Back in early March, (Bonds Shaken, Not Yet Stirred) I made the case that U.S. Treasury Yields were about to take another leg lower:

Its been my view for years as the Fed ended quantitative easing (QE) in 2014 and then ending their zero interest rate policy (ZIRP) in 2015 that their ability to materially reduce their $4.5 trillion balance sheet of assets accumulated since the start of QE in 2008 would massively strain their ability to get Fed Funds back anywhere near “normal” but clearly nowhere near their prior highs above 5% in 2007 and above 6% in 2000. That inability would obviously weigh on the long term trajectory of interest rates, which has been lower… and that we are likely to see zero or negative interest rates far more frequently in the decades to come than we have in the past 100 years.

…

a story this morning from Bloomberg catching some attention, and causing some to believe that a trade deal with China might not cover the major issues at the heart of our longstanding issues… Trump Pushes China Trade Deal to Boost Markets as 2020 Heats Up… the issue here is that he wants a win so badly that a less substantive deal will only really address the trade deficit and those changes might already be incorporated in market participants expectations and it may not provide the sort of stimulus that the global economy needs after a period of softness, that was caused by trump’s insistence in tariffs in the first place. Oh and not just with our adversaries like China but also the steel and auto tariffs with allies like Canada, Mexico, and Europe. If a trade deal is the last potential positive catalyst to spark a global reflation in growth, then a half baked trade deal is likely to be a big flop and fending off a recession in Europe and Asia seems unlikely, and you know what comes next… the U.S. To combat that the Fed will get more dovish, rates will go lower while we also see a potential flight to quality in U.S. Treasuries as we normally do in periods of global economic strife.

In that scenario, short-dated options prices in the TLT are some of the cheapest on the board with 30-day at the money implied volatility at just 8%

Here was the trade idea I detailed to express the view that we are likely to see greater risk asset volatility in the spring, that treasury bonds could catch a bid, and the implied volatility on the etfs that track them was too low:

So what’s the trade? If you are looking for ways to play greater financial market volatility in the coming months, TLT vol is some of the cheapest you will find. But for the ETF to appreciate we would likely need to see an increasingly dovish Fed which would likely be a reaction to a weakening global economy. You could bet against stocks, but options premiums are a bit more expensive than the TLT…

BULLISH TRADE IDEA: TLT ($120.35) BUY JUNE 122 / 130 CALL SPREAD FOR $1.45

-Buy to open 1 June 122 call for 1.70

-Sell to open 1 June 130 call at 25 cents

Now the TLT is $128.65, up $8.35 or 7%, and the June 122 / 130 call spread that could have been bought then for $1.45, that expires in three weeks and can only be worth $8 on expiration is worth $6. At this point to remain long for the next few weeks you would be risking $6 to possibly make another $2, not exactly a great risk-reward. At this point, it makes sense to close the trade, take the profit and roll a portion of the profits up and out.

Action: Sell to close TLT ($128.65) June 122 / 130 call spread at $6 for a $4.55 profit

It is worth noting that $130 in the TLT is the level the etf gapped lower from the surprise election of trump in early November 2016. While this might serve as some near-term technical resistance, it is interesting that at the time, bond yields rose sharply because of the belief that a trump administration would be pro-growth, but the fact that we are now round-tripping the move two and half years later it is worth considering where we are in the cycle, especially as we appear to be heading into a difficult trade impasse with China.

For those who like to look at the 10-yr Treasury yield as a reflection of growth expectations, it is hard to see how it does not re-test the level it busted out through in the days following the 2016 election and bounced hard off of in 2017 and not retest:

Over the next few months, there are clearly a few catalysts for a big rate move one way or the other.. first and foremost a substantive resolution to the trade fight between the U.S. and China would relieve some of the pressures weighing global growth. I don’t think a substantive deal that addresses much other than the trade deficit is in the cards. I suspect the headwinds to global growth remain throughout 2019 and global yields remain suppressed.

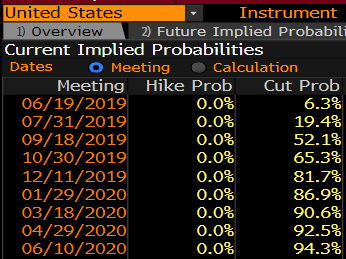

Then, of course, there are expectations of the next move by the Fed, which got the party started in January, weeks after their last Fed Funds quarter-point hike, with a pivot to a much more dovish stance. In a matter of weeks, Fed Funds futures were pricing two quarter-point rate INCREASES in 2019 to now what looks like a 50% probability of a quarter-point cut in at their September meeting, and an 80% chance of a quarter-point cut at their December meeting, per Bloomberg:

So what’s the trade? If I were inclined to roll this bullish view on US Treasuries (bearish on yields) up and out I might consider the following call spread in Sept in the TLT:

Bullish Trade Idea: TLT ($128.65) Buy Sept 130 – 140 call spread for $1.60

-Buy to open 1 Sept 130 call for 2.10

-Sell to open 1 Sept 140 call at 40 cents

Break-even on Sept expiration:

Profits of up to 8.40 between 131.60 and 140 with max gain above 140

Losses of up to 1.60 between 130 and 131.60 with max loss of 1.60 below 130

Rationale: this trade idea risks 1.25% of the etf price and can make 5.25x the premium at risk if the TLT is up close to 9% by Sept expiration.