Yesterday in my weekly In The Money segment with Fidelity Investments we discussed the current trading range the S&P 500 (SPX) has found itself in over the last month as investors contemplate potential opportunities of economies, here and abroad reopening vs the risk of re-opening too soon and having the coronavirus spread again to levels that might cause further lockdowns. Some stocks, such as Starbucks (SBUX) have demonstrated extraordinary volatility in 2020, but as the company signals that it will reopen 85% of their company-owned stores in the U.S. the stock’s recent strength might discount any and all good news in the near-term. We also discuss a hedge for long holders of Roku Inc (ROKU) into their earnings tomorrow and detail trade management in a prior bullish trade idea in Gilead (GILD). Click below to watch:

Here are my notes from the recording yesterday morning May 5th:

Trade Idea #1:

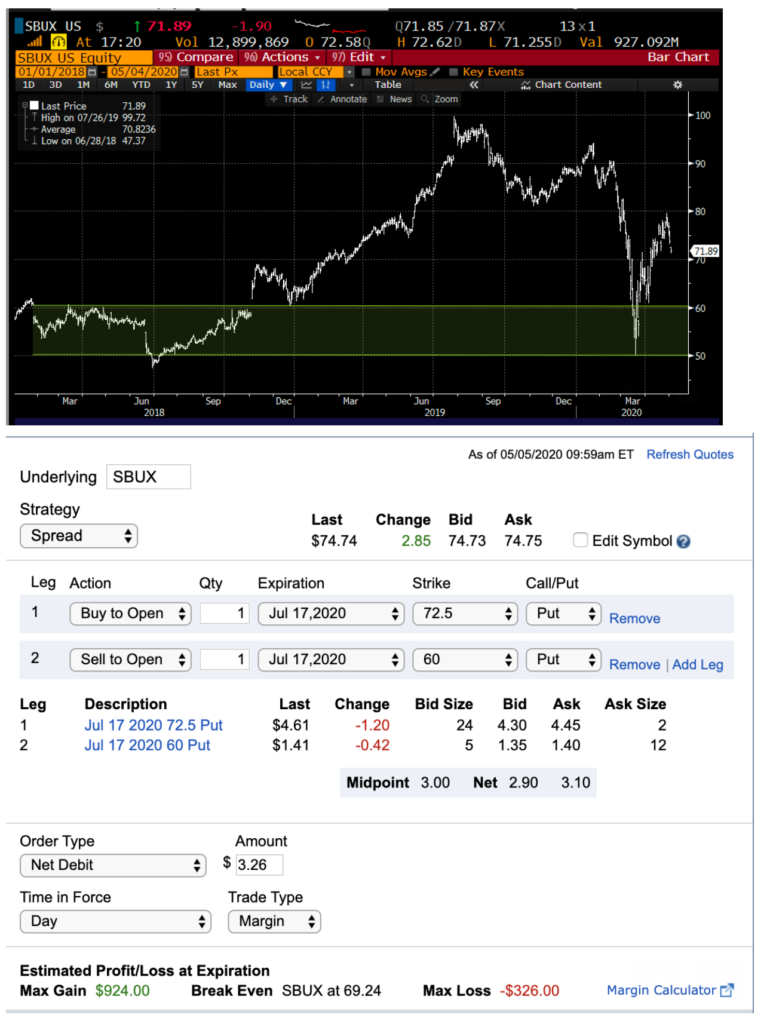

Trade Idea: Short SBUX… was oversold and got down to massive long term technical support in late March… had a 60% bounce… they started to open stores in China a few weeks ago, this week stated they will look to re-open 85% of company-owned stores…the stock’s bounce, in my opinion, reflects a way to the optimistic outcome, costs are going to be up a lot, and sales down at least 20% given new procedures. Might be a “sell the news” once the realization that operating in this environment might be entirely unprofitable…

Bearish Trade Idea: SBUX ($74.75) Buy July 72.50 – 60 put spread for $3

-Buy to open 1 July 72.50 put for $4.35

-Sell to open 1 July 60 put at $1.35

Break-even on July expiration:

Profits of up to 9.50 between 69.50 and 60 with max gain below

Losses of up to 3 between 69.50 and 72.50 with max loss of 3 above 72.50

Rationale: risk 4% of the stock price for a break-even down 7% with the profit potential of up to 13% if stock is down 20% by July expiration.

Trade Idea #2 (hedge vs long stock):

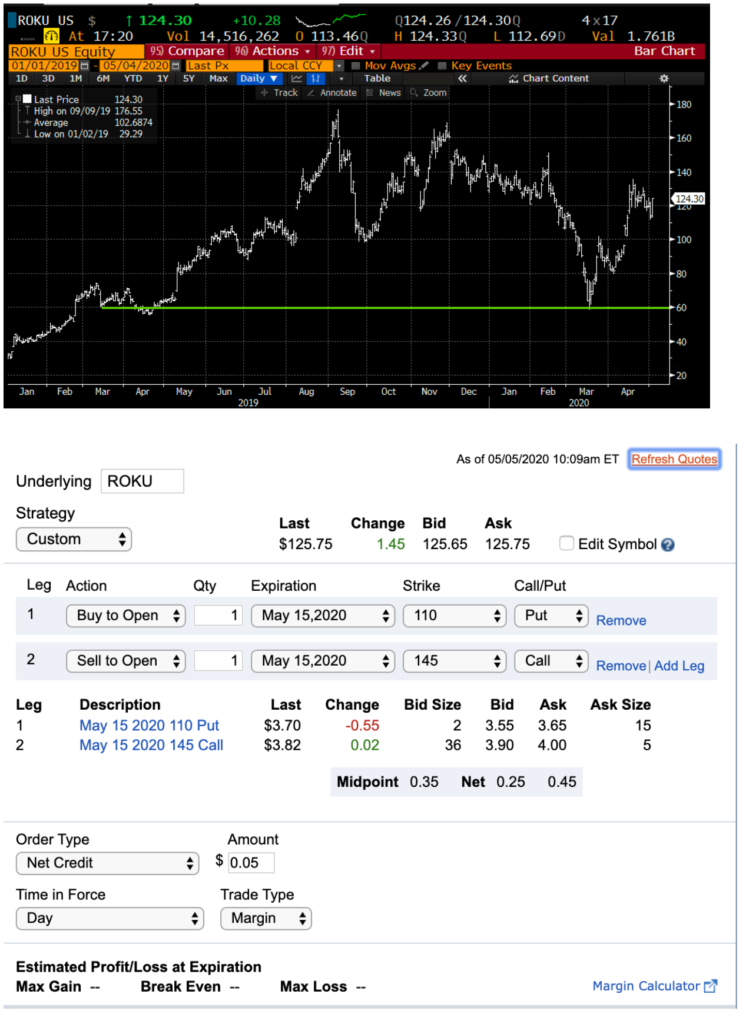

I was asked by a friend who is an enthusiastic equity investor, but very new to options how he might hedge his long ROKU position into earnings this Thursday. He has been long the stock for a year and endured the extreme volatility, and despite them already pre-releasing some very good user numbers he is more concerned with extreme downside volatility than a huge rip Higher post results in the stock… I detail a collar strategy in the name:

ROKU will report Q1 results after the close on Thursday… the options market implying about a 14%, the stock has moved on an average day after earnings 20% since IPO in 2017.

Collar long stock… Sell an out of the money call and buy and out of the money put, 1 contract per 100 shares:

vs 100 shares of ROKU at $125… Buy the May 110 – 145 collar for even money

-sell to open 1 May 145 call at $3.75

-buy to open 1 May 110 put for $3.75

Break-even on May expiration:

-Profits of the stock up to 145, in line with the Implied move, profits capped at 145, can always cover the short call if want to keep long stock position intact if stock is at or above 145 on May expiration

-Losses of the stock down to 110 but protected below.

AN investor would collar their stock into a potentially volatile event like earnings in a stock like this if they were more concerned with extreme downside as opposed to upside, willing to give up some potential upside for defined risk to the downside.

ROKU is up 100% from its March lows…

Lastly, we looked back on how to manage a short put spread, a bullish strategy first detailed on a segment back on March 31st:

GILD on March 31st I detailed a bullish strategy on the stock when it was $75.50:

TRADE IDEA: GILD ($75.50) SELL TO OPEN THE MAY 70 – 65 PUT SPREAD AT $2

–Sell to open 1 May 70 put at 4.25

-Buy to open 1 May 65 put for 2.25

Stock is now $80 and the May 70-65 put spread that was then sold at $2 can now be bought to close for 20 cents.

With the stock near $80, and a little more than a week to May expiration, It makes sense to close this trade for a $1.80 profit… The risk is that some bad news came out between now and May 15th expiration and the stock went back to 65 and the short put spread would go from a $1.80 gain to up to a $3 loss… risking $3 to make 20 cents is not a great risk-reward.