On July 11th I wrote a post on Facebook (I Know What You Did Last Summer) attempting to bookend last summer’s all-time high in the stock on the eve of their report of their Q2 2018 earnings as we head into today’s Q2 2019 after a very volatile 12-months in the stock which resulted in a 43% peak to trough decline into the end of 2018, and the subsequent 63% bounce from those lows to current levels. Looking back to the start of 2018, the stock appears to be sitting on an important technical level in and around $200:

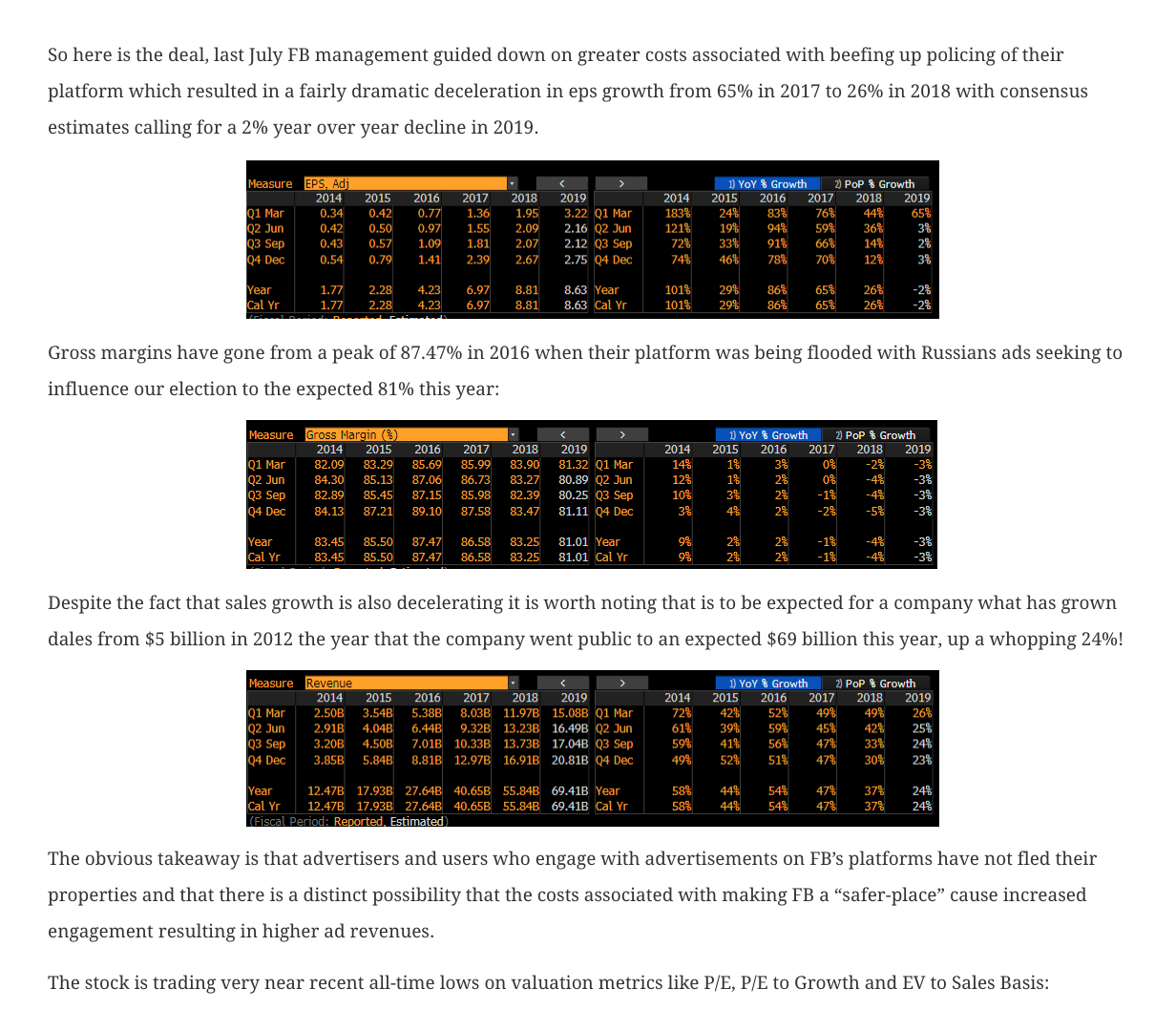

I had some thoughts on earnings and sales expectations for the stock going forward, and valuation:

Today FB agreed to pay a fine of $5 billion to the FTC, the largest ever for improper practices related to customer data privacy dating back to the 2016 presidential election. The hit to eps growth noted above in the earlier post is the result of the company’s costs associated with expenses related to changing its practices in an attempt to guard against its platform being co-opted by bad actors in the future.

This settlement and fine is NOT connected to what the WSJ is reporting this morning that the Justice Department to Open Broad, New Antitrust Review of Big Tech Companies:

The review is geared toward examining the practices of online platforms that dominate internet search, social media and retail services, the department said, confirming the review shortly after The Wall Street Journal reported it.

The new antitrust inquiry under Attorney General William Barr could ratchet up the already considerable regulatory pressures facing the top U.S. tech firms. The review is designed to go above and beyond recent plans for scrutinizing the tech sector that were crafted by the department and the Federal Trade Commission.

It is impossible to know how companies like Facebook will be adversely affected, and what the costs to comply with any rulings and the potential fines maybe, but I think it is safe to say as we head into what I likely to be one of the most contentious political years in our countries history this may end up being a bi-partisan issue, and one not likely to go away soon and possibly weigh on all of the companies ability to return cash to shareholders or take other corporate initiatives like product rollouts or m&a.

So what’s the trade? The options market is implying about a $13 move in either direction tomorrow, or about 6.5%, which is shy of the 9% average one day move following the last four quarters, but basically in line with the average of about 7% since its 2012 IPO.

Short-dated options prices seem dollar cheap to me. If you thought the company could beat Q2 and guide higher then the stock is likely on its way back to the all-time highs made last July near $217 in the days/weeks to come. With the stock at $202, the July 26th weekly 202.50 call is offered at $6 or 3% of the stock price for a break-even up at $208.50, up 3.2%.

On the flip side, a miss and a guide down and the stock is likely on its way back to $180 in the days/weeks to come. With the stock at $202, the July 26th weekly 202.50 put is offered at $7.25, or 3.,5% of the stock price, with a break-even at $195.25, down 3.3%.

As we often outline when discussing long premium directional trades into earnings… you need to get a lot of things right to merely break-even, direction first and foremost, the magnitude of the move and of course timing. Buying at the money weekly options into events like earnings can be very Binary and should be used for those with high conviction when one is looking to define their risk, or hedge a long or short position, or possibly add leverage but be cognizant of risking what you are willing to lose.

Overlays vs Long Stock…

Hedge Vs Long Stock:

If I was long stock, do not want to sell my shares up 54% on the year, but looking to define my risk into the earnings print and into what might prove to be a volatile period for the broad market over the next month, I might consider collars vs long stock, selling an out of the money call and using the proceeds to buy an out of the money put, allowing for upside in the stock to the short call strike-through expiration, with profits capped at the call strike, losses down to the long put strike till expiration, but protected below… for instance…

VS 100 Shares of FB long at $202 Buy Aug 217.50 / 185 collar for even money

-Sell to open 1 FB Aug 217.50 call at $2.30

-Buy to open 1 Aug put 185 put for $2.30

Break-even on Aug expiration:

Gains of the stock up to $217.50 between now and Augt expiration, profits capped above. On or before Aug expiration investor could always cover the short call strike if the stock is at or above 217.50 to keep the long position intact.

Losses of the stock of up to $17 down to the 185 long put strike. Protected below

Rationale: an investor would do this if they did not want to sell their long position and are more worried about extreme downside near term then they are about extreme upside. Most importantly willing to suffer losses down to 185 and have gains capped at 217.50 between now and Aug expiration.

OR

Leverage Vs Long Stock:

Or If I were long FB and not concerned with the potential downside post-earnings, but had high conviction on a rally back to new highs on a beat and raise I might look to add leverage to an existing long position by overlaying a 1×2 call spread… for instance:

Vs 100 shares of FB long at $202 Buy Aug 215 / 225 1×2 call spread for 70 cents

-Buy to open 1 Aug 215 call for $3

-Sell to open 2 Aug 225 calls at $1.15 each or $2.30 total

Break-even on Aug expiration:

Profits of the stock up to $225, capped there, but gains of the overlay of up to $9.30 (width of the call spread overlay less the premium paid for the overlay). Best case scenario on Aug expiration the stock is $224,99, the stock position has gained $23, and the call spread has gained $9.30, adding 4.6% yield to the position on top of the 11.3% gain of the stock.

Losses of the stock below current levels plus the 70 cents premium for the overlay.