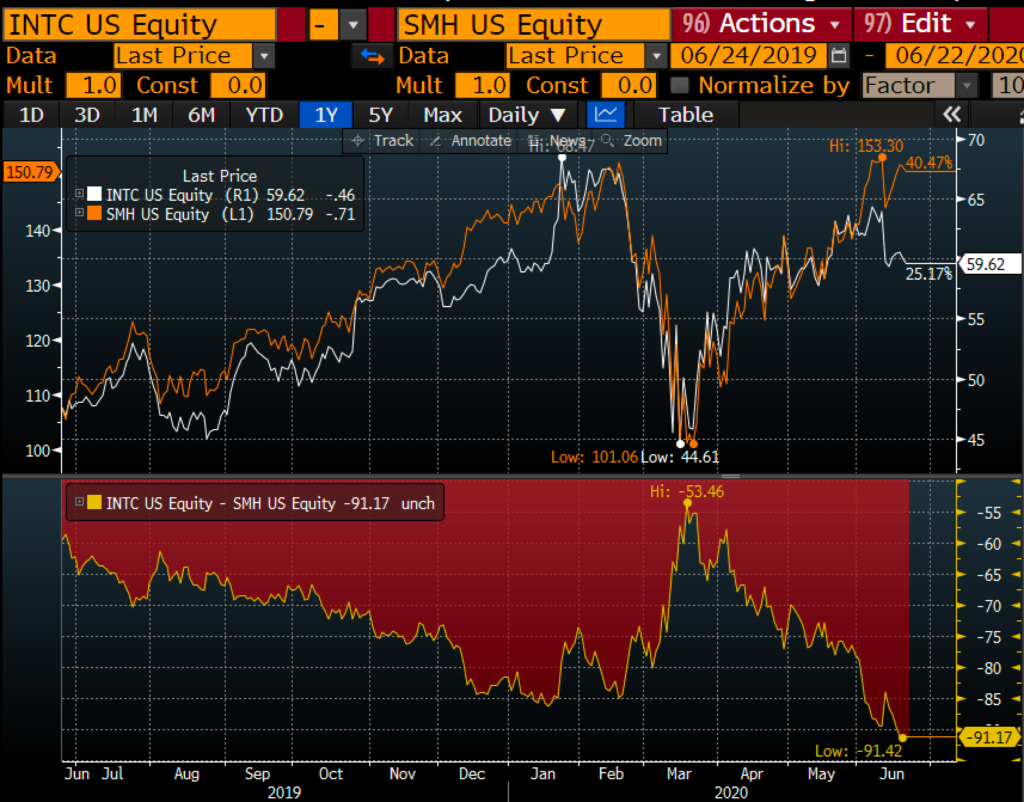

INTC Added to Favorite Names List. INTC has been a pretty big laggard with the stock making fresh 1 year lows vs. the SMH on Friday so perhaps WWDC marks the bottom when AAPL announces their internal chip solution for Mac? I would imagine this is a covering event for many. Over the weekend, I added INTC to my Favorite Names List given relative valuation and laggard status. The bear case is well known – everyone is concerned about sustainability of DCG trends and potential for PC weakness in the 2H as WFH benefits revert, but at just ~12x EPS and consensus estimates that have revenue growth decelerating by 3600bps (not a typo) between now and year-end, I think it’s a compelling set-up.

On an absolute basis, INTC is below the uptrend from the March lows… maybe we see a sell the rumor, buy the news in the stock?

No matter what Apple announces today, at least from Jared’s perspective that consensus has gotten way too bearish for the second half of this year.

Shares of INTC are unchanged on the year, vs the Nasdaq up 11% and the SMH up 6%, both within a couple of percent off of recent highs.

Earlier I asked, “sell the rumor, buy the news”? but the stock seems to want to re-test the April and May lows near $56 near-term.

So what’s the trade?

The next identifiable catalyst for the stock will be its Q2 earnings which should come in about a month. If I were inclined to play for shifting sentiment after their print I might consider a call calendar, seeking a shorted dated out of the money call and using the proceeds to help finance the purchase of a slightly longer-dated call of the same expiration that would catch their earnings, for instance…

Bullish Trade Idea: INTC ($59.60) Buy July 17th – July 31st 62.50 call calendar for 85 cents

-Sell to open 1 July 17th 62.50 call at $1

-Buy to open 1 July 31st 62.50 call for $1.85

Break-even on July 17th expiration:

The ideal scenario is that INTC is near 62.50 on July 17th expiration and the short 62.50 call expires worthless or can be covered for a small amount and you are left long July 31st 62.50 call for just 85 cents or about 1.5% of the stock price, which is your max risk, The main idea is that the stock remains range-bound with the goal of being near $62.50 prior to July 17th expiration, in which case the short call will have decayed while the long call will have picked up deltas off-setting decay.

The max risk of the trade is 85 cents on a sharp move lower than current levels or a sharp move above the $62.50 strike price.