Yesterday I got “In the Money” again with my friends from Fidelity Investments, we took a look at Intel into its Q4 earnings print tomorrow after the close, and talked a little macro and how to play for lower bond yields over the next few months (watch here or click-through the link in the tweet below).

I’m at the NASDAQ with @Fidelity again — tune in for my fresh takes! https://t.co/QpE4p6cT5P

— Dan Nathan (@RiskReversal) January 22, 2020

As for Intel (INTC), the implied move in the options market is about 5% in either direction or about $3 which is shy to the average one-day post-earnings move over the last four quarters of about 6%.

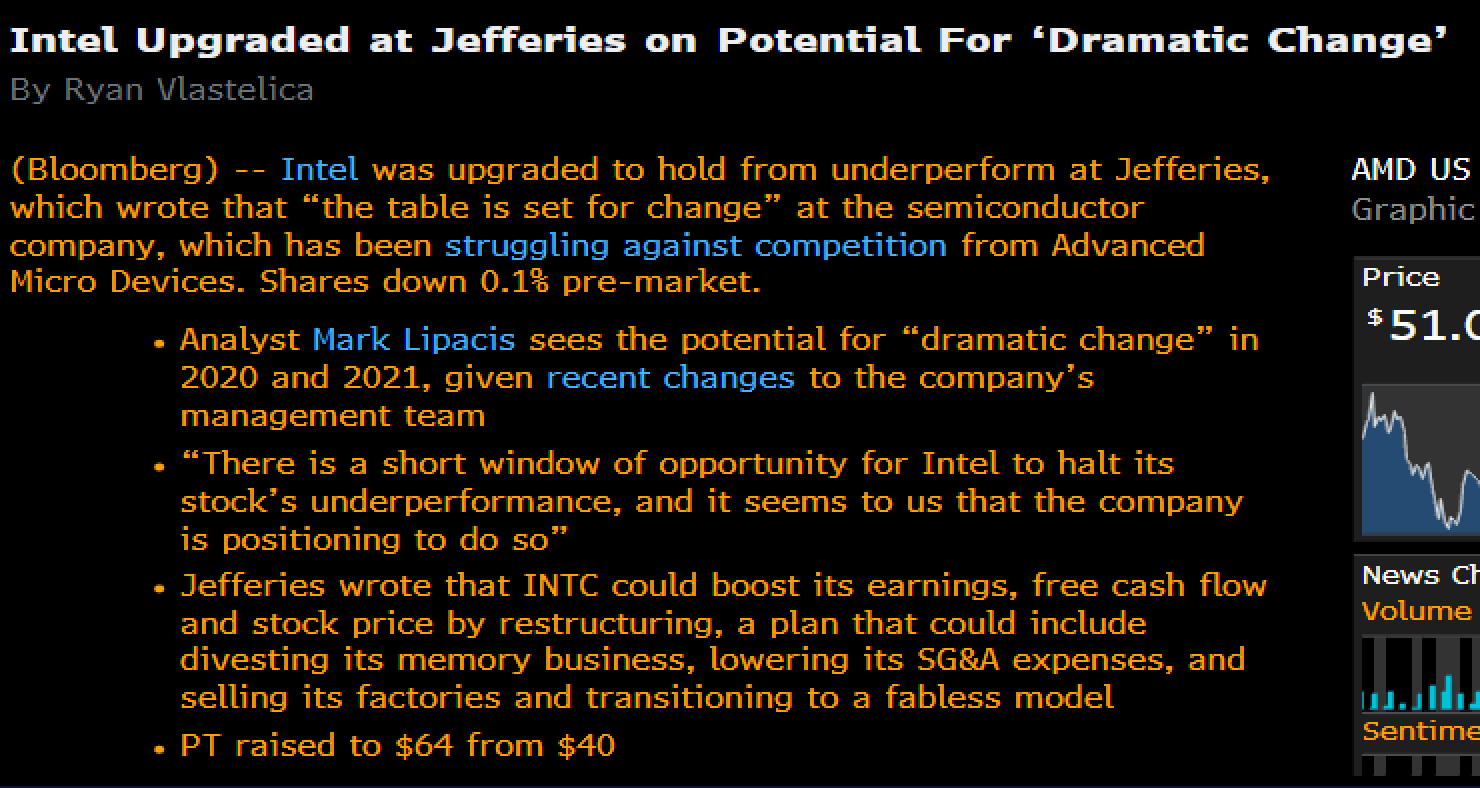

The stock was upgraded yesterday morning by Jeffries, not exactly a table pounder, from Sell to Hold with a 12-month price target of $64, less than 10% above where the stock closed the prior day. The main takeaway was that this analyst has been dramatically offsides, but he now sees the potential for “dramatic change” at the company, per Bloomberg:

The stock trades at a fairly dramatic discount to many of its higher growth peers largely due to company-specific issues regarding delays in important chipsets and supply constraints that led to market-share gains at competitor AMD and also management turnover.

Yesterday the stock broke out to a new 52-week high, looking fairly constructive from a technical point of view:

It is also worth noting that INTC is one of very few mega-cap tech stocks, that was a mega-cap tech stock 20 years ago that has yet to make a new all-time high:

I detailed two near-dated defined risk trade ideas for those with a directional inclination… my thought is that if the company were to post a beat and raise, given its cheap valuation, and the potential for restructuring, the stock would soon be on its way towards $70.

If you agree with that, then buying at the money calls look attractive, for instance:

Bullish Trade Idea: INTC ($60.60) Buy Feb 60 call for $2.10

Break-even on Feb expiration:

Profits above $62.10, up 2.5%, risking 3.5%, less than the one day implied move but offers more than three weeks to play out.

Loses of up to 2.10 between 60 and 62.10, with max loss of 2.10 below 60

Or If you are inclined to think that INTC missed the current cycle and the issues leading to the company, and the stock’s underperformance persists, then short-dated puts to express an outright bearish view, or a hedge against a long after a healthy 40% move since the summer makes sense, for instance:

Bearish Trade Idea: INTC ($60.60) Buy Feb 60 put for $1.80

Break-even on Feb expiration:

Profits below 58.20

Losses of up to 1.80, between 60 and 58.20 with max loss of 1.80 or 3% above 60.

Lastly, I reviewed my near-term bullish view on U.S. Treasuries (bearish view on yields). Given the rhetoric from the president, the Fed’s inclination to stay dovish in an election year, the technical set up and the reach for safe-haven assets in an uncertain world, I suspect yields go lower and demand for Treasuries remains high in the coming months.

Starting with the 10-year Treasury yield, it was unable to get above the psychologically important 2% and now threatens the uptrend from the summer lows:

Conversely, the TLT, the 20-year U.S. Treasury etf once again found support in the mid $130s and yesterday broke above the downtrend that had been in place from its August 2019 highs…

Here was the trade idea I detailed on yesterdays In the Money as a defined risk way to play for a re-test of the prior highs in the coming months:

Bullish Trade Idea: TLT ($139) Buy April 140 call for $2.50

Break-even on April expiration:

Profits above $142.50

Losses of up to 2.50 between 140 and 142.50 with max loss of 2.50 below 140

This trade idea breaks even up 2.5% and risks 1.8% of the etf price.