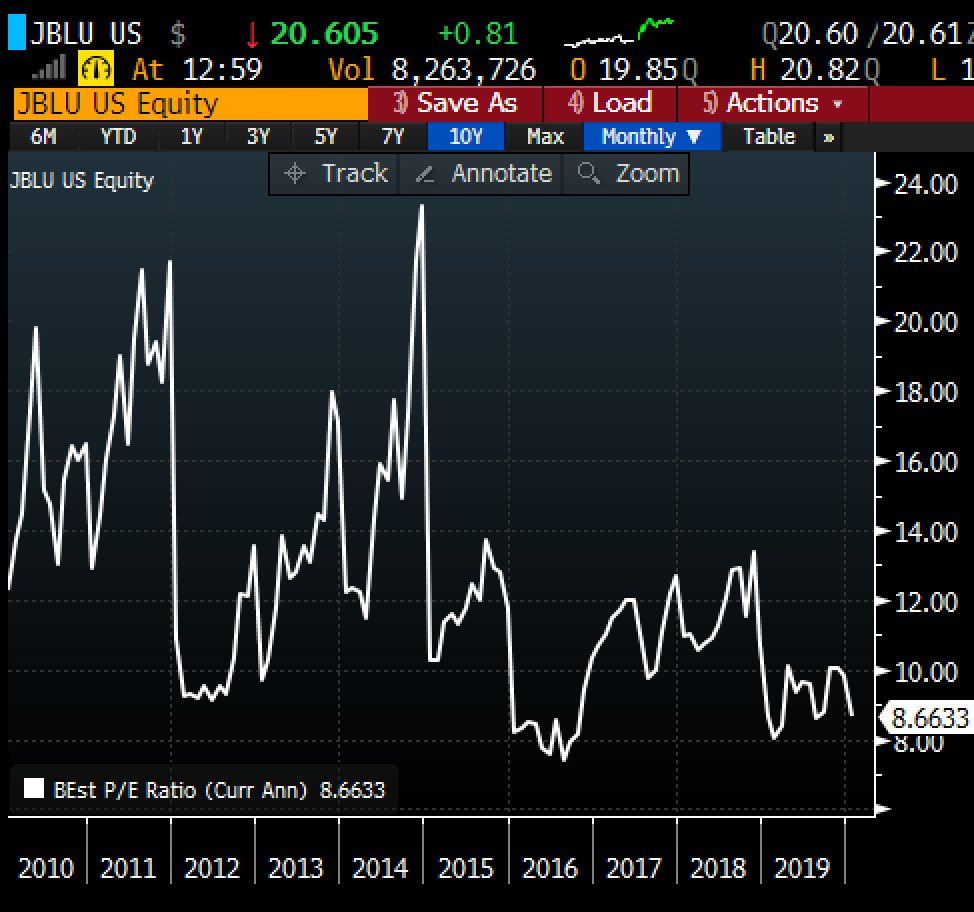

Shares of Jetblue (JBLU) are trading up today on Q4 earnings that beat and 2020 EPS guidance of $2.50 – $3.00, well above prior consensus estimates of $2.38. Given the new midpoint of the 2020 guidance the stock trades at just 7.5x expected eps, which would place its P/E below its 10-year lows:

Today’s gains have resulted in a new 52-week high after a years-long consolidation between mid-teens and $20:

The longer-term chart shows another breakout, of the five-year downtrend:

Investors the world over, but particularly in Asia seem spooked by the spreading of a flu type virus, with major travel bans going in effect in China. The fear is that an epidemic could slow trade and general economic activity at a time where some economists see GDP in China dropping below 6% for the first time in decade in 2020. Crude oil has come in hard as a sort of avatar for this theme which should be helpful to an airline like Jetblue that has minimal international explore, with no long haul routes that night be affected by a slowdown in international travel.

All of this makes JBLU look attractive to some airline peers on valuation, exposure, fundamentals, minimal exposure to Boeing 737 Max grounding and its technicals.

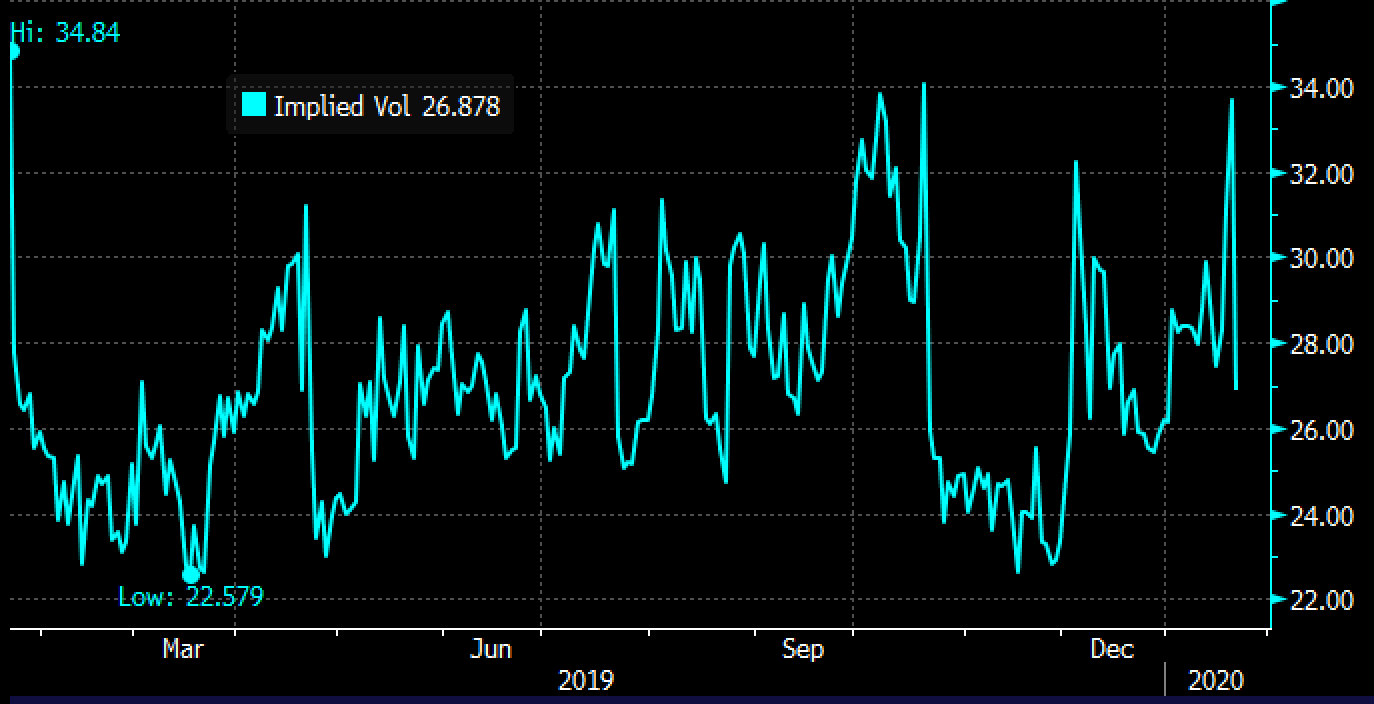

With earnings out of the way, short-dated options prices have come in hard today making long premium directional trades in the near-term look attractive:

So what’s the trade? If I were inclined to play for further upward momentum over the next two months, possibly targeting $23, I might consider defining using call spreads in March, for instance:

Bullish Trade Idea: JBLU ($20.55) Buy March 21 – 23 call spread for 50 cents

-Buy to open 1 March 21 call for 75 cents

-Sell to open 1 March 23 call at 25 cents

Break-even on March expiration:

Profits of up to 1.50 between 21.50 and 23 with max gain of 1.50 above 23

Losses of up to 50 cents between 21 and 21.50 with max loss of 50 cents below 21

Rationale: this trade idea risks 2.5% of the stock price, breaks-even up 4.6% from current levels, and offers a payout of 3 to 1 in the stock is up 12% in two months.

At the moment the options market is suggesting there is about a 37% chance this trade is break-even on March expiration and about a 17% chance it is worth full value at 23.