In October, when XOP (S&P Oil and Gas ETF) was 39.20 Dan looked at the technical setup, having just broken support at 40 as well as fundamental issues like rates, oil prices and dollar and concluded a breakdown was possible into year end. Here was the trade idea, from Oct 22nd:

BEARISH TRADE IDEA: XOP ($39.20) BUY DEC 39 / 35 / 31 PUT FLY FOR 75 CENTS

-Buy to open 1 Dec 39 put for 1.90

-Sell to open 2 Dec 35 put at 65 each or 1.30 total

-Buy to open 1 Dec 31 put for 15 cents

Alot of that has come to fruition and XOP is much lower heading into December expiration. With XOP now 33.15 and below the short strike this trade is worth about 1.60. If XOP were to find some footing and get back towards 35 this trade could be worth up to $4. But with markets so volatile we also need to be careful of this becoming a loser on the downside! It’s breakeven lower is 31.75, and any close above 32.60 it is worth a little more than it is right now at expiration. Therefore it makes sense to keep a really tight stop on this to the downside. If the market looks like it may follow through (and there are alot of moving parts here obviously) to the downside then it probably makes sense to take the profits and move on. If XOP were able to bounce a little then patience would be in order.

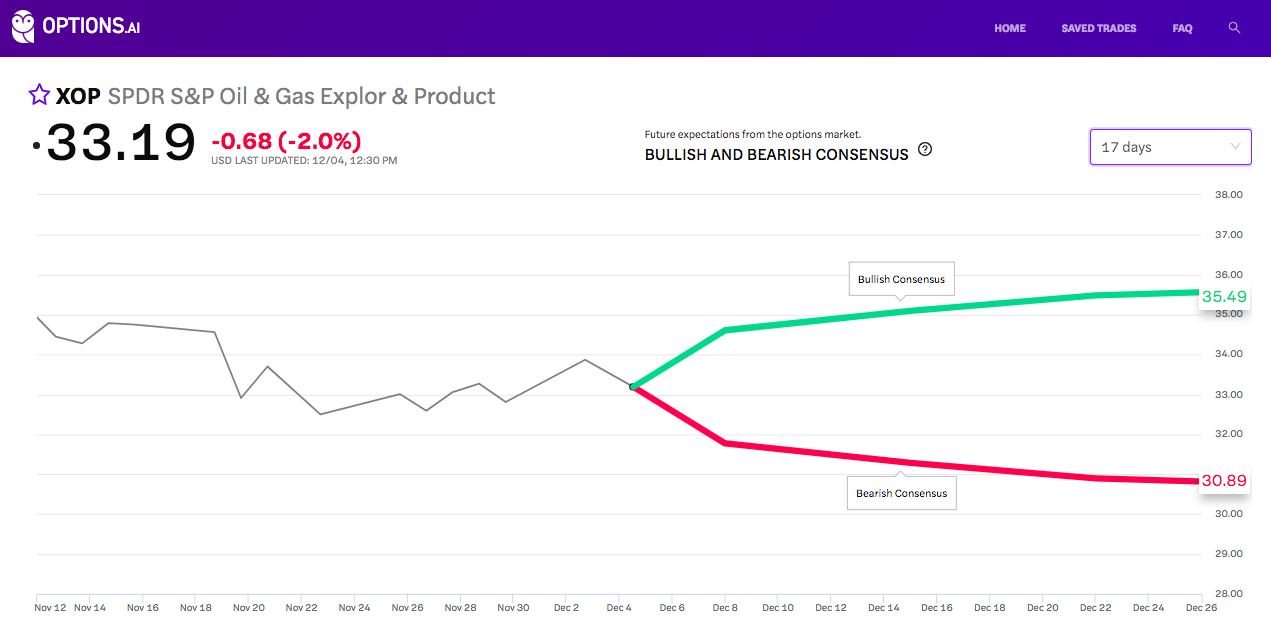

The expected move currently priced by the options market into Dec 21st puts XOP at about 35 on the upside but below 31 on the downside, so both are in play in this vol environment (from Options.ai):