Toll Brothers (TOL) will report its fiscal Q2 earnings after the close. The options market is implying about an 8% one day move tomorrow, which is a tad rich to its 4-quarter average one-day post-earnings move of about 7%

Shares of TOL have been on a WILD 3-month ride… from 2-year highs, in early February the stock sold off 70% before touching levels not seen since late 2011 in late March, having since rallied 140%, but still down 20% on the year and 35% from the Feb highs. The stock is now flirting with key technical resistance or prior 1-year support, and its 100-day moving average:

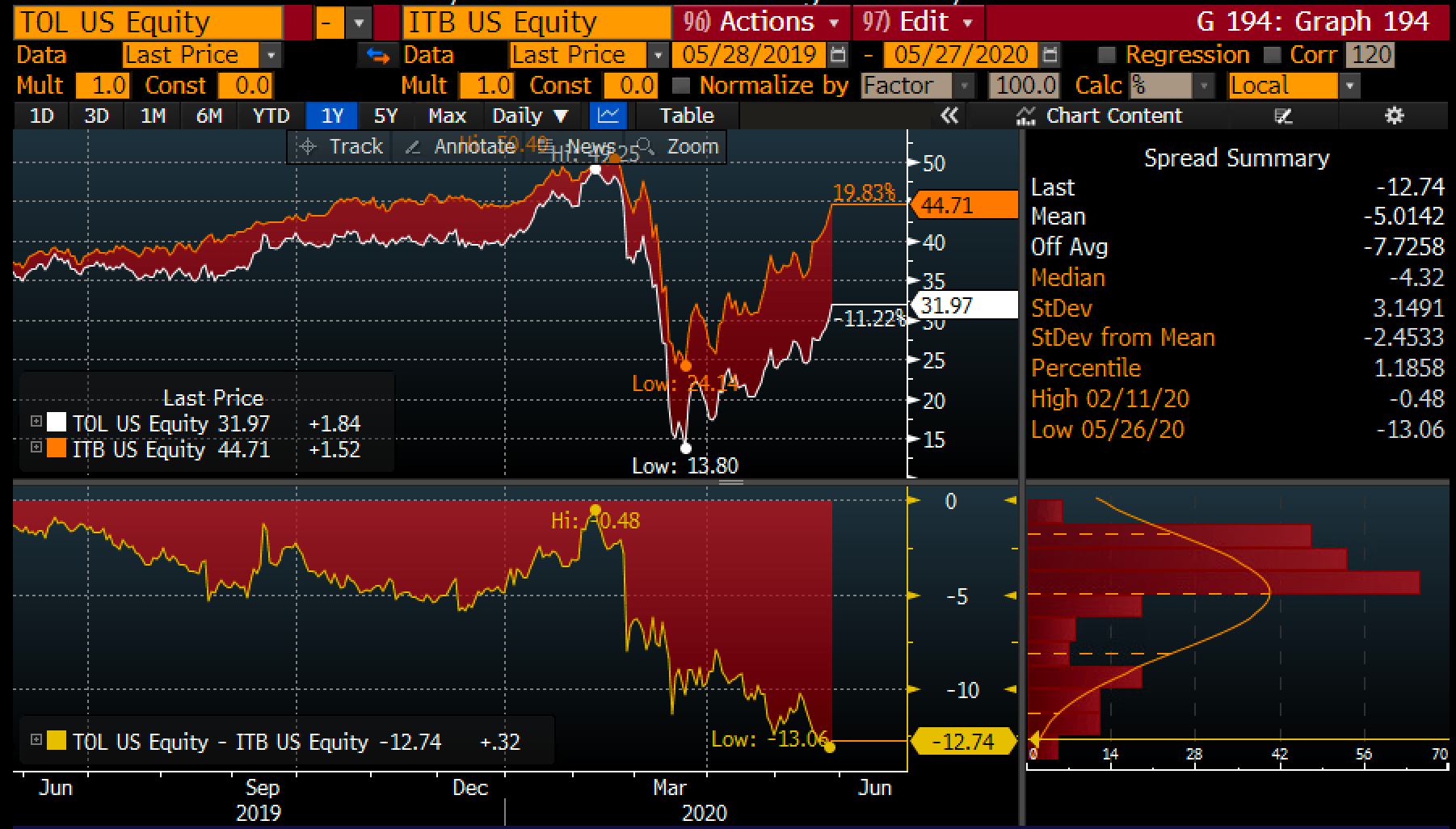

The underperformance of TOL relative to the ITB, the iShares Home Construction etf is notable

Investors are looking past what is likely to continue to be downright horrid financial results in many of the hardest-hit sectors of our economy like homebuilders, but if I were inclined to play for a catch-up trade to the broader group I would most certainly define my risk in calls or calls spreads in a name like TOL into an event like earnings, for instance…

With the stock at $32 the May 29th weekly 32-35 call spread is offered at 95 cents, breaks-even at $32.95 and has potential gains up of $2.05 up to $35 by Friday’s close, risk 1 to possibly make 2 if the stock is up 10% in 2 trading days, not a great risk-reward, and the options market is saying there is only about a 20% chance the stock is at $35 on Friday’s close.

Call Calendar might make more sense, selling the weekly May 29th weekly 35 call at 30 cents and buying the July 35 call for $1.75.

On the flip side if I were inclined to play for a miss and guide down and a pullback to $25 in the coming weeks I might consider buying the July 30 – 24 put spread for $1.50, with a potential 3 to 1 payout.