Adobe (ADBE) will report their fiscal Q2 results tomorrow after the close. The options market is implying about a 4% one-day move Wednesday, which is in line with the average one-day post-earnings move over the last four quarters, but just shy of the 5% average one-day post-earnings move over the last 10 years.

Shares of ADBE are up 22% on the year, slightly besting the 18.5% gains of the Nasdaq Composite, with the chart banging around technical resistance just below $280 at its prior all-time highs from Sept 2018, while it also found some technical support earlier this month very near its 200-day moving average in the mid $250s:

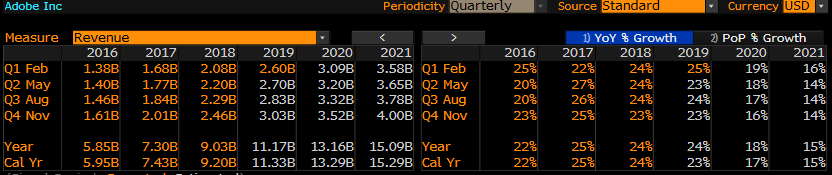

Wall Street analysts are fairly mixed on the stock with 19 Buy ratings and 13 Holds, one reason might be the lack of progress the stock has made year over year, the other might be the fact that it trades 35x expected 2019 eps growth of 16% and 12x expected sales growth of 24%. But that 24% sales growth is not a one-off, as this year the company is expected to print its 4th consecutive year of 20% plus revenue growth, which is fairly astounding:

You get the point despite eye-popping revenue growth and stable mid-teens eps growth, the stock is expensive.

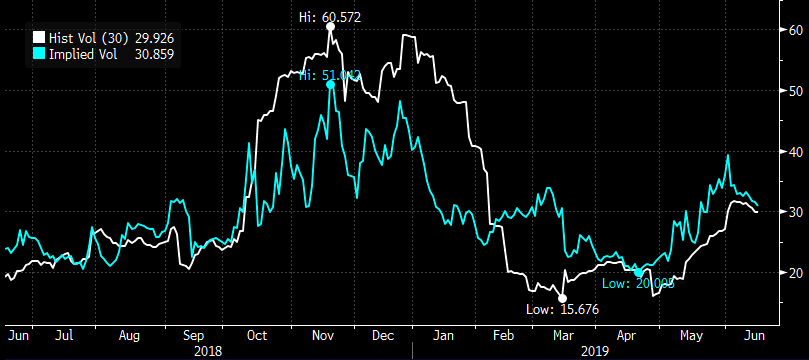

Short-dated options prices seem fair relative to realized volatility in the stock, with 30-day at the money implied volatility (the price of options, the blue line below) at a very narrow spread with realized (white line below) at 31% vs 30%, making options prices look fair to cheap.

So what’s the trade? the stock’s recent consolidation and the relative cheapness of short-dated options make an attractive argument to own weekly at the money puts or calls for those with a strong directional bias post-earnings.

With the stock at $276, the June 21st 275 straddle (the call premium + the put premium) is offered at about $12.50, if you bought that, you would be buying the implied movement in either direction between now and Friday’s close or about 4.5%, most of which would be for the post-earnings movement. But let’s say you thought the stock was going to rally on Wednesday on strong earnings and guidance, and the stock would rally at least in-line with the implied move then you could merely buy the June 275 call for about $7 (vs stock at $275) risking about 2.5% of the stock price into the print for a break-even up at $282 on Friday’s close… and vice versa if you thought the company would miss and/or guide down one could buy the June 275 put for $5.50, or about 2% of the stock price for a break-even down at $269.50 on Friday’s close.