Salesforce.com (CRM) is scheduled to report their fiscal Q2 results tonight after the close. The options market is implying about a 4% move in either direction or about $6.50, which is very rich to the 1.6% average over the last four quarters, but shy of its ten-year average one-day post-earnings move of about 6.4%. With the stock just below $155. the Aug 31st weekly 155 straddle (the call premium + the put premium) is offered at $6.50, if you bought that, and thus the implied movement between now and Friday’s close, then you would need either a rally above $161.50 or a decline below $148.50 to make money.

Last Friday CRM broke out to a new 52-week and all-time high, placing the stock up 51% on the year, 3x the year to date performance of the Nasdaq Composite. The stock is up more than 100% from the start of 2017, gaining more than $50 billion in market cap. There is NO overhead resistance, while the next real support is down near the 100-day moving average, very near last month’s low at $135ish, a level that the stock has routinely checked back to during its 18-month, 100% plus run:

Sentiment towards the stock, like its chart, is pushing hard at the upper right. CRM has Wall Street analysts tripping over one another to top bullish estimates, despite rich valuation, with 36 Buy ratings, only 5 Holds and No Sells with an average 12-month price target of about $159. Short interest is below 2% of the float.

CRM trades about 67x expected eps growth (adjusted) of 71% in fiscal 2019, which is set to meaningfully decelerate in FY2020, whiles sales growth this year is expected to be flat at 25% with slight deceleration to 21% next year, placing the company at about 7.25x sales. ADBE which sports a slightly higher market at cap $131 billion vs $115 billion) trades richer an astounding 14.7x expected sales this year of $9 billion growing at an expected rate of 22%. I think it is safe to assume that both stocks at new 52 week highs, aside from Nvidia (NVDA) are the most expensive stocks over $100 billion in market cap.

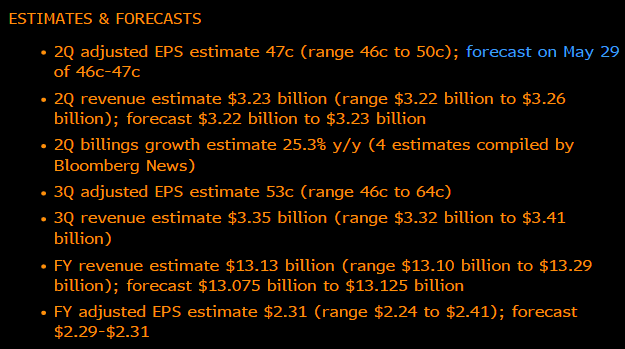

Expectations from Bloomberg:

If you are wondering how bulls justify higher highs after such strong price appreciation and rich valuation, from Morgan Stanley, per Bloomberg:

Partner checks continue to highlight healthy demand trends across Salesforce’s portfolio of products…

Next leg of stock performance will be based on proving the durability of better than 20% organic growth against harder comparisons and foreign exchange pressure, while at least maintaining operating margins.

Credit Suisse who also rates the stock a Buy, suggests, emphasis mine:

Our checks suggest an overall strong F2Q performance, particularly in large enterprise as we continue to hear evidence of strategic deals with Salesforce as the partner of choice for digital transformation. Our conversations were net positive yet more mixed concerning CRM’s Commercial Business, yet we note this segment seems to wax/wane a bit more based on economic and product cycles, but over time and combined with Enterprise, has driven steady performance.

So what’s the trade? If you were to pick a direction that means that you need just half of the implied move of 4% using at the money weekly options. if you were to make them into a vertical call spread then you define your risk to less than 2%, for instance…

Bullish Trade Idea: CRM ($154.85) Buy Aug 31st 155 / 165 call spread for 2.60

-Buy to open 1 CRM Aug 155 call for 3.10

-Sell to open 1 CRM Aug 165 call at 50 cents

Break-even on Aug 31st expiration:

Profits of up to 7.40 between 157.60 and 165 with max gain of 7.40 at 165 or higher

Losses of up to 2.60 between 155 and 157.60 with max loss of 2.60 at 155 or lower.

Rationale: this trade idea targets a move slightly higher witht he implied move, risks less than 2% to that.

The big issue with this trade idea is how binary it is, get the direction wrong and there is avery high probability that the trade is a total loss. Risking 1.7% of the stock price to make a two day bet that the stock rallies at least half of the implied move for earnings.

OR

If I were inclined to play for a miss and guide down I would look to play for a more sustained sell-off given how extended the stock is and how bullish the sentiment is, possibly targeting a check back towards the 100 day moving average.

Bearish Trade Idea: CRM ($154.80) Buy Sept 155 / 1378 put spread for $4

-Buy to open 1 Sept 155 put for 4.50

-Sell to open 1 Sept 137 put at 50 cents

Break-even on Septexpirationn:

Profits of up to 14 between 151 and 137 with max gain of 14 at 137 or lower.

Losses of up to 4 between 151 and 155 with max loss of 4 at 155 or higher

Rationale: this trade idea risks 2.5% of the stock price to target a move of nearly 10% over the next month towards what appears to be important near-term technical support.

Ill offer our normal disclaimer for long premium directional trades into events like earnings, you need to get a lot of things right to merely break-even, direction first and foremost, the magnitude of the move and of course timing. Trades like these are for those with directional conviction and an eye towards defining one’s risk.