Microsoft (MSFT) will report its fiscal Q3 results today after the close. The options market is implying about a 4.5% one day move tomorrow. The weekly at the money 175 straddle (the call premium + the put premium) is offered at about $7.80, or about 4.5% of the stock price, if you bought the implied move you would need an $8 move in either direction by Friday’s close to make money. Shares of MSFT have moved about 2% on average the day following their last four earnings reports.

Shares of MSFT are up 10.5% on the year, massively outperforming the S&P 500’s (SPX) ~10% decline and the Nasdaq’s ~1% decline. The stock has the slightest bit of technical support at $170 and very obvious upside target at its prior all-time close high from Feb 10th near $190, which would also serve as healthy technical resistance:

Short-dated options prices in MSFT have come in significantly from last month’s multi-year highs but still remain well above pre-sell off levels, with 30-day at the money implied volatility just below 40%. If the company were to report earnings and offer guidance that causes the stock to move higher or, less to the downside than the implied move, then options prices will continue to come in hard.

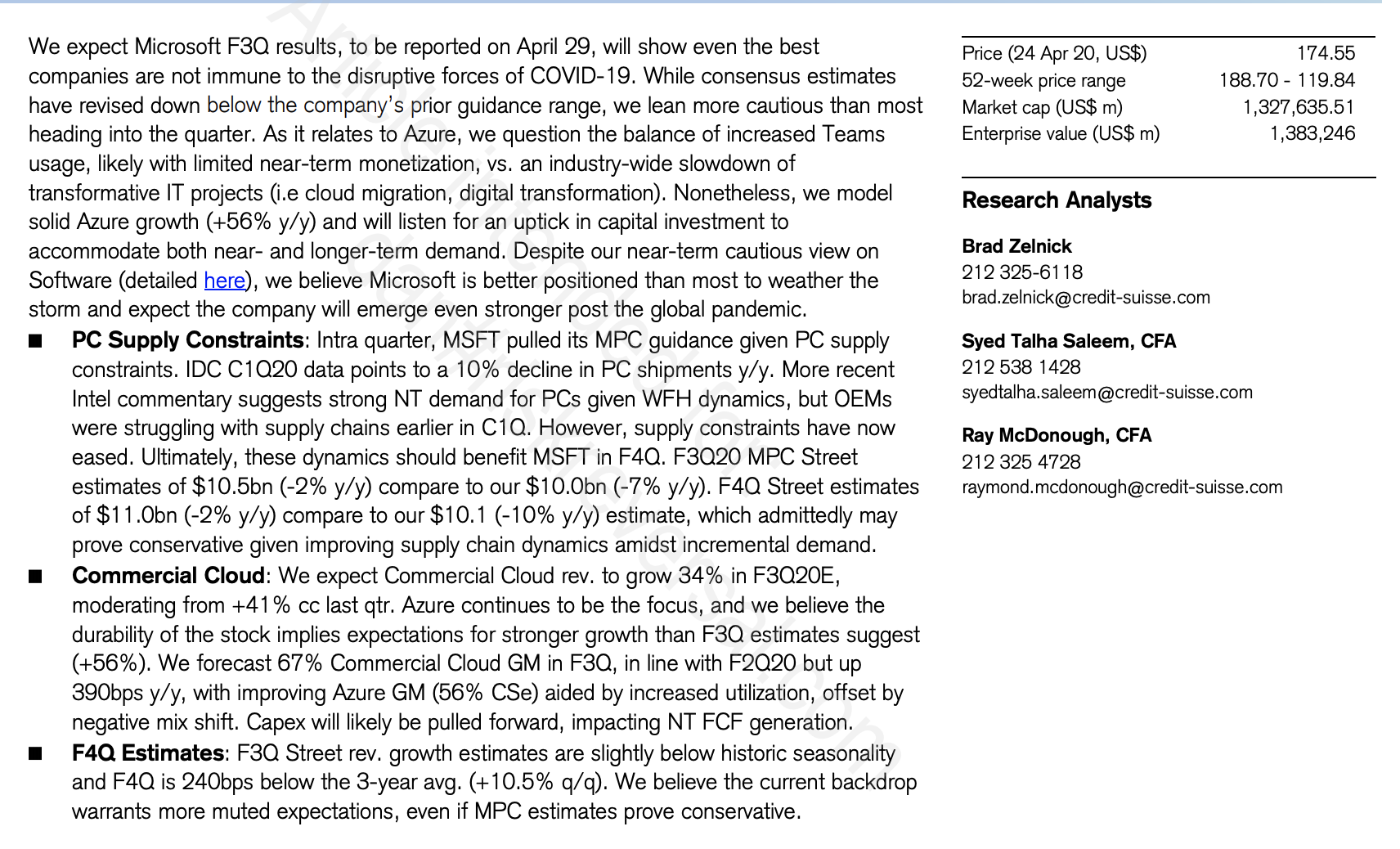

Credit Suisse’s Software analyst, Brad Zelnick who rates the stock a Buy with a $190 price target highlights the following to look for in the quarter in a noted to clients this week:

IN an earlier post (here) detailing my weekly In The Money segment with Fidelity Investments I offered an overwriting yield enhancement strategy for holders of MSFT:

vs 100 shares of MSFT ($173) sell to open 1 June 185 call at $4.25

Break-even on June expiration:

Profits of stock up to 185. If the stock is 185 or lower take in $4.25 in premium, or 2.5% of the stock price with an effective call-away level at $189.25, up 9.5% in 6 weeks. Profits are capped to $16.25. If the stock is 185 or higher prior to June expiration and you do not want your stock called away you could merely cover the short call.

This strategy also makes a lot of sense for investors who place a good till cancel sell orders in stock they own above the markets, think of it as a way to get paid to put that order in. I wrote about this strategy last month (here)

Losses of the stock below current levels, but less the $4.25 in premium received for the call sale, which serves as a 2.5% buffer to the downside.

I chose the 185 strike as that level, plus the premium received equals the all-time closing high on Feb 10th, near $189, where the stock might find sellers and serve as technical resistance:

For those who think the stock could double up the implied move to the upside the way GOOGL is doing today following its better than expected results and outlook then the at th money call, with the stock at $175 is offered at $3.90, or half of the implied move, if you bought that you would need a rally by Friday’s close above $178.90.

On the flip side if you thought that the stock would be down more than the implied move than the at the money weekly put at $3.90 would need a decline to $171.10 to make money by Friday’s close.

I’ll offer my normal disclaimer about long premium short-dated directional trades into events like earnings, you need to get a lot of things right to merely break-even, first and foremost directional then the magnitude of the move and timing.

Giving yourself more time makes sense, playing for more than a one day pop, but that usually is the case if you don’t get the initial greater than expected move and the stock works its way towards your target over time.

Let’s say you were targeting a rally in MSFT to its prior highs near $190, the options market is saying there is only about a 7% probability of that happening by this Friday’s close, a 15% probability of it happening by May 15th expiration and a 25% chance that it happens on June expiration. Aside from direction, time is the most important factor as the longer the time the greater the probability of success, but the closer you come to expiration, all of these factors converge to make a combustible situation that ends up being quite binary for holders of options.