This morning when U.S. stock markets opened down 2% one of the early bright spots was cloud-based software stocks with some like Zoom (ZM) quickly rallying 6% in the first hour of trading. This is something that we have seen for a couple of months now, the perceived winners of the pandemic, those companies who have not only seen the addition of hundreds of thousands, if not millions of new customers flock to their services but at current valuations, investors are wagering that they will maintain these customers and in the case of ZM that work and schooling will be changed for good.

What’s interesting about today’s price action in ZM is that it has held its gains all-day…now sporting a $67 billion market cap trading 37x sales:

As the S&P 500 (SPX) opened on the low and has rallied 3% to its now highs of the session

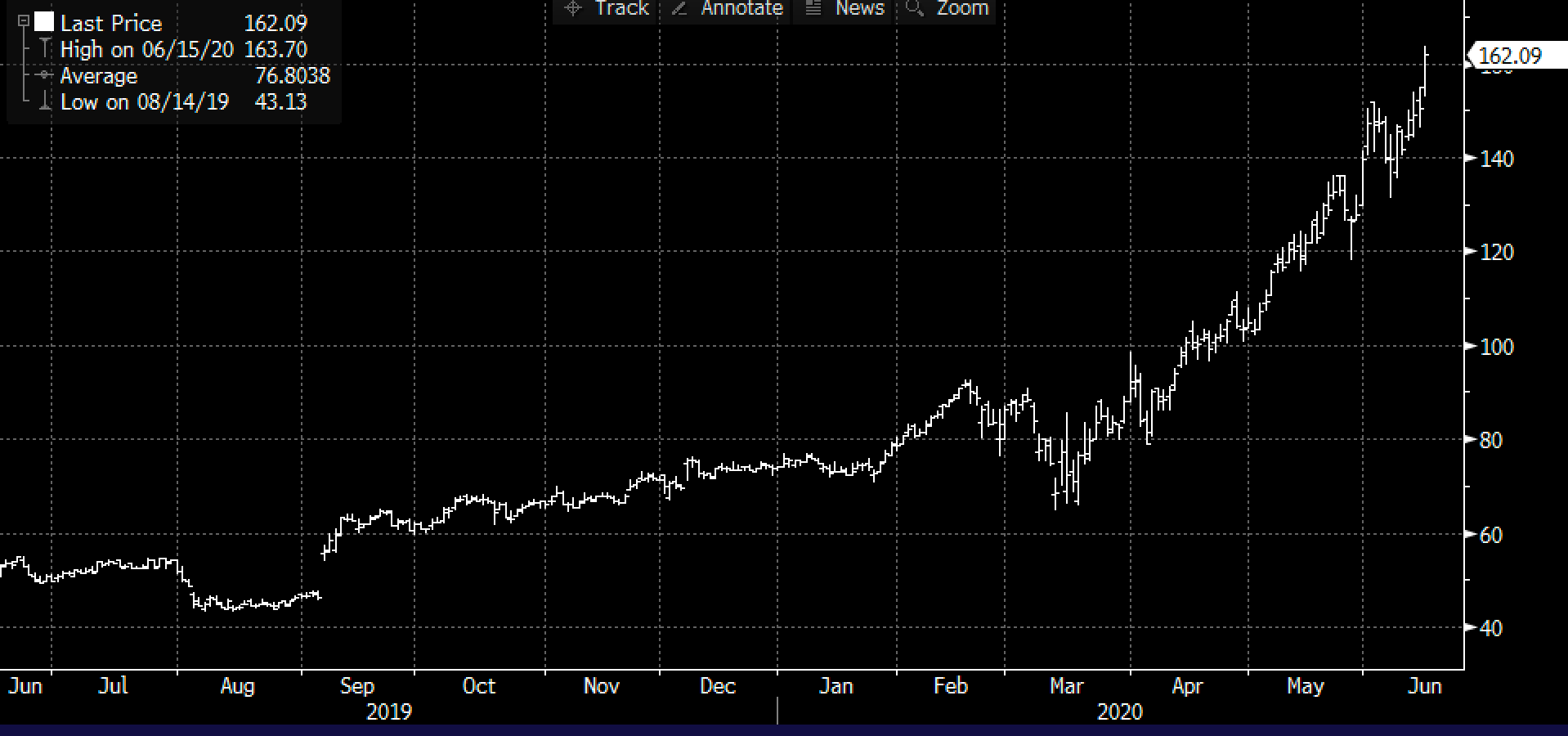

And it is not just ZM, shares of Crowdstrike (CRWD) are up 6.5%, threatening a new all-time high, up 211% from its March lows sporting a $21 billion market cap, trading 28x sales:

Datadog (DDOG) is trading up 5.5% today, up 188% on the year, sporting a $25 billion market cap and trading 43x sales:

DocuSign (DOCU) is up 7.5% today, up 150% from its March lows, sporting a $30 billion market cap and trading 22x sales:

I can’t be any clearer, this is what a stock market mania looks like, as the passive money piles into F’MAGA (FB, MSFT, AAPL, GOOGL, AMZN) the daytraders and hedge funds are running stocks that fit almost every cooky narrative that exists in the market at this unique moment in time.

I can’t tell you that it makes sense to short any of these stocks based on perceived fundamentals as there appears to be a scarcity of stocks that check these boxes at the moment, but I can tell you that stocks don’t grow straight to the clouds which appear to be the case with this lot. I would certainly be much more inclined to trade the momentum, if that means higher highs, with fairly tight stops, then to take a long term investment view in any of these names. They have pulled forward so much demand for their businesses, and possibly deservedly so, but growing into these valuations will be very hard when we see a deceleration in their growth and it is also worth noting that back in the last year or so when these companies IPO’d I suspect there were easy cases to be made how they could be acquired at fat premiums but larger tech incumbents but not at these market caps, not at these valuations.

SO w had risk-off this morning and clouds stocks ripped, and now we have risk-on and clouds stock have held all their gains, though caution to the wind I guess.

And it is odd that stock’s like Salesforce (CRM) are still in the penalty box since giving slightly cautious guidance a couple of weeks ago, which I thought made sense the time. While the stock is far from cheap on most metrics, it trades 8x sales, that are expected to grow 18% a year for the next two years off of a $20 billion base. If we were playing would you rather I’d play CRM for a breakout of its recent range, possibly for a move back to it February all-time highs near $195, instead of riding the momentum of the upstarts at this stage of the game.

But long premium options trades look far from attractive for instance if you thought the stock could breakout above $180 and rise to $200 by July expiration, the July 180 – 200 call spread costs $6, breaks-even at $186 and has a max gain of $14 at 200, up 12%. Not a great risk re-ward for one month to risk 3.3% to possibly make up to 8% if the stock is up 12%. When evaluating trade ideas it makes sense to consider our options, and in this case defined risk on the long side is far from attractive which might speak to the market we are in.