Cisco Systems (CSCO) will report their fiscal Q3 results Wednesday after the close. The options market is implying about a 5% one-day post-earnings move, which is rich the average one-day post-earnings move over the last four quarters, and a tad below the 5.4% average over the last ten years. With the stock at $53.25, the May 53 straddle (the put premium + the call premium) is offered at about $2.60, or about 5%, if you bought that, and thus the implied movement between now and next Friday’s close you would need a rally above $55.60, or a decline below $50.40 to make money by next Friday’s close.

Shares of CSCO are up about 23% on the year, besting the performance of the Nasdaq Composite which is up 19.5%, and up 32% from its 52-week lows made over Christmas. Before this morning’s reversal, the shares had corrected nearly 10% from their 52-week and nearly 20-year highs made last month.

I think it is safe to say that the stock’s recent weakness is associated with investor concerns about the U.S. trade skirmish with China that was reflected in other U.S. multi-national tech companies forward guidance of late (see INTC and TXN).

Today’s reversal in the stock is impressive, but when you consider some of the main issues for our trade dispute with China, and CSCO competitor in the communication equipment space, the Chinese behemoth, Huawei, and I am hard pressed not to think CSCO will not offer some form of cautious guidance for the current quarter.

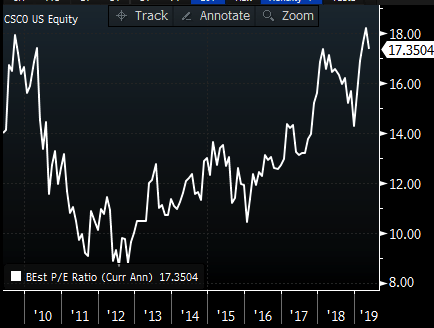

Oh, and the stock is trading at a very high multiple at about 17.5x, which is very near a 10 year high:

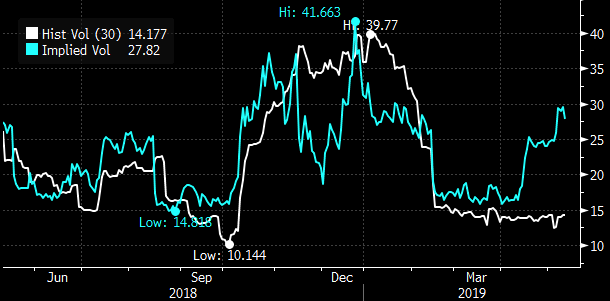

Short-dated options prices are rightfully high with 30-day at the money implied volatility (blue line below) around 28% are at a massive premium to realized volatility (white line below, how much the stock has been moving):

My View into the print? Last month Intel (INTC) lowered guidance for 2019 and among other things specifically cited weakness in China. The stock dropped 9% from a then 52-week and also nearly a 20-year high. The stock has since dropped another 10% after lowering guidance this week on more product-specific issues. The 20-year charts of INTC and CSCO overlayed against one another are uncanny, the only thing CSCO is missing is the 20% drop from the 19 year highs… stay-tuned:

So what’s the trade? Given the volatility in the stock and the broad market today, we might get some follow through on Monday, but prior to Wednesday’s earnings, I might look to play, with defined risk for a 10% move lower following CSCO’s Q3 print. Short-dated options, while expensive look fair for those with conviction of a greater than expected move… here is the trade I would consider on Wednesday before earnings (I am not doing this trade today) if the stock is still around $53.25:

Bearish Trade Idea: CSCO ($53.25) Buy May 53 – 49 put spread for $1

-Buy to open 1 May 53 put for $1.20

-Sell to open 1 May 49 put at 20 cents

Break-even on May expiration:

Profits of up to 3 between 52 and 49 with max gain of 3 at 49 or lower

Losses of up to 1 between 52 and 53 with max loss of 1 above 53

Rationale: this trade idea risks 2% of the stock price with a break-even down 2.4% and offers a max potential payout if the stock is down 8% in week after earnings.