In November Dan checked in on 3M (MMM) after it had rallied 13% from post earnings lows in late October. Dan’s view was that the rally likely had to do with the collapse in oil prices during that time, but as only one input the stock had probably bounced too far too fast and a retest of recent lows could come if volatile markets continued. Here was the initial trade idea, from Nov 19th:

Bearish Trade Idea: MMM ($207) Buy Dec 28th (weekly) 205 / 185 put spread for $4.25

-Buy to open 1 Dec 28th 205 put for 5.25

-Sell to open 1 Dec 28th 185 put at 1

With MMM now about $10 lower this trade is in good shape with a couple of weeks left until expiration, so let’s check in on it and see how to best manage. Right now, with the stock 197.80 this put spread is worth about 7.50, versus the initial 4.25 at risk. It can be worth up to $20 if the stock was 185 or lower at the end of the month, but right now, it’s worth about what it would be worth at expiration of the stock closed here (with the stock 197.80 this trade is intrinsically worth 7.20). That means that there’s not alot to think about as far as time value at the moment, so this is more an issue of what the stock does next. If it bounces, it will not lose profits on a one to one basis as it’s not 100 deltas yet, but it wouldn’t have to go much higher until not only the profits are at risk, but it could also be a loser. That breakeven spot to the upside is 200.75, so that’s a very important stop to keep, as getting out there would still mean a small profit in the next week or two, but anything above that means possible losses into expiration. On the downside you can be really patient with this as it could be worth up to $20 on a continued market selloff.

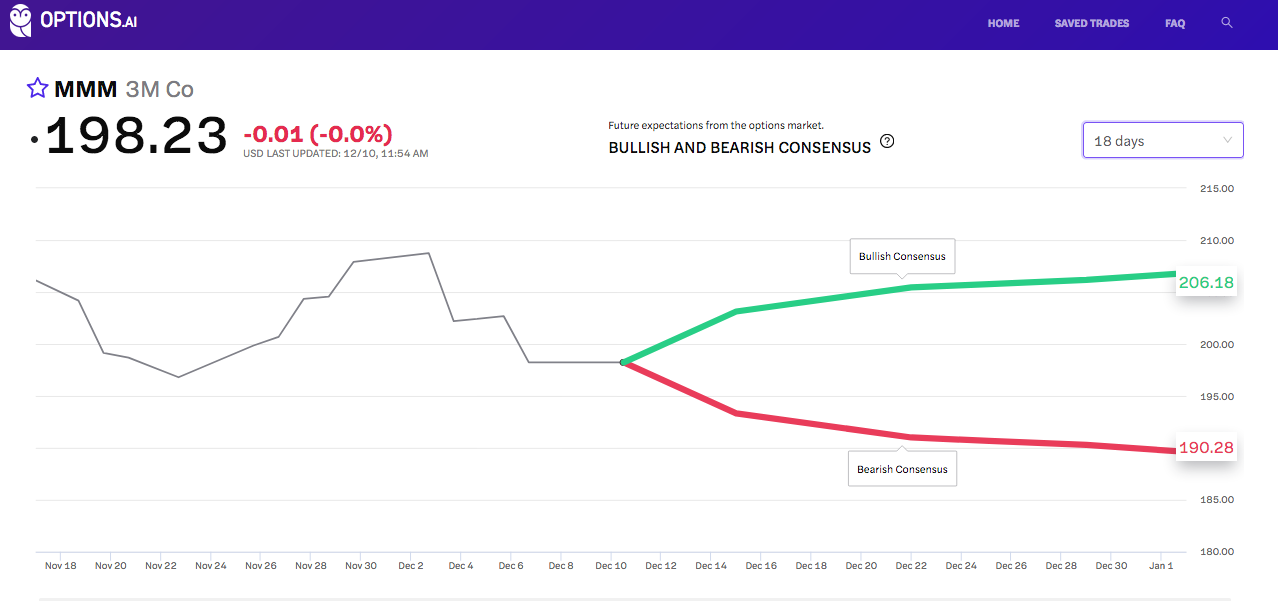

How are options pricing possible moves into year end? About $206 on the upside (which would make this trade worthless) and $191 on the downside (where this trade would be worth $14):

Therefore a tight stop on the upside around breakeven on this trade (200.75) and patience to the downside is in order.