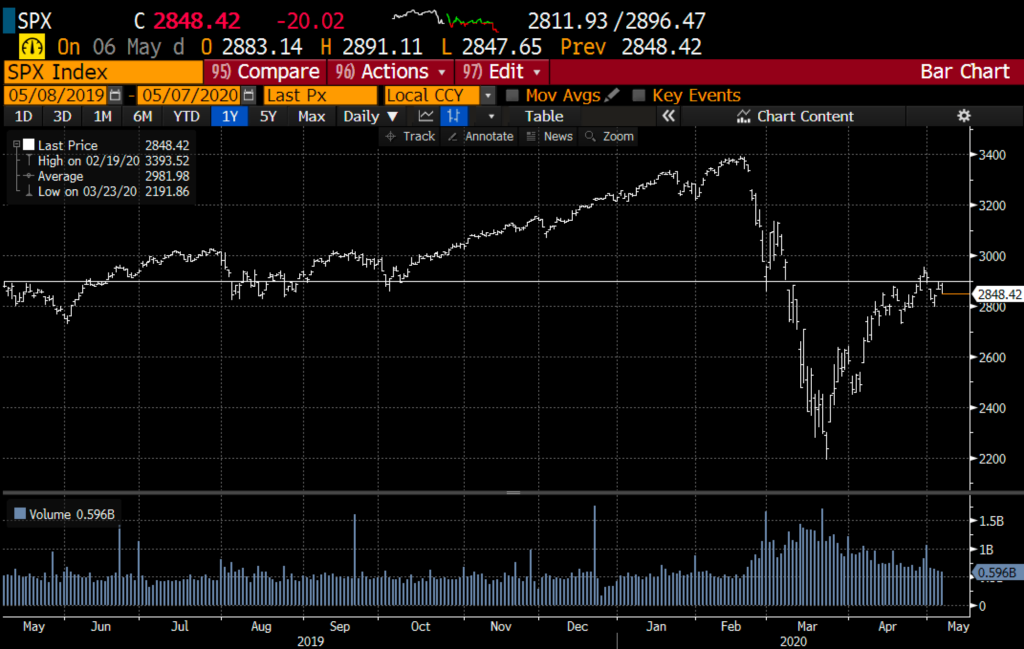

The S&P 500 (SPX) is up 1.5% in the pre-market as I write, nearly recovering all of what it gave up late yesterday:

I sincerely have no idea why they are up today, or for that matter at any point in the last month, but it is notable that the index is sitting at nearly the exact spot it was a year ago today:

A year ago today there was optimism that the headwinds to economic growth above the 10-year average of U.S. GDP around 2.2% would be lifted as a trade deal with China was one of the only things holding us back, oh and high-interest rates with Fed Funds at an 11-year high just above 2.2%

Again, up 1.5% this morning, on these headlines… Really??

Yes, the stock market is a discounting mechanism, and at this point given he uncertainty of the virus, the reopening of economies, the likelihood of rolling lockdowns in the future and the success with therapies and vaccines, the only thing the stock market is discounting here is that the Fed will do whatever it takes to keep risk assets afloat.

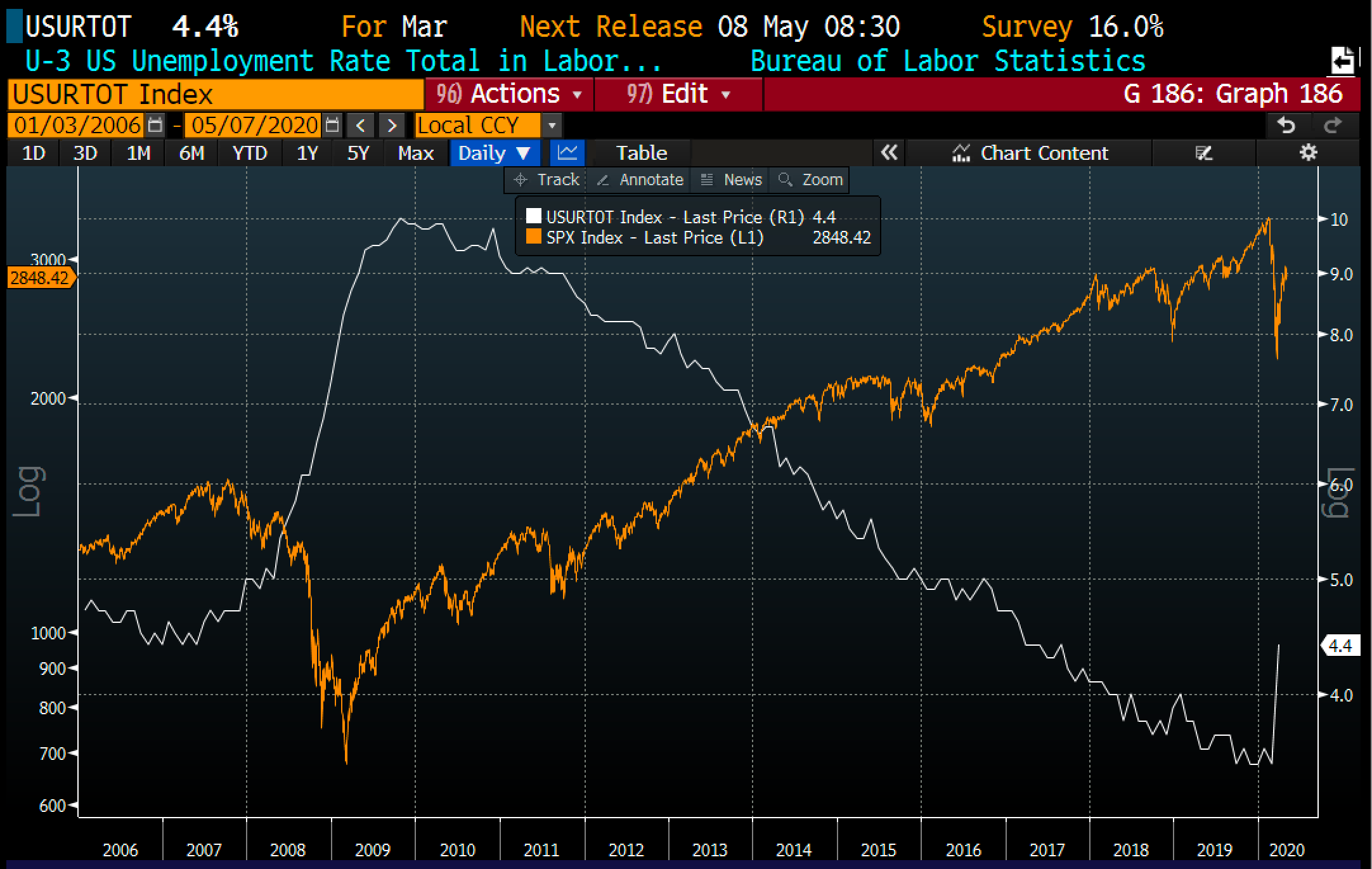

So what’s different this time to the last recession and bear market? Well if you are a regular reader you know my answer, the size and speed of the financial assistance, and of course the jawboning of more to come if needed. The highs in the Unemployment rate in this crisis are likely to be front-end loaded, as is the case with the stimulus/assistance. In the Great Recession unemployment topped out nearly two years after the stock’s markets topped in Nov 2007:

And while the Fed Balance sheet did not start to go up meaningfully until a year after the stock market topped out in Nov 2007, it did continue to go up for years in an effort to keep unemployment suppressed:

Again, I am not an economist, but I suspect unemployment tops out in 2020 at a ridiculously high and unsustainable level (unless we go into a depression) but stays very high, probably at least 2x that of the recent lows of 3.6% and ultimately that, coupled with the front end loaded nature of the stimulus (likely to abate) will remain a weight on economic growth, and the very thing that causes the stock market to start to price a slower pace of economic growth and longer to get back to peak S&P earnings.

I remain very steadfast that the stock market is a distorted lens for evaluating the likely sustained damage of the health and economic crisis we are in.