Last Friday on the site, I detailed a bullish trade idea to play for a retest of Starbuck’s (SBUX) prior highs, and detailed the idea on CNBC’s Options Action program:

The trade idea was simply to buy near the money calls in Jan expiration:

SBUX ($86.25) BUY JAN 87.50 CALL FOR $1.50

Break-even on Jan expiration:Profits above 89

Losses of up to 1.50 between 87.50 and 90 with max loss of 1.50 at or below 87.50

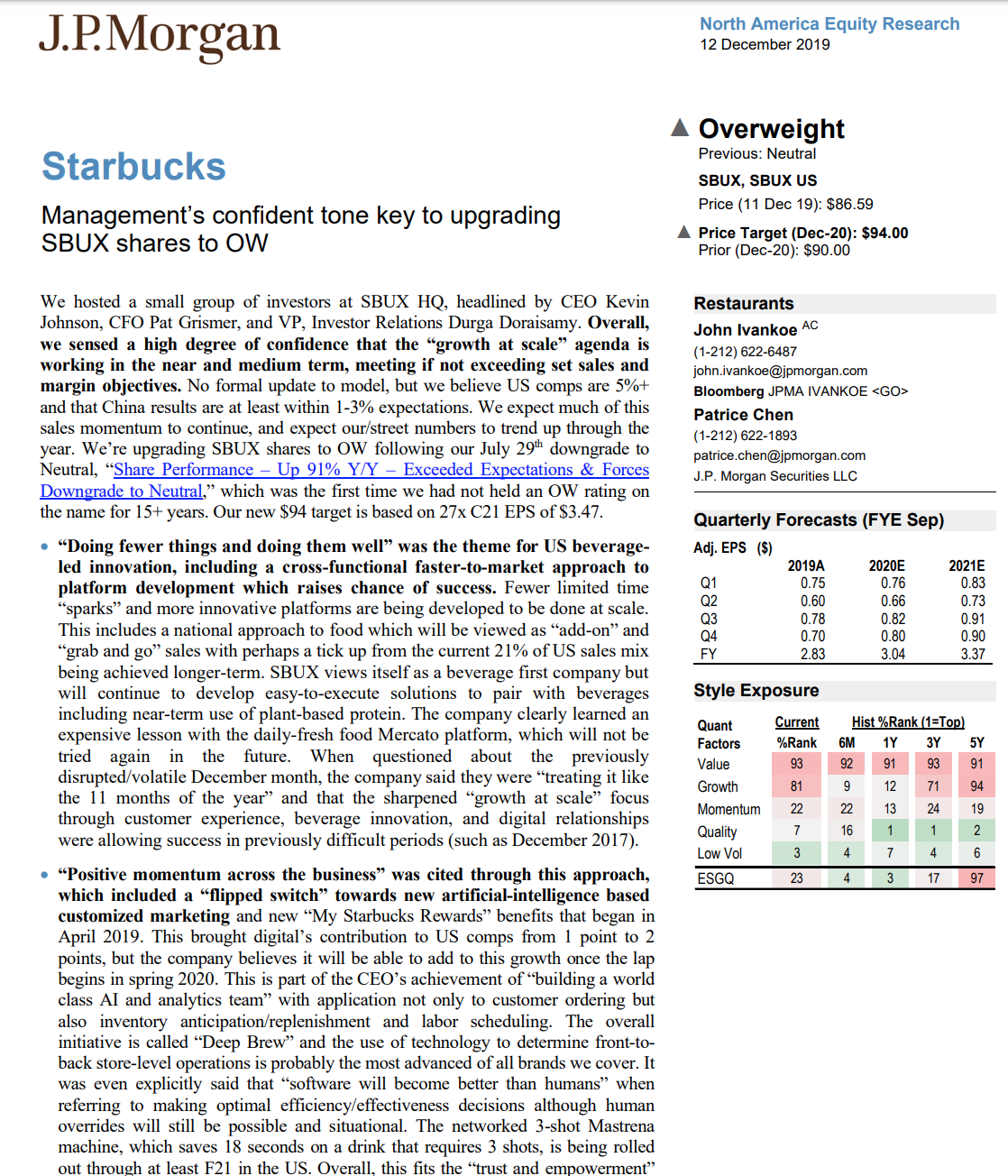

Yesterday the stock was upgraded to a Buy at JP Morgan:

The stock has traded up $2.25 this week, with the stock now trading above the Jan 87.50 call strike causing the calls to gain $1, making them worth $2.50. At this point, it might make sense to roll these calls up a little to the Jan 90 strike that is offered at $1.23 with the stock at $88.60.

Update: SBUX ($88.60)

-Sell to close Jan 87.50 call at $2.50 for a $1 profit

-Buy to open Jan 90 call for $1.23

New Position: Long Jan90 call for 23 cents… this new trade breaks-even at $90.23, up 2%.