If you are a publicly-traded tech company, and your stock is up on the year, the likelihood that you are considered a #WFH (work from home) play is pretty large. One such company is Slack (WORK) the enterprise messaging tool that is basically AOL Instant Messenger for Millenials. No joke there is little functionality on Slack that did not at one time exist on AOL’s now-defunct messaging app. I guess it is all in one slick package, works well on mobile and most importantly is a sexy alternative to Microsoft Office.

WORK is up 12% on the year, but interestingly up 67% from its mid-march lows. What’s interesting to me about the stock’s recent out-performance that it really was the back half of March when most Americans came to the realization that their work and home life were about to converge, and that productivity was about to take on a new meaning.

WORK went public last June through a direct listing on NYSE at a reference price of $26 giving it a market cap of around $15 billion, very near where it is today. A direct listing is different than an initial public offering in that the company merely lists the shares and they are free to trade, whereas a traditional IPO the company is selling shares to the public, to raise capital, putting cash on their balance sheet while also giving early investors liquidity, as is also the case with a direct listing.

Today WORK announced that they were raising capital via a convertible bond to the tune of $600 million which will bolster the existing $768 million in cash, or about $542 million net of their existing debt. For a company that is NOT profitable (lost $113 million in adjusted net income in FY2020 on $630 million in sales), with sales growth expected to be mid to low 30s% for the next few years and trades at 16.4x expected FY2021 sales, I’d say a cash cushion on their balance sheet makes a lot of sense given the stock is where it was when they “took the company public”. The idea of issuing a convert now at nearly the same price the stock was last year makes sense because they are raising cash but avoiding the dilution of raising via issuing new equity and the play is that interest expense on the debt now is tax-deductible and as the company become profitable, the stock should also rise, and the dilution on the conversion will have far less of an impact on a higher-priced stock of a profitable company.

All that said, If I were Alphabet (GOOGL), sitting on $120 billion in cash, relatively unhappy with GSuite and their collaborative work tools, always trying to keep up with Microsoft (MSFT) Office & Teams, I would simply make a $25 billion knockout bid for WORK and make their CEO Stuart Butterfield the head of productive and collaboration tools. To be fair there are no shortage of companies that should buy WORK, MSFT, ORCL, ADBE, CRM and even FB.

What’s the trade?

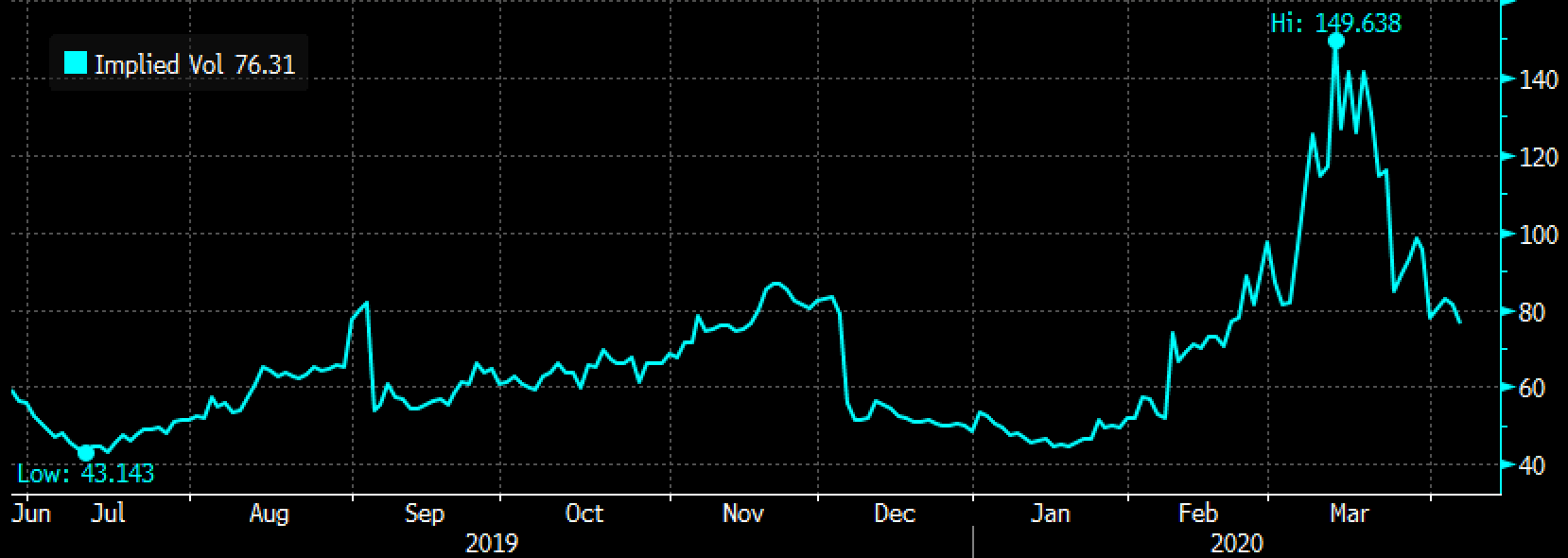

As one might expect, short-dated options prices are extremely elevated, despite nearly halved from the recent highs, with 30-day at the money implied volatility at 76%:

No matter what your directional inclination is in a stock with options prices this elevated you have to look to sell an option to help finance the purchase of another. IN this case, if I were looking to try to establish some long exposure I might consider a call calendar, selling a short-dated out of the money call and using the proceeds to help finance the purchase of a longer-dated out of the money call of the same strike… for instance:

Bullish Trade Idea; WORK ($25.15) Buy May – Dec 30 Call Calendar for $3

-Sell to open 1 May 30 call at 70 cents

-Buy to open 1 Dec 30 call for 3.70

Break-even on May expiration:

The ideal scenario is that WORK is near $30 on May expiation, if below the short call will expire worthless and you will be left long the Dec 30 call for only $3 as opposed to the $3.70 it costs now. If the stock is at or above the 30 strike than the short call can be covered if you want to stay long the Dec 30 call. The idea of the trade idea is chip away at the longer-dated premium and set up for a rally later in the year.

Why $30? Well past support, not resistance, gets trough there for any good reason and straight shot maybe back to the highs near $40: