In case you missed it, the U.S. stock market has made a new all-time every day for what feels like a month, I think the technical term traders use to describe this price action is: a melt-up.

As we head into the last month of the year, with the S&P 500 (SPX) up 25.6% on the year, market participants are looking for stocks or indices that might play some catchup to the broad market. On Monday (here) I took a look at a new nine-month high in small-caps, which have yet to confirm any of the new highs in the SPX over the last year as one candidate and yesterday on the single stock front The Home Depot (HD) which got hit last week on disappointing earnings and guidance, but yesterday bounced off of key technical support and could be poised for a retest of recent highs into their Dec 11 Analyst Day (here).

Scrolling through some charts earlier, Electronic Arts (EA) caught my eye, as a stock that has been basing for the better part of the year in the $90s, despite being up nicely on the year to the tune of $27.5%, besting the performance of the SPX, and just this week breaking out of what some technicians might call a wedge pattern:

While I can’t put my finger on any upcoming events as their next earnings will be Jan 30th, I suspect that EA games will be on many holiday shopping lists and this might merely be a situation where rising tides lists all boats for now.

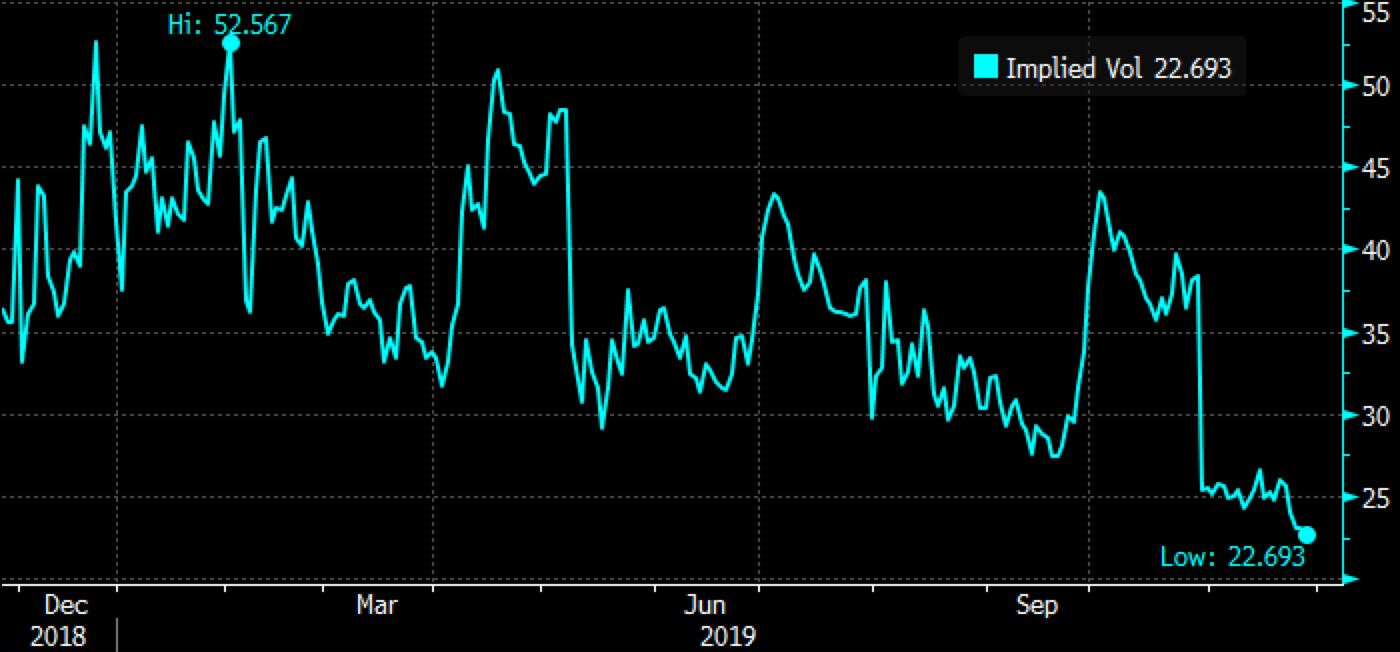

Short-dated options prices in EA have absolutely collapsed to 52-week lows, with 30-day at the money implied volatility at just 22.7%, while high in absolute terms for a $30 billion market cap company, low relative to itself, nearly 10 points below the 1-year average. This suggests that long premium trade ideas are at the very least attractive for those looking to express directional views with defined risk:

So what’s the trade? I have a couple ideas, one for those who think the stock might march right back to its 52-week highs this month, and one for those who think it might take a tad longer to hit those levels in Jan.

If I were inclined to play for a continuation of the technical breakout right till Christmas I might consider the following call spread in Dec expiration:

Bullish Trade Idea: EA ($100.80) Buy Dec 101 – 108 call spread $2

-Buy to open 1 Dec 101 call for $2.35

-Sell to open 1 Dec 108 call at 35 cents

Break-even on Dec expiration:

Profits of up to 5 between 103 and 108 with max gain of 5 at 108 or higher

Losses of up to 2 between 101 and 103 with max loss of 2 at 101 or lower.

Rationale: this trade risks 2% of the stock price for the next few weeks and breaks even up 2%. The options market is suggesting there is about a 38% chance this trade is break-even on Dec 20th expiration and a 13% chance that it is at max value at 108.

I much prefer trades like this is this complacent market environment with options premiums so low, and risk of a broad market sell-off increasing every day. The trade-off to what will be fairly quick decay of the 101 calls is that the trade is defined to the premium risk and for risk management purposes when entering a trade idea like this it makes sense to consider using a stop to the downside in premium terms, usually 50% of the initial premium paid makes sense.

Or

Another trade idea that could make sense is a call calendar, selling an out of the money call in Dec and using the proceeds to help finance the purchase of the same call strike in Jan. This strategy would play for a little bit more upside in the coming weeks but set up for a late-year early 2020 rally above the call strike, for instance…

Bullish Trade Idea: EA ($100.80) Buy Dec Jan 105 call calendar for $1

-Sell to open 1 Dec 105 call at 95 cents

-Buy to open 1 Jan 105 calls for $1.95

Break-even on Dec expiration:

This trade performs best with a gradual move towards the 105 strike over the next few weeks into Dec expiration. If the stock is below 105 Dec expiration the short 105 call will expire worthless and the trade will be left naked long the Jan 105 call. If the stock is close to 105 then the Jan 105 call will have appreciated as it will have picked up deltas. At that point, it might make sense to further reduce the premium at risk by selling a higher strike call in Jan turning the trade into a vertical call spread. The max risk f this trade is the $1 premium paid, and would be at risk with a large move below the current level, or well above the 105 strike.