Today after the close Salesforce.com (CRM) will report its fiscal Q4 results. The options market is implying about a 6% move (or about $11) in either direction tomorrow, which is about double the 3% average over the last four quarters,

Back in early January, I detailed a bullish trade idea playing for a breakout above 1-year technical resistance:

Salesforce.com (CRM), a stock that underperformed many of its mega-cap tech peers in 2019, closing up 19% vs the Nasdaq Composite up 2x that. The stock spent the better part of 2019 in a trading range between $145 and $165, and is now punching up against that level where the stock has been rejected a few times since last March:

Why might the stock breakout in early 2020? Well in 2019 investors were certainly fine with multiples expanding on “growth at a reasonable price”, like Apple (AAPL) and MSFT, if the market were to continue its tear higher, investors will look to play catch in names that have underperformed and a high valuation, high growth name like CRM which fits in plenty of buzzy tech narratives will likely benefit, despite its rich valuation. It is also worth noting that in early 2017 after a multi-year consolidation, CRM broke out and has been up 100% since.

Well, the stock did breakout and went up nearly 20% in a straight line until last week’s all-time highs and has since sold off about $10, actually outperforming the broad market over the last week:

Credit Suisse’s star software analyst, Brad Zelnick, who has a Buy and a 12-month price target of $215 had the following to say about what to expect in the quarter in a note to clients:

4Q Seasonality and 1Q Guidance: F4Q seasonality is below the historical average on leading metrics (cRPO, Billings). Consensus is modelling F4Q $14.4bn in current RPO (+21% y/y, +12.5% q/q) vs. prior 2 years at +19% q/q and +21.5% q/q, respectively and Billings for $8.5bn (+25% y/y, +102% q/q) vs. 3-year avg. +140% q/q. For F1Q, consensus cRPO of flat q/q is in line with historical seasonality and prior guidance cadence. We note for F4Q and F1Q FX is slightly less of a headwind.

FY21 Guidance: For FY21, we anticipate operating margins will be guided in line with Street expectations for a 120bp improvement as the company’s typical cadence of 125-150bps organic expansion will be offset by some incremental investments towards recent M&A as highlighted at Analyst Day. We anticipate potential upside to FY21 OCF growth (Consensus +23% y/y) as a full year of Tableau helps offset increased investments into medium and long-term opportunity.

Thoughts on the Quarter: Positives: (1) Our field work indicates an uptick in field performance across vertical markets; (2) healthy Commercial commentary; (3) some strong large deal activity, typical of an F4Q, but particularly in the Telco vertical; (4) Constructive Enterprise pipeline commentary; (5) Seasonality sets up below historical avg. on all leading metrics. Concerns: (1) We’ve been hearing of more rep turnover in the field vs. the past. Small sample size, perhaps just a sign of maturity and a very competitive hiring backdrop for talented sales reps; (2) Higher embedded expectations, stock +14% YTD vs. IGV +8%.

My take into the print: The stock is up 13.5% on the year still, does not have a ton of exposure to Asia (about 10% of sales), and the secular shift towards corporations managing customer interactions in the cloud is not stopping anytime soon. In a less volatile market with far less a focus on valuation, and it wouldn’t take much to keep the stock banging around at current levels.

That said, we have gotten a bunch of negative earnings and sales pre-announcements from many U.S. multinationals whose businesses are being impacted by the attempts to thwart the spread of the virus and this should weigh on CRM’s forward guidance,

If I were long the stock I might consider stock replacement with calls or call spreads and thus defining my risk, or at the very least overwriting my stock, selling an out of the money call to take in some premium with options prices elevated…

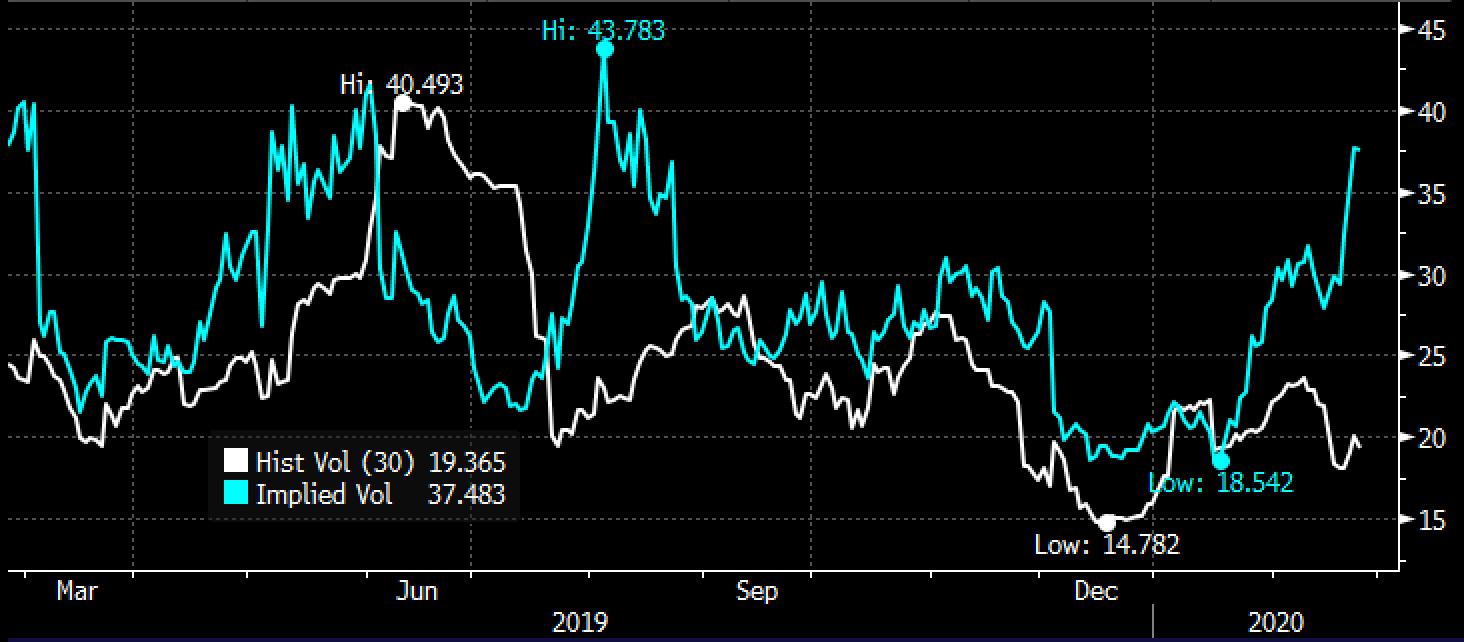

30-day at the money implied volatility (the price of options, blueline below) is now trading a nearly a 100% spread to 30-day at the money realized volatility, the white line below), making options appear very expensive for those looking to express directional views:

Longs might consider overwriting…

Vs 100 shares of CRM long at $184.50 sell to open 1 Feb 28th weekly 195 call at $2

Call-away level on this Friday’s close at $197, up nearly 7%, above the implied move… if the stock is below $195 then the short call expires worthless and you have added nearly 1% yield in 3 trading days and have created a small buffer to the downside of $2.

As for stock replacement, the March 190 – 200 call spread costs $3, breakeven at 193 and can make up to 7 between 193 and 200 with max gain of 7 above 200, not exactly a great risk-r3eward in my opinion.

Call calendars might make more sense for those looking to lean bullish, targeting the implied move to the upside… for instance…

CRM ($184) Buy Feb 28th / May 195 call calendar for $4

-Sell to open 1 Feb 28th 195 call at $2

-Buy to open 1 May 195 call for $6.50

Break-even on Feb 28th close:

This trade performs best with a move towards the 195 strike over the next three trading days into Friday’s weekly expiration. If the stock is below 195, the short 195 call will expire worthless and the trade will be left naked long the May 195 call. If the stock is close to 195 then the May 195 call will have appreciated as it will have picked up deltas. At that point it might make sense to further reduce the premium at risk by selling a higher strike call in May turning the trade into a vertical call spread. The max risk f this trade is the $4 premium paid, and would be at risk with a large move below the current level, or well above the 195 strike.