Target (TGT) will report Q34 results Wednesday before the open. The options market is implying about a $7.50 move, or about 6.5% in either direction that day. This is shy of the 4-quarter average one-day post-earnings move of about 11%, which includes the stock’s 20% gap resulting from a strong earnings beat that was highlighted by a better than expected same-store sales of 3.4%, a 34% increase in online sales and a bump to full-year guidance. Since Aug 21st, the stock has only once tested the closing high on the day following earnings and has been forming a healthy upward trending base, now only 1% from its prior all-time high made in Oct:

Backing the chart out a bit, one can see just how powerful the August earnings gap was, for a stock that had been in a multi-year base:

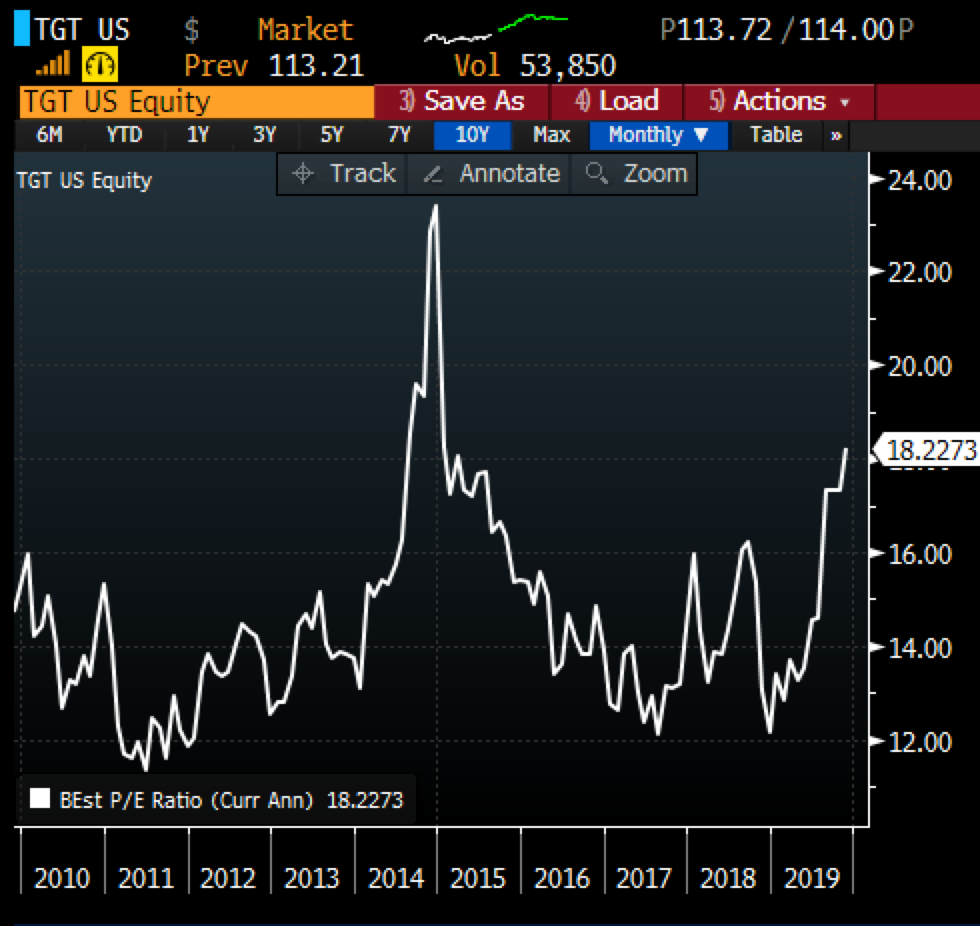

TGT trades at about a market multiple near 18x expected 2020 earnings, which seems fair and cheap to Walmart (WMT) at 24x and Costco (COST) at 35x expected 2020 earnings, but getting quite rich to its own history:

On Friday’s Options Action program on CNBC, I detailed a bearish trade idea with defined risk to play for a near-term pullback in the shares possibly back towards the level the stock gapped to in late August following its Q2 results:

Here is the trade idea broken out:

Trade: TGT $113.25 Buy Dec 110 – 100 put spread for $2.50

-Buy 1 Dec 110 put for 3.50

-Sell 1 Dec 100 put at 1

Break-even on Dec expiration:

Profits of up to 7.50 between 107.50 and 100

Losses of up to 2.50 107.50 and 110, max loss of 2.50 above 110

Rationale: this trade idea breaks-even down 5% within the implied one-day earnings move, but offers a month for it to do so. The trade idea risks 2.2% of the stock price vs a potential gain of 6.7%, or $7.5 if the stock is down 13% from current levels by Dec expiration. The options market is suggesting there is about a 33% chance this trade is break-even on Dec expiration.