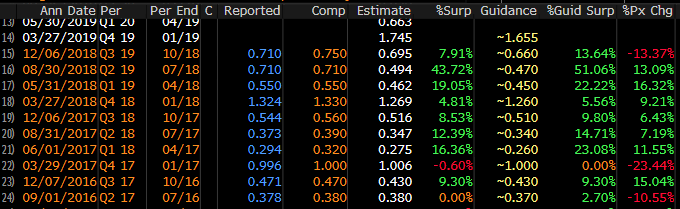

Lululemon (LULU) reports their fiscal Q4 results tonight after the close, the options market is implying about a 10% one day move tomorrow that is shy to its average one-day post-earnings move over the last four quarters of 13%. The post-earnings movement has been off the hook over the last couple of years… look below at the far right column that says % px chg, that is the one day move after earnings dating back to July 2016, the average one-day post-earnings move over the last ten quarters has been 12.5%:

While past volatility is certainly not indicative of future volatility, the stock’s two-month consolidation after its sharp January reversal from its 3-month 33% peak to trough decline from all-times made in October suggests that the stock might be poised for movement, as investors wait for the earnings and guidance to catalyze the next major move int he stock:

I think it makes sense to go back to early Dec when the company issued earnings and guidance that sent the stock careening 13% on Dec 6th following their fiscal Q3 results and forward guidance. What was fascinating about the stock’s earnings reaction was that the news was generally good, per Barron’s:

earned 75 cents a share on revenue of $747.7 million, while analysts were looking for EPS of 70 cents on revenue of $736.1 million. Comparable sales rose 18% on a constant-dollar basis, above the 13.9% consensus estimate. Same-store sales rose 7%, while direct-to-consumer net revenue rose 46%. Gross margins increased 240 basis points to 54.4%.

For the fourth quarter, lululemon expects to earn between $1.64 and $1.67 a share on revenue of $1.115 billion to $1.125 billion. Consensus calls for EPS of $1.65 on revenue of $1.12 billion.

So what gives? Was it the stock’s then 70% ytd gains into the print, positive sentiment from the Wall Street analyst community and rich valuation relative to peers and the market? Possibly all of the above, but I think it is also safe to suggest that the broad market was in the throes of a global sell-off following the disappointment of trump to nail down a substantive trade deal the week prior at the G-20.

Shares of LULU trade at about 33x next year (FY 2020) expected eps growth of 18% on 14% expected sales growth. This compares to Nike (NKE) trading at 27x expected next year (FY 2020) eps growth also of 18% on 8% expected sales growth. LULU seems a tad rich to one of its main peers on an eps basis. But it is worth noting that LULU is a $19 billion market cap company, trading at about 5x its expected 2020 sales of $3,7 billion vs NKE which sports a $130 billion market cap and is expected to print close to $43 billion in sales next year. Last week shares of NKE dropped 6.6% on March 21st following earnings and guidance found disappointing.

So what to expect from LULU? I would be surprised to see the stock up 10%, in line with the implied move on a beat, without a material bump in forward guidance, while I could easily see the stock down 10% on a miss and a guide down. Obviously, the magnitude of the guide will be the determination on the move, but with the stock’s recent consolidation, and NKE’s reaction to its recent results, I suspect the risk is to the downside following the print.

So what’s the trade?

If I were inclined to play for a beat and raise and a rally in line with the implied move of 10% I might consider the following call spread…

Bullish Trade Idea: LULU ($146) Buy April 148 -165 call spread for $5.50

-Buy to open 1 April 148 call for 7.50

-Sell to open 1 April 165 call at 2

Break-even on April expiration:

Profits of up to 11.50 between 153.50 and 165 with max gain of 11.50 at 165 or higher

Losses of up to 5.50 between 148 and 153.50 with max loss of 5.50 below

Rationale: risk-reward on long premium directional prints in a name like this into an event with options premiums where they are is not great, risking 1 to possibly make a little more than 2 is not an ideal relationship.

Or

If I were inclined to play for a miss and a guide down I might consider the following put spread that allows for the trade to play out over the next few weeks…

Bearish Trade Idea: LULU ($146) Buy 145 / 120 put spread for $7

-Buy to open 1 April 145 put for 8

-Sell to open 1 April 120 put at 1

Break-even on April expiration:

Profits of up to 18 between 138 and 120 with max gain of 18 at 120 or lower

Losses of up to 7 between 138 and 145 with max loss of 7 at 145 or higher

Rationale: Again, this trade idea has an only ok risk-reward, as long premium directional trades are challenged with implied volatility where it is into the print.