Today after the close Shake Shack (SHAK) will report Q3 results. The options market is implying about an $8 one day move tomorrow, or about 9.5% in either direction. While that seems like a hefty move the stock rallied 18% to a new all-time high in early August after reporting better than expected results and has moved nearly 8% the day following earnings since its first report as a public company in 2015.

Despite being down 20% from its all-time highs in early September, the stock is still up a whopping 85% on the year. The year-to-date chart below shows support near $77 at the intersection of the August breakout and the uptrend from the 52-week lows made in December:

For those who are looking to be constructive into the print a perfect retracement back to the August breakout, and very well defined support would have been ideal, bu sadly the stock feels as if it is in no-man’s-land,

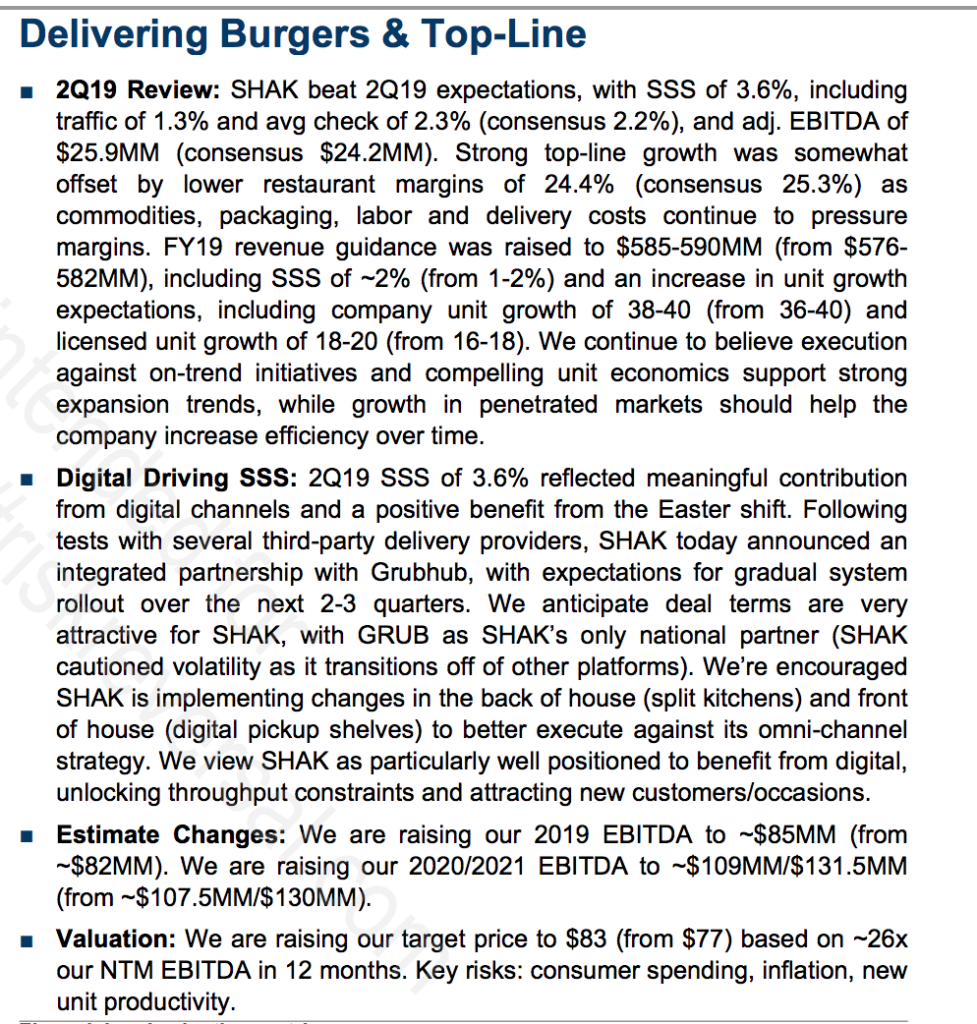

It might make sense to first go back to the Q2 results and see why the stock rocketed 18% the day after.. oper Credit Suisse who’s analyst rates the stock an Outperform:

So its that last part that has lots of analysts on the sideline, only 5 rate the stock a Buy, with 9 holds and 1 Sell. I guess the thing about this story is that it is all about what it can be, not exactly what it is now. McDonald’s does $400 million in sales in a week, not that far from the $600 million SHAK is expected to do in the entire year 2019. SHAK trades 130x expected 2019 eps and 109x expected 2020 eps, which is barely positive in net income terms… $25 million adjusted on those expected $600 million in sales.

The stock is obviously priced to perfection, but with a market cap of only $3.1 billion and expected revenue growth of 25% a year by only growing stores annually by 40 or so a year, you can see a long runaway for this premium brand.

If I were McDonald’s given the very recent results and today’s management shakeup, I might consider a purchase of SHAK, a $5 or $6 billion knockout bid that would include CEO Randi Garutti taking over MCD’s new premium product and a location offering that they would turbocharge and make SHAK founder Danny Meyer (current Chairman) the Chairman of MCD’s board. That’s obviously a pie in the sky scenario but make no mistake, the QSR wars are only increasing with the success of once regional brands like Chick Fila and In N Out Burger branching out a bit… MCD has done a lot of heavy lifting under Easterbrook, with value meals, upgrading quality, all-day breakfast with a focus on tech ordering, but what else do they got right now?

So what’s the trade? I have a few thoughts…

Bullish Scenario: Another beat and raise and this stock is on its way back to $100 before year-end…

Bullish trade idea: SHAK ($83.50) Buy Dec 90 – 100 call spread for $2.20

-Buy to open 1 Dec 90 call for $3.30

-Sell to open 1 Dec 100 call at $1.10

Break-even on Dec expiration:

Profits of up to 7.80 between 92.20 and 100 with max gain of 7.80 at 100 or higher

Losses of up to 2.20 between 90 and 92.20 with max loss of 2.20 at 90 or lower

Rationale: this trade idea risks 2.6% of the stock price, has a break-even up at 92.20, or up 8%, with a max payout up 18% in a little less than 2 months. The options market is saying there is only a 35% chance that this trade is break-even on Dec expiration at 92.20 and only an 18% chance this trade is at max profitability at 100 on Dec expiration. To do a trade like this one needs a conviction on the outcome. Not a great risk-reward, but if you get the direction right this trade idea offers some time for it to get back to 100.

If you thought the rally would be quick you might consider sacrificing time to expiration for closer breakeven, but at a higher premium outlay, for instance with the stock at $83.50 the Nov 15th 85 – 95 call spread costs about $3 with break-even at 88, up 4.8% with a max potential payout of 7 at 95, up 13% which the options market says has only a 20% chance of happening.

or

If you think the weakness in MCD, Starbucks (SBUX) and Yum Brands (YUM) will further seep into sentiment around SHAK then play for a retest of the low $70s….

Bearish Trade Idea: SHAK ($83.50) Buy Nov 15th 80 – 70 put spread for $2

-Buy to open 1 Nov 80 put for $2.65

-Sell to open 1 Nov 70 put at 65 cents

Break-even on Nov expiration:

Profits of up to 8 between 78 and 70 with max gain of 8 at 70 or below

Losses of up to 2 between 78 and 80 with max loss of 2 above 80

Rationale: this trade idea risks 2.4% of the stock price, offers a downside breakeven down 6.5% and a max gain of 9.5% if the stock is down 16% in a little less than two weeks, which the options market suggests is only about a 10% chance of happening.

As always I’ll offer my normal disclaimer for long premium trade ideas into events like earnings, you need to get a lot of things right to merely break-even, first and foremost you need to get the direction right, the magnitude of the move and timing.

ONE MORE THING… If you like the idea of playing SHAK for takeout, but think it is a low probability chance.. consider call calendars, selling short-dated out of the money call premium and use the proceeds to help finance the purchase of longer-dated out of the money call premium… for instance…

SHAK ($83.50) Buy Nov – Jan 95 call calendar for $1.60

-Sell to open 1 Nov 95 call at $1.15

-Buy to open 1 Jan 95 call for $2.75

Break-even on Nov expiration:

This trade performs best with a gradual move towards the 95 strike over the next two weeks into Nov 15th expiration. If the stock is below 95 on Nov expiration the short 95 call will expire worthless and the trade will be left naked long the Jan 95 call. If the stock is close to 95 then the Jan 95 call will have appreciated as it will have picked up deltas. At that point, it might make sense to further reduce the premium at risk by selling a higher strike call in Jan turning the trade into a vertical call spread. The max risk of this trade is the $1.60 premium paid, and would be at risk with a large move below the current level, or well above the 95 strike.