Tomorrow morning before the U.S. stock market open Deutsche Bank (DB) will report their Q3 results. The options market is implying about a 6% move in either direction.

The stock has been a trainwreck in 2018, down 44% on the year, down 91% from its all-time highs made in 20017, and now just a couple percent above its 52-week lows made in late June and a few percent above its all-time lows made in 2016:

Sentiment on the stock could hardly be worse with only 3 analysts who rate the stock a Buy, 13 as a Hold and 17 as a Sell. I am hard pressed to find an equity the world over with a greater than $20 billion market cap so hated by the analyst community. Despite the stock’s weakness and the fairly well known fundamental issues, short interest is less than 5% of the float. One reason for this is that investors might have on top of mind the potential for a forced merger (as has been rumored with German peer Commerzbank) depending how much pressure they face as the European banks are shaken by disruptions with the UK’s Brexit plans, and Italy’s budget problems which has put dramatic pressure on European banks as a group. The Euro Stoxx Bank Index (SX7E) which is today making new two-year lows, is down 26% year to date, and down 33% from its 52-week highs made in January. The index appears to have solid long-term support down about 15% from current levels:

And its obviously not just European banks getting hit, the XLF, the etf that tracks the U.S. bank stocks today broke down below 1-year support at $26:

Regular readers know that I have not been a fan of owning banks all year (here) since the Jan highs, the banks have underperformed the broad market, despite the supposed benefits of the tax cuts implemented in late 2017, continued deregulation by the current administration, a supposed booming U.S. economy with the backdrop of lower unemployment, wage growth,manageable inflation and rising rates to assist net interest margins. If bank stocks could not rally here in the U.S, in that regime, I am not sure they will again for some time.

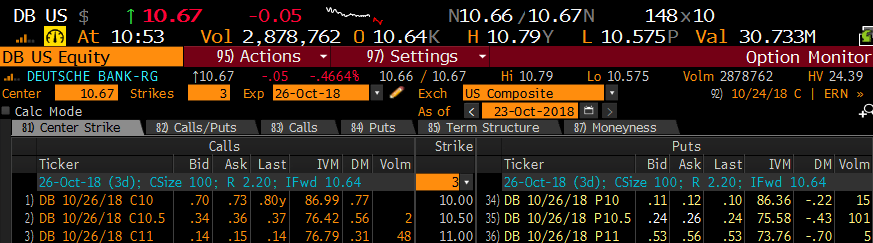

Now back to DB, with all that said, it is clear I am not a buyer of banks stocks, but don’t think they are a good press on the short side here either. But if I were inclined to play for a directional move post-earnings, the at the money put or call are dollar cheap, with the stock at 10.67 the oct26th weekly 10.50 call which is 17 cents in the money is offered at 37 cents and the Oct 10.50 put is offered at 25 cents. If you had a view that the stock could move 10% in either direction by Friday’s close, that would be the way to play for a trade.

If you had a directional view but wanted to give it a bit more time, so the trade is less binary if you got the initial direction wrong, then call or put spreads in Nov expiration look attractive… for instance:

Bullish trade idea: DB ($10.70) Buy Nov 11 / 12.50 call spread for 28 cents

-Buy to open 1 Nov 11 call for 38 cents

-Sell to open 1 Nov 12.50 call at 10 cents

Break-even on Nov expiration:

Profits of up to 1.22 between 11.28 and 12.50 with max gain of 1.22 at 12.50 or higher

Losses of up to 28 cents 11 and 11.28 with max loss of 28 cents below 11

Or

Bearish Trade Idea: DB ($10.70) Buy Nov 10.50 / 9 put spread for 32 cents

-Buy to open 1 Nov 10.50 put for 42 cents

-Sell to open 1 Nov 9 put at 10 cents

Break-even on Nov expiration:

Profits of up to 1.18 between 10.18 and 9 with max gain of 1.18 at 9 or lower

Losses of up to 32 cents between 10.18 and 10.50 with max loss of 32 cents above 10.50

The rationale for both trade ideas is fairly simple, if looking to pick a direction, long premium trades look dollar cheap, risking 3% to possibly make 10% with the backdrop of no shortage of market-moving news over the next month.