The Home Depot (HD) will report its fiscal Q1 results tomorrow before the opening. The options market is implying about a $14 or ~5.5% move tomorrow, which is rich to its 2.75% one-day pos earnings average over the last four quarters.

Shares of HD are up 13% on the year, up 75% from its 52-week lows made in mid-March and at interesting technical resistance spot flirting with a new all-time high. Near-term support is between $240 and $220:

The logical assumption for the recent strength is that HD is a been a beneficiary of a few simple facts, most of their competitors have been forced to be closed, millions of American families were given stimulus cash with the hope of them spending it while they were faced with boredom in lockdown in their home for the last couple months.

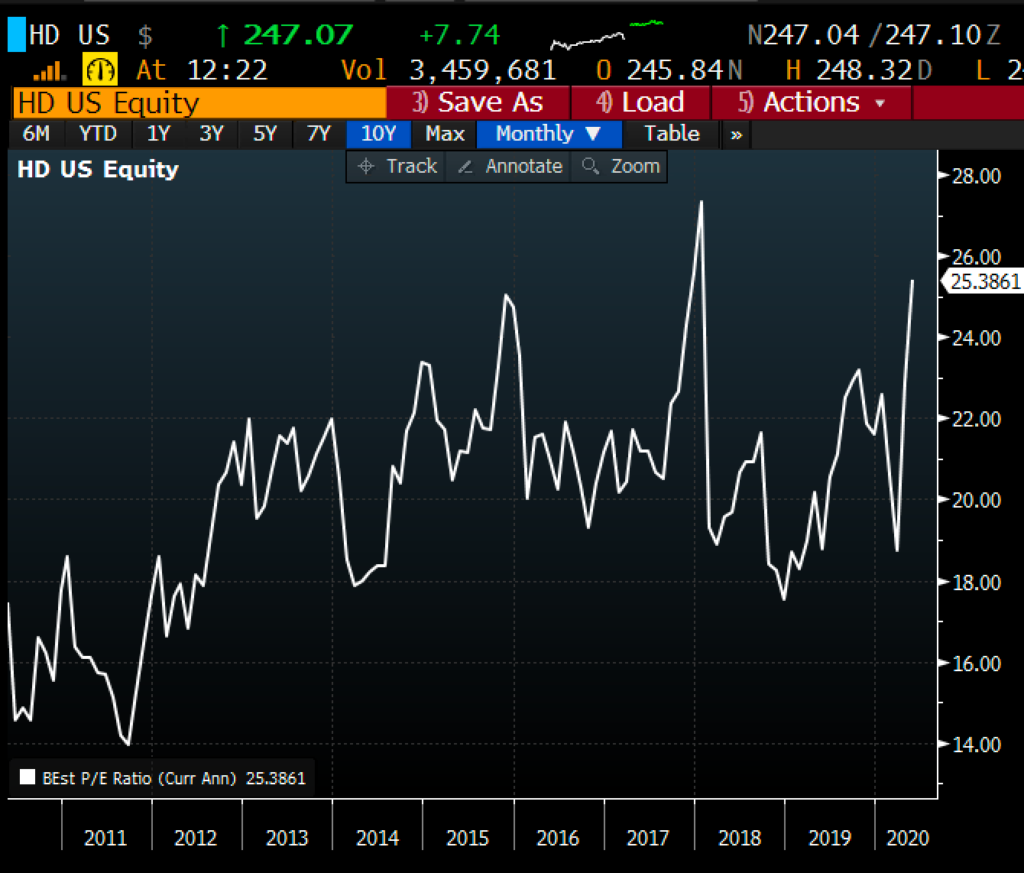

Regardless of the ability of HD to maintain a higher level of sales, the companies costs most certainly went up during this period, and the stock’s expected eps hit has its P/E back above 2019 levels:

So what’s the trade? After such a large rally into the print, it might make sense for long holders too take advantage of elevated options premiums and sell short-dated calls against long stock in an effort to take in some yield, playing for near-term consolidation.

For instance, vs 100 shares of HD long at $247.25, you could sell 1 May 22nd weekly 255 call at $3.60. If the stock is below 255 on this Friday’s close you would take in the $3.60 or 1.5% of the stock price. This $3.60 creates a small buffer to the downside. If the stock is at or above $255 on Friday then the stock would be called away at the strike price, but really at $258.60 (the strike plus the premium) up about 4.6%. If the stock was near or above 255 on Friday and the long holder wanted to keep the position intact one could always cover the short call prior to the close on Friday.

OR

If you were looking to take a directional view, with the implied move about 5.5%, if you were looking to define your risk you could merely buy the at the money put or call, with the stock at $247.25, the May 22nd weekly 247.50 call or put is about $7 (on either side of the strike) and you would need a rally by Friday’s close to $254.50 or higher or a decline below $240.50 or lower to make money.

Regular readers know that I am not a big fan of long premium short-dated at the money calls or put purchases into events like earnings, you need to get a lot of things right to merely break-even, direction first and foremost, the magnitude of the move and of course timing.