Yesterday on my weekly In The Money series with Fidelity Investments we discussed Oil’s decline on market sentiment and what it might mean for stocks in the near term.

Watch the video by clicking below:

I also detailed a defined risk bearish strategy in the XLP, the etf that tracks the consumer staples sector. The XLP is heavily weighted to a handful of mega-cap household names:

A tweet by economist David Rosenberg last week got me thinking about this sector and the likelihood that some of these companies see the sort of pent up demand once quarantine restrictions abate, the thing that most who are optimistic about a quick economic recovery point to:

Grocery stores saw an epic 26% surge in March. Americans added more food (and drink!) to their pantries and refrigerators in one month than in the previous nine years combined. With so much extra food in the bunker, will they still go out to eat once the restaurants re-open? pic.twitter.com/XMvrSyzkdU

— David Rosenberg (@EconguyRosie) April 15, 2020

It might be as good as it gets for this sector for a while, with most of these stocks showing strong relative strength to the broad market over the last two months, while also sporting aggressive P/E multiples around 23x earnings, well above the 19x forward P/E the S&P 500 (SPX) trades at despite the strong likelihood that the E is going much lower.

It is my view that these stocks should underperform near-term to the upside if the market were to stage another leg to the rally in anticipation of the economy reopening. But in the event that the stock market has a leg lower (which is my view) and attempts a re-test of the March lows, I would expect that the XLP moves in lockstep with the SPX as valuations will easily be one of the pillars for the second leg lower.

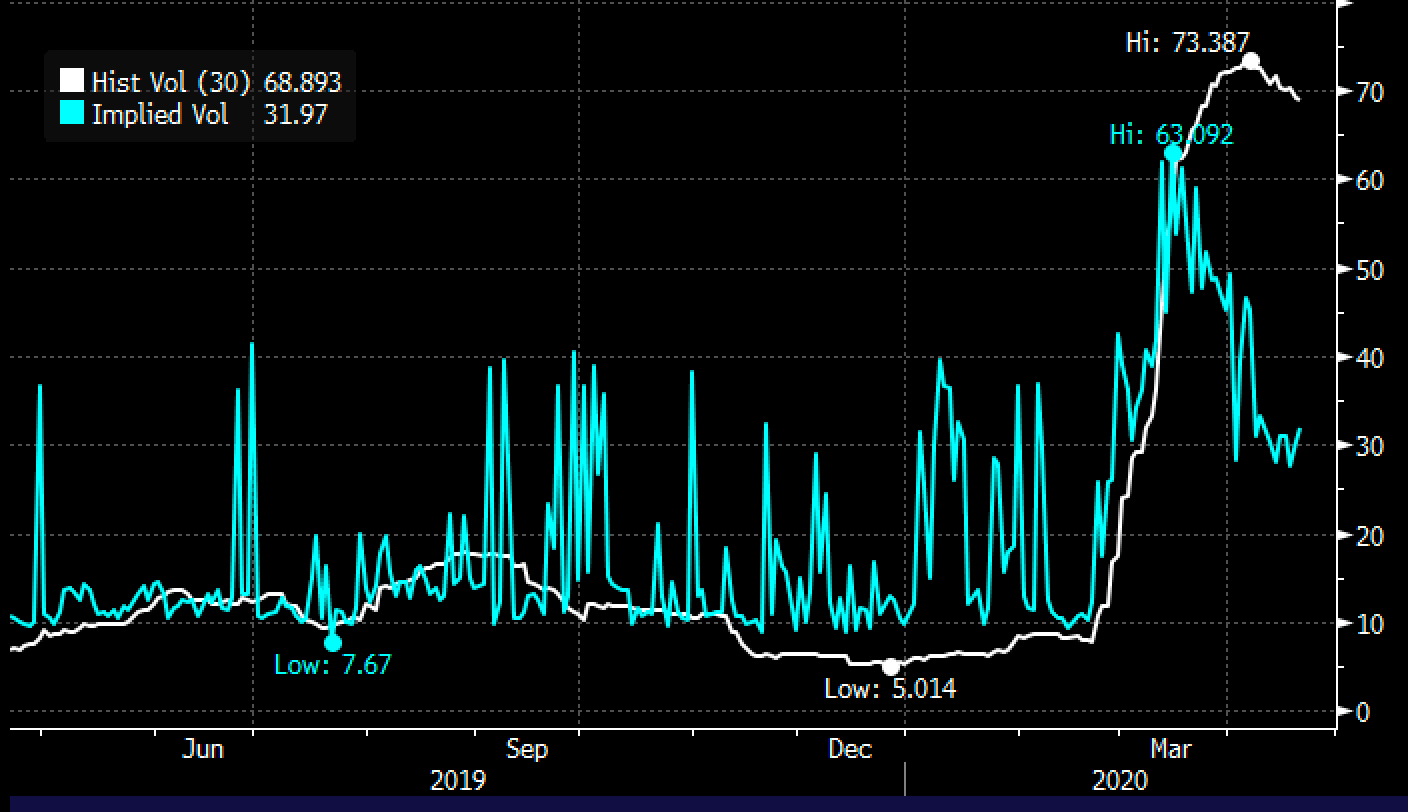

So what’s the trade? Despite options prices remaining very elevated across the board, despite being down significantly from their March lows… long puts are the way to play as the strategy can offer optionality. With 30-day at the money implied volatility at 32% (blue line, the price of options) less than half of 30-day at the money realized vol (white line, how much the etf has been moving), directional trade ideas look fair in vol terms, especially in a market that I expect to remain volatile:

If the XLP were to drop quickly then you could leg into a put spread by selling a lower strike put in the same expiration, reducing the premium at risk. Or you might consider a rolling strategy in the same expiration or rolling down and out.

To my eye the XLP was just rejected at technical resistance, the breakdown level from March, and if bearish it makes sense to target a decline near the recent lows which would also mark a double bottom low from late 2018 in the high $40s:

Bearish Trade Idea: XLP ($58.50) Buy June 58 put for $2.60

Break-even on June expiration:

Profits below $55.40

Losses of up to 2.60 between 55.40 and 58 with max loss above 58

Rationale: this trade idea risks 4.5% of the etf price, for a little less than 2 months, has a break-even down 5.3% with a 3 to 1 profit potential near the downside target.

I also reviewed a bullish trade idea in EBAY from Feb 25th:

Bullish Trade Idea: EBAY ($37.50) Buy June 40 for 1.30

Break-even on June expiration:

Profits above 41.30, up 10%

Risks 3.5% of the stock price.

Well, the stock got nailed, going straight to $26 from $38, but has since come all the way back:

What’s interesting about this trade idea is that this June call was nearly worthless at the March lows, but now is actually worth more than on Feb 25th with the stock at the same price:

And there is a simple reason for that, the rise in options prices has offset the nearly two-month decay in time value:

At this point, it might make sense to consider trade management…. either take this one off the sheets (consider it our bailout of bad timing), spread by selling a higher strike call in June to reduce the premium at risk, or roll up and out to a call spread.