TJX Companies (TJX), the off-priced retailer will report their fiscal Q1 results tomorrow morning before the opening. The options market is implying about a 4.25% one-day post-earnings move which is nearly in line with the 4% average the stock has moved the day following its last four reports, but above the ten-year average of about 3.2%.

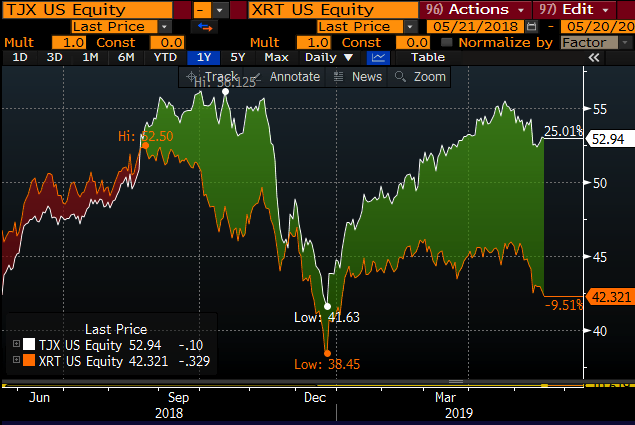

Shares of TJX are massively out-performing most of its Softline and department store peers, up 18.5% on the year, massively out-performing the XRT (the S&P Retail etf) which is only up 4% on the year and the S&P 500 (SPX) which is up 13% on the year.

While the relative strength is nothing short of impressive, It is important to note that the stock is down about 5% from its recent highs, slightly more than the 3.5% decline in the SPX from its high on May 1st, which was a new all-time high, which it is worth noting, TJX failed to confirm the high with a new one of its own:

The one year chart above shows just how important the technical support is between $53 and $50, with its 200-day moving average at $51.67 and the earnings gap level from last August and the collapse level Nov 19-20, also around earnings.

Shares of TJX trade about 20x the fiscal year 2020 eps growth of only about 6% on an expected 6% yoy sales growth, which I about the midpoint of its P/E multiple over the last five years.

Wall Street analysts remain overwhelmingly positive on the stock with 20 Buy ratings, 6 Holds and only 2 Sells with an average 12-month price target of $56.33, 6% above where the stock is trading just below its all-time made on October 1st.

So what’s the trade?

If I were inclined to play for a beat and raise and a move back to the previous highs I might consider the following defined risk strategy.

Bullish Trade Idea: TJX ($53) Buy June 52.50 – 57.50 call spread for $1.75

-Buy to open 1 June 52.50 call for 2

-Sell to open 1 June 57.50 call at 25 cents

Break-even on June expiration:

Profits up to 3.25 between 54.25 and 57.50 with max gain of 3.25 at 57.50 or higher

Losses of up to 1.75 between 52.50 and 54.25 with max loss of 1.75 at 52.50 or lower.

Rationale: this trade idea risks 3.3% of the stock price for a month into a potentially volatile event. The trade idea is already 1% in the money, so the break-even to the upside is 2.3% less the premium at risk.

Or If I thought the outperformance of TJX was about to come to an end, and a miss and guide down was in the cards I might look to play for a move back to the highs $40s…

Bearish Trade Idea: TJX ($53) Buy June 52.50 – 47.50 put spread for $1.15

-Buy to open 1 June 52.50 put for $1.40

-Sell to open 1 Jun 47.50 put at 25 cents

Break-even on June expiration:

Profits of up to 3.75 between 51.35 and 47.50 with max gain of 3.75 at 47.50 or lower.

Losses of up to 1.15 between 51.35 and 52.50 with max loss of 1.15 above 52.50

Rationale: this trade idea risks 2.2% of the stock price but unlike the bullish trade idea, this one is out of the money and has a further break-even, down 3.1% but a higher potential payout vs the premium at risk given the out of the money nature of the idea. I guess if the stock were to miss and guide lower the reaction would likely far outperform the implied movement of 4%.