On November 19th shares of The Home Depot (HD) closed down 5.4% after issuing worse than expected Q3 sales and guidance for the current period, per WSJ:

The home-improvement retailer trimmed its sales forecast for the year and now expects fiscal 2019 sales growth to increase by 1.8%, down from its previous guidance of 2.3%. Same-store sales are projected to grow by about 3.5%, lower than its previous forecast of 4%.

Third-quarter sales at the Atlanta company rose 3.5% from a year ago to $27.22 billion, slightly lower than the $27.53 billion Wall Street was expecting, according to FactSet. Sales at stores open at least a year were up 3.6% for the period, below the 4.7% analysts were anticipating.

Shares of HD dropped 9% from its pre-earnings all-time high on Nov 19th to yesterday morning’s low:

This morning the company issued a press release that they will be hosting an Investor and Analyst Conference on Wednesday, December 11, at 9 a.m, and the stock has caught a bid, as shorts might suspect the company will tell a rosier story for 2020 and that much of the bad news might be out of the way for the time being.

Interestingly, the stock found support right where it should have, at its uptrend from the December 2018 lows:

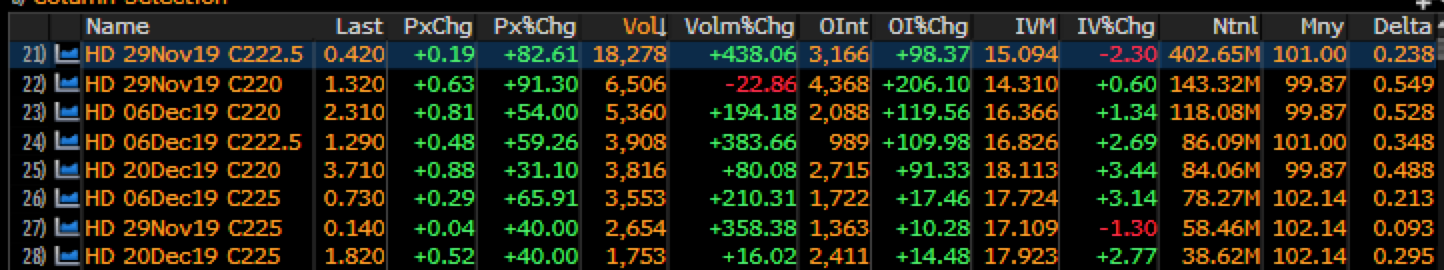

The bounce in the stock has been matched with a flurry of call activity, with calls outpacing puts more than 3 to 1 today with total options volume more than 2x average daily volume. The most active strike on the day is the Nov 29th weekly 222.5 calls with 18,000 trading so far at an average price of 36 cents vs open interest of 3100 coming into the day.

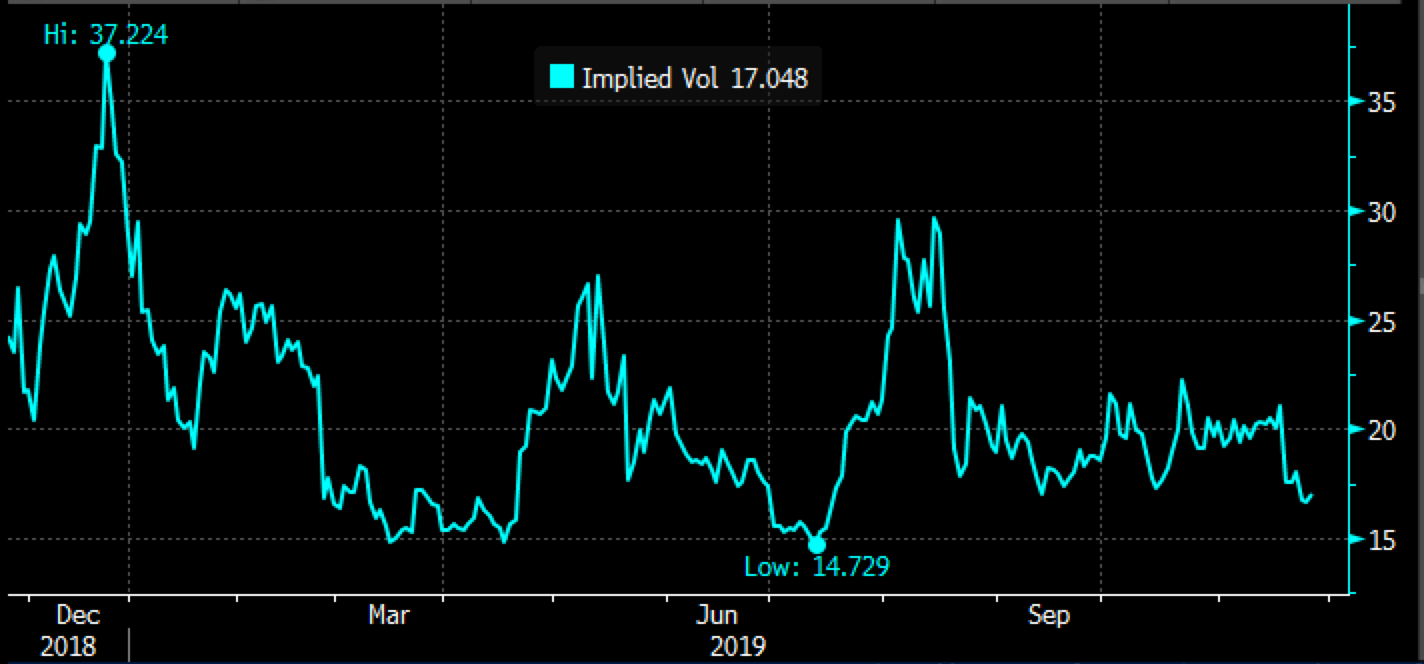

Since earnings, short-dated options prices have come in, with 30-day at the money implied volatility at 17%, while this is still above the 52-week low made this summer just below 15%, it is worth noting that prices did not get too elevated into last week’s print.

So what’s the trade? If I were inclined to play for better news from the company at their Dec 11 investor day, using today’s hold at technical support as a good entry, I might consider calls or calls spreads, as I would not want to be long the stock below the uptrend if it were to break and I would look to define my risk… for instance…

Bullish Trade Idea: HD ($220.30) Buy Dec 222.50 – 232.50 call spread for $2*

-Buy to open 1 Dec 222.50 call for $2.55

-Sell to open 1 Dec 232.50 call at 55 cents

Break-even on Dec expiration:

Profits of up to 8 between 224.50 and 232.50 with max gain of 8 at 232.50 or higher

Losses of up to 2 between 222.50 and 224.50 with max loss of 2 at 222.50 or lower

Rationale: this trade idea breaks even up at 224.50, up 2%, risks only 1% of the stock price for the next month, which includes and event and has a max potential payout of 4x the premium at risk if the stock is up 5.5% in a month.

* I am not sure it makes a ton of sense to sell the Dec 232.50 call for only 55 cents, but for purposes of helping to describe the risk-reward, and what a spread does to the potential payout it is sometimes useful and at the very least it does reduce the premium outlay by 20%. If I were to only buy the calls I would look to spread them on a move higher to reduce the premium at risk.