On Friday, August 16th I previewed Salesforce.com’s (CRM) FQ2 earnings (read here) and detailed a hedge idea into the print for long holders that I also discussed on CNBC’s Options Action that evening, watch below:

Salesforce is gearing up to report next week, and @RiskReversal has a way to trade it ahead of earnings. $CRM pic.twitter.com/08a0KR7PdA

— Options Action (@OptionsAction) August 16, 2019

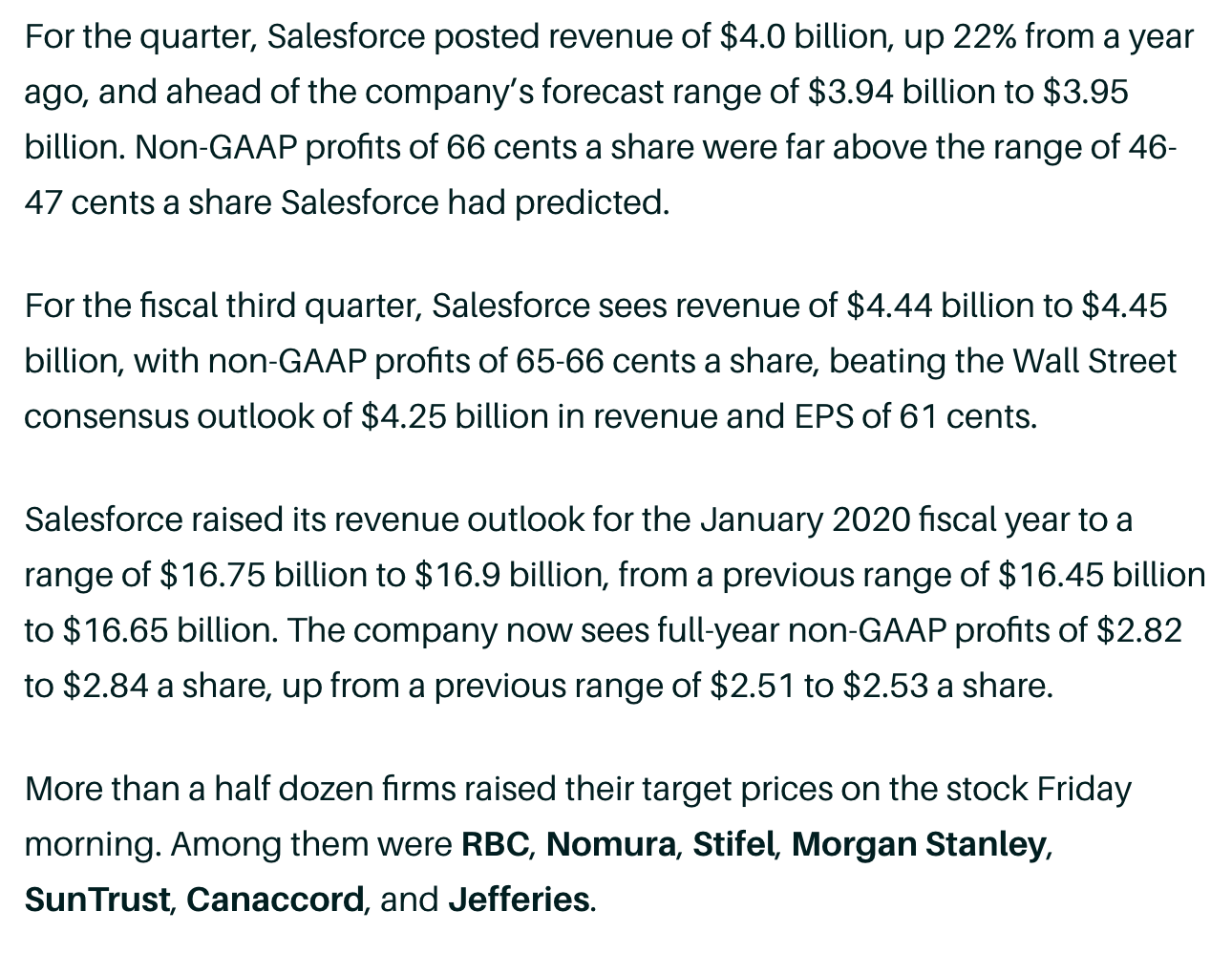

Thursday after the close CRM put up a big beat and raise, per Barron’s:

CRM gapped up nearly 7% on the open Friday, the stock spent the rest of the day pairing its gains in sympathy with the Nasdaq Composite that closed down 3% on the day, resulting in only a 2.25% gain for CRM:

In the post on Aug 16th I detailed an Oct collar for long holders, suggesting:

If looking to hedge long stock into an event like earnings, options premiums are usually elevated as market makers expect greater than usual volatility post results, so to sell options, they require higher prices… this elevated implied volatility is one reason why collars make sense relative to merely buying put protection as you are helping to finance the purchase of the put with the call sale…

….

Here is an example of a collar I might consider in CRM over the next couple months keeping in mind that after earnings there will be no shortage of macro headlines related to the trade war with China, Brexit and a whole host of other issues that have caused market volatility of late.

Hedging Idea:

VS 100 SHARES OF CRM LONG AT $144 CONSIDER BUYING OCT 160 – 130 COLLAR FOR 70 CENTS

-Sell to open 1 Oct 160 call at $2

-Buy to open 1 Oct 130 put for $2.70Break-even on Oct expiration:

Gains of the stock up to $159.30 (160 call strike less 70 cents premium paid) between now and Oct expiration, profits capped above $160. On or before Oct expiration investor could always cover the short call strike if the stock is at or above 160 to keep the long position intact.

Losses of the stock down to the 130 long put strike (plus the 70 cents premium paid). Protected below 130.

With the stock closing at $151.57 the Oct 130 – 160 collar that cost 70 cents when the stock was $144 on Aug 16th is now worth about $2.20 for a $1.50 loss on the hedge, despite the stock rallying $7.57. So the cost of protection below $130, down about 10% shaved off about a third of the stock’s gain. But I think it is important to remember what we are trying to achieve with hedges, especially those where we are looking to help finance the put protection with the sale of a call. From the Aug 16th post:

Rationale: an investor would do this if they do not want to sell their long position but are more worried about extreme downside near term then they are about extreme upside. Most importantly willing to suffer losses down to 130 and have gains capped at 159.30 between now and Oct expiration.

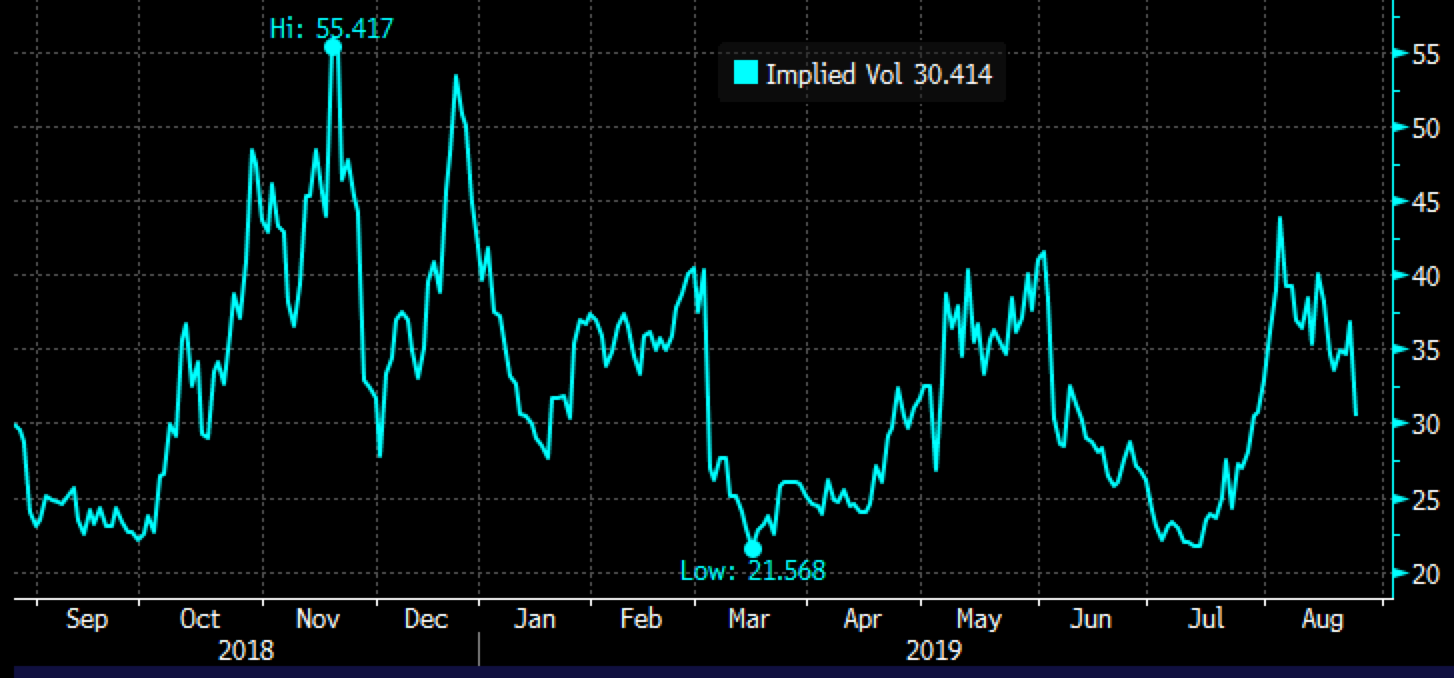

It’s also worth discussing the change in the value of the two options used in this hedge overlay with the stock up 5.25% in a week, but I guess most importantly after an earnings event. At the time of the trade, 30-day at the money implied volatility was at 34%, but after Friday’s gap higher in the stock, and the broad weakness in the market causing the VIX to push back up towards 20, options prices stayed relatively bid. But despite all that the Oct 160 calls that could be sold at $2 when the stock was $144 on Aug 16th were worth $3.50 on Friday’s close when the stock was $151.57 and the Oct 130 puts that could have been bought for $2.70 when the stock was $144 could be sold at $1.30 for a little more than half their value from the prior week.

So the question for holders of the stock and this overlay is whether to keep the overlay on, close one leg or both legs.

I suspect that if the market were to settle a bit in the coming days, in a calmer market where investors are once again embracing growth, the stock is likely to re-test Friday’s highs and possibly make a run back to its prior highs near $167.50 from April:

And if that happens then options prices will come in, hard… likely back towards the 2019 lows in the mid-20s:

In that scenario, the stock is far closer to the short call strike than they are to the long put strike, and the Oct 130 puts will decay far quicker than the Oct 160 calls which have a much higher delta just $8.5 out of the money with nearly 2 months to expiration.

If you thought the stock is likely to move higher as soon as the market regains its footing than it makes sense to cover the short call for a loss and allow for upside above $160. I would use any weakness this coming week in CRM to cover the short call of this overlay if I wanted to keep the long stock position intact.

In this case, I’d need to ask myself how useful is the Oct 130 put, now $21 or 14% out of the money, and I’d say not too helpful unless I thought the market were to crash in the coming weeks.

As of Friday’s close, the Oct 160 call had about a 34 delta which means the options should gain or lose about 34 cents per $1 move in the stock with the stock in and around current levels (but there are other factors that could affect that), while the Oct 130 puts had about a 12 delta, moving only 12 cents per dollar in and around current levels. The delta change for each option will obviously change, get higher as the stock moves closer to, or in the money of either strike.

If I were long stock, long Oct 130-160 collar from lower levels I would look to close hedge on a pullback in the stock early this week.

If I were long stock and looking to put on another low-cost collar I might look to roll up the short call strike, possibly to $165, and roll up the short put strike, possibly to $140…