Dan previewed NKE’s Q2 earnings report yesterday and detailed a hedge for those long the stock. With the stock higher on the report and about a month until the hedge expires I wanted to check in on that for position management purposes. Here was the overlay, from yesterday:

vs 100 shares long of NKE ($68.50) Buy Jan 75 / 65 collar for 50 cents

-Sell to open 1 Jan 75 call at 1.10

-Buy to open 1 Jan 65 put for 1.60

With the stock now 72.20, the gains in the stock stand at $3.70, but against that, this collar is down about 1.25 mark to market (it would cost about .75 to close, it cost .50 to open). The 65 puts aren’t doing a ton of good anymore with the event past, even in a market as volatile at this one. Therefore it may make sense to close those, in order to retain the premium left (about .80). What to do with the short 75’s is another question. It may make sense to let those stand and have an over-write on, if NKE stays below 75 into next month those would decay and the net result of the entire trade would be a profit on the overlay versus the gains in the stock. However, we are in a volatile market, and that doesn’t just mean to the downside, we could see some sharp rallies higher over the next few weeks. And in that case those short calls versus the stock could end up being pretty tight. So for those that just wanted a hedge into the event and are fine with a slight loss on the overlay versus the gains in the stock the entire collar can be close. For those fine with leaving an over-write and maybe even a little worried about these gains not holding the short call would be helpful on any sideways or slightly lower move.

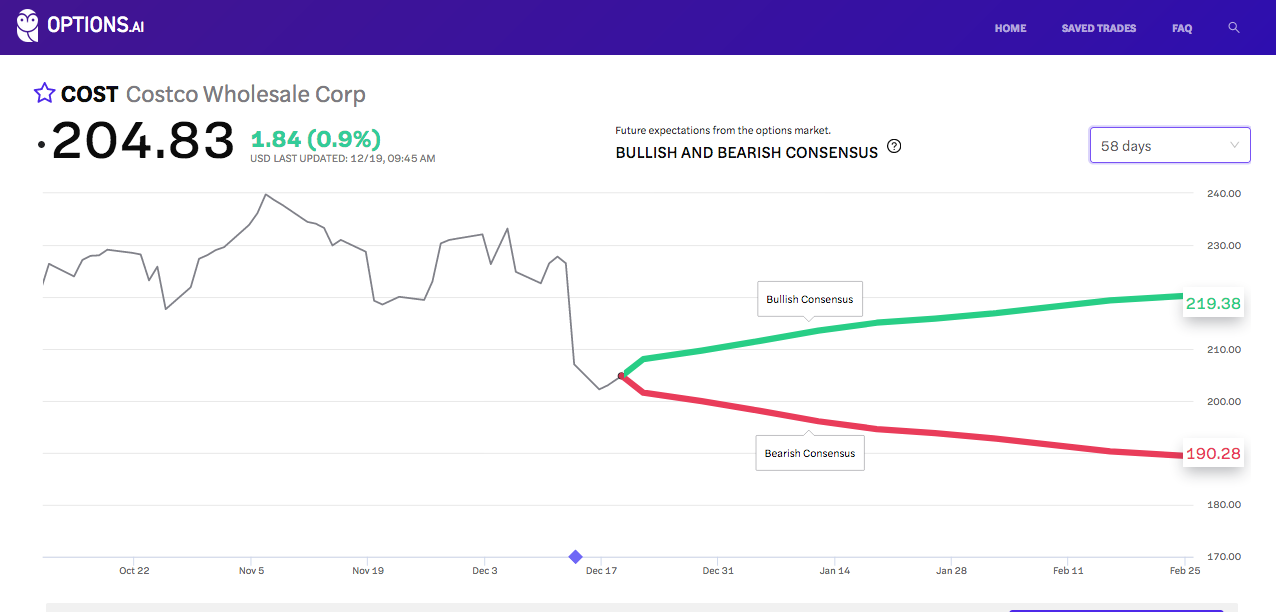

Here’s the expected move as currently priced by the options market into the end of January, as you can see the 65 puts aren’t doing a ton of good anymore with the stock higher, and the calls are certainly within striking range. So whether to take the entire hedge off or simply just the puts at this point is up to your own market sentiment. And for those really bearish in this market, leaving the entire overlay on for the outside chance NKE gets hammered in the next couple of weeks isn’t the dumbest idea in the world, but remember any close between 65 and 75 and this is worthless, costing .50: