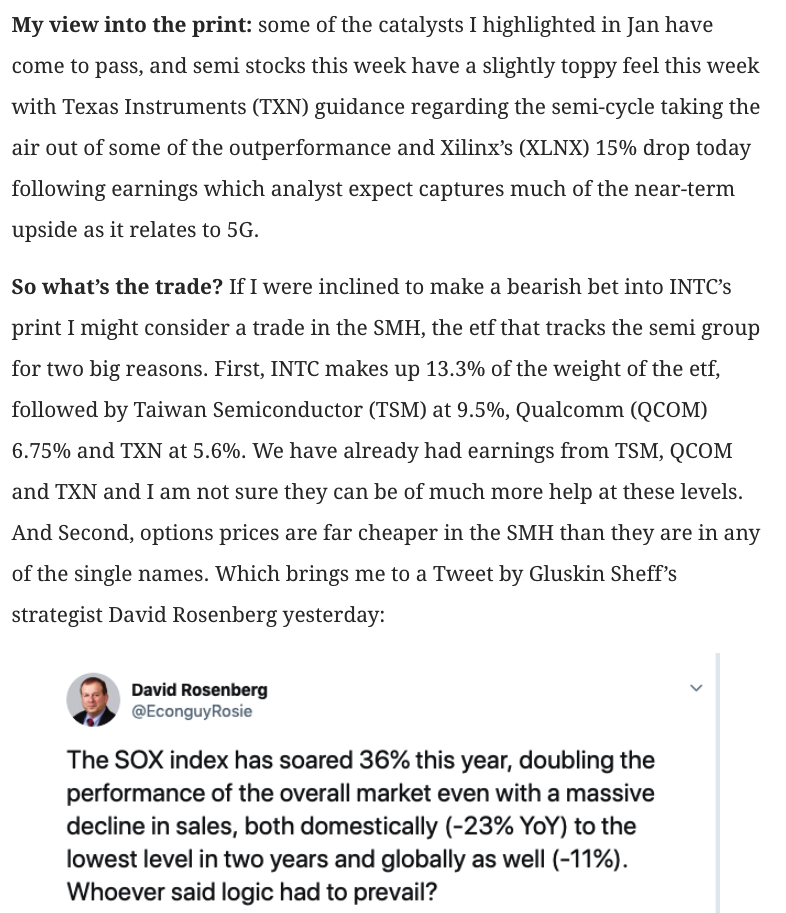

On April 25th prior to Intel’s (INTC) Q1 earnings, I laid out a bearish case for semiconductor stocks:

And here was the trade idea:

To quote the dude, this aggression will not stand man!

BEARISH TRADE IDEA: SMH ($117) BUY JUNE 117 – 106 PUT SPREAD FOR $3

-Buy to open 1 June 117 put for $4.30-Sell to open 1 June 106 put at $1.30

Break-even on June expiration:

Profits of up to 8 between 114 and 106 with max gain of 8 below 106

Losses of up to 3 between 114 and 117

Since April 25th when the SMH, the etf that tracks the semiconductor space, has reversed and is now down 12% from the all-time high the etf made on April 24th and trading just above the short put strike of the put spread detailed above.

So what to do now? With the etf at $105.75, the $11 wide put spread that cost $3 can be sold at about $7 with more than a month to expiration. At this point you are risking $7 to make just another buck because at expiration, the profit on the long 117 put can only be $11 (because of the short 106 put) and that is less the $3 that was paid.

Action: SMH ($105.75) Sell to Close June 117 – 106 put spread at $7 for a $4 gain.