On Friday’s Options Action program on CNBC, I teamed up with an old friend Bonawayn Eison who runs equity derivative trading at XP Investments. My job was to offer a near-term view on the direction of 5he stock of Goldman Sachs (GS), and Bonawyn would supply the options strategy, watch here:

Here were my three main points to play for higher highs into the new year:

GS. – Stock upgraded Monday by Citi to a Buy

1. Valuation cheap to peers, yield curve steepening, 1MDG settlement would be good.

2. If the Global economy bottoming then GS should play catch up and get back to 2018 highs near $275

3. Technical set up constructive and options prices cheap to play with defined risk

As for technicals, the 1-year chart shows a very nice uptrend with a series of higher lows and higher highs having just broken out:

The five-year chart shows what some might view as near term resistance, the early November 2018 high that saw the stock drop 35% in two months before bottoming and what is ultimately the target of Bonawayn’s trade idea near $275, the 2018 high:

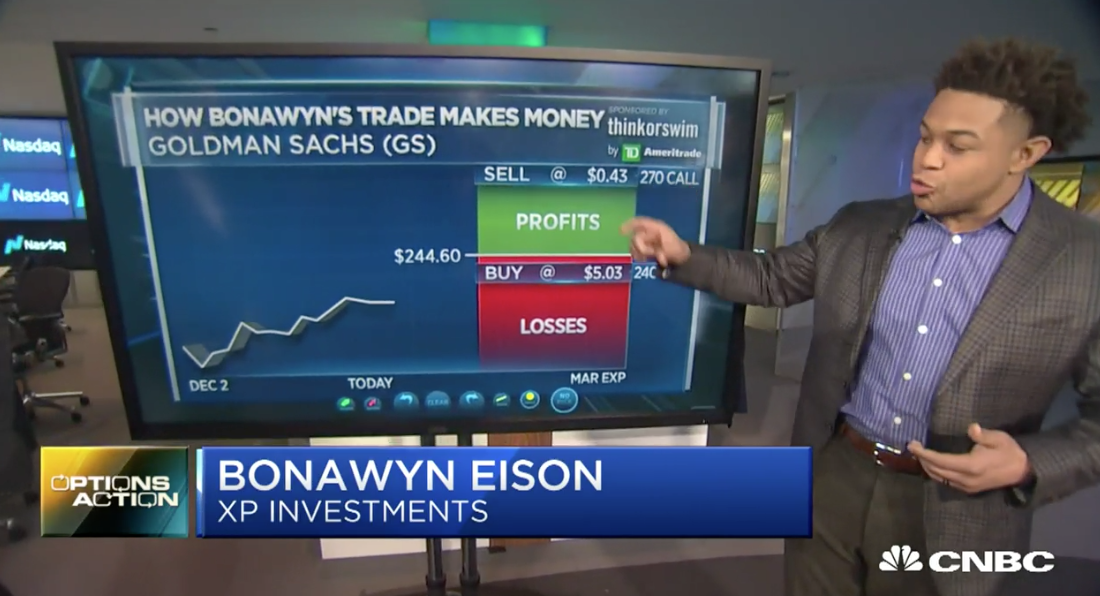

Here was Bonawayn’s Trade Idea on GS to correspond with my near-term bullish view:

GS ($230) Buy the Mar 240 – 270 call spread for just under $5.00 or ~2% of the stock price

-Breakeven is $245 or about 6.5% of the current stock price

-Makeup to $25 between $1245 and $270, risking 1 to possibly make 5.

Rationale: The time frame gives you exposure to both earnings and all of the developments of what is sure to be an active Q1. Time frame also gives you enough time to trade around your position without having rapid theta erosion of your option premium

Short-dated options prices are cheap, with 30-day at the money implied volatility (blue line below) at just 20%, while 30-day realized volatility (how much the stock had been moving, the white line below) is near 19%. That slight gap between the two suggests that those looking to express directional views can do so with options to define risk without too much worry of over-paying for the defined risk.

I would also add that it is probably not that necessary to sell the way out of the money call, and merely wait for a move above the long call strike to look to roll up or spread once the 275 call has a little more meat to it, at least 1% of the stock price. Either way, I really like Bonawyn’s trade idea, the way he laid it out in both strcuture and duration.