Target (TGT) will report their fiscal Q2 results tomorrow before the open. The options market is implying about a 7.5% one day move, which is rich to its four-quarter average one-day post-earnings move of about 5.5%, and well above its ten-year average of only 3.3%.

On a couple occasions in 2018 I made the case why I thought TGT shares were cheap (here and here), and if they continued to execute on their turnaround plan laid out in 2017 that the stock should test it’s prior all-time highs made in 2015 near $85.

Despite the stock’s year to date out-performance of 27% vs the S&P 500’s 14% gains, and the S&P Retail etf’s (XRT) 15% gains, the stock remains fairly cheap at about 15x 2019 & 2020 eps expectations, despite low single-digit sales growth and flat gross margins.

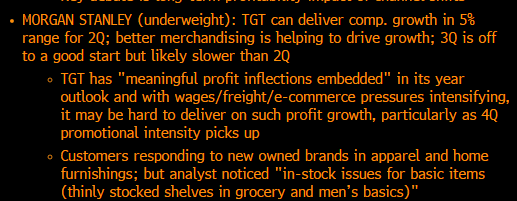

Wall Street analysts are fairly mixed on the stock with 8 Buy ratings, 17 Holds and 2 sells. Morgan Stanley who rates the stock a sell with a $70 twelve month price target highlighted the following risks into the print, per Bloomberg:

I guess the takeaway from this commentary is that expectations are already high and that the growing headwinds like rising wages, freight charges, and e-commerce competition could weigh on profitability.

From purely a technical perspective, the prior all-time high at $85 could serve as near-term resistance, while $79, the intersection of the breakout to new highs and the uptrend from the 52-week lows should serve as healthy near-term support:

So what’s the trade? I’ll offer a hedge for current longs and a defined risk way to play for upside into the fall…

If I were long stock, given the high implied move I might consider collars, selling an out of the money call near the implied move and using the proceeds to buy a put or a put spread. For instance…

vs 100 shares of TGT at $83 Buy Sept 89 / 80 collar for 60 cents

-Sell to open 1 Sept 89 call at $1

-Buy to open 1 Sept 80 put for $1.55

Break-even on Sept expiration:

Profits of stock of up to $6 between current levels and $89, stock called away at $89 but if stock there or above on Sept expiration, but could always cover the short call to keep the long stock position intact.

Losses of the stock down to $80, have protection below $79.45 (put strike less premium paid for hedge)

Rationale: Collars are to be used tactically, ideally paying as little as possible, in this case less than 1% of the stock price. One would only do this if they were more concerned about having defined risk to the downside and willing to give up some potential upside to lessen the cost of the protection.

OR

If I were inclined to play for a bounce post results tomorrow, and then possibly a sustained rally into Oct, I might consider a call calendar, selling weekly upside calls slightly below the implied move and buying Oct of the same strike. For instance…

Trade Idea: TGT ($83) Buy Aug 24th weekly / Oct 87.50 call calendar for $1

-Sell to open 1 Aug 24th weekly 87.50 call at 75 cents

-Buy to open 1 Oct 87.50 call for $1.75

Break-even on Aug 24th (Friday’s) close:

If the stock is 87.50 or lower the short Aug weekly call will expire worthless. Depending on where the stock is and how many deltas the Oct call gained or lost that premium from the sale of Aug could offset or add to value of the Oct. The max risk of the trade is the $1 in premium paid, a full loss could result from a sharp decline below the current price or a sharp rise above the strike.

Rationale: the idea of this trade is to catch a breakout on results, but then a consolidation for the rest of the week. Even if the stock is above the strike, the position can be profitable as the long call strike with more time value will also gain in deltas. The ideal scenario on Friday’s close is that the stock is 87.49, the Aug call expires worthless or covered for pennies, and the long Oct call has gained in value and now you are long a call in Oct that you can turn into a vertical call spread by selling a higher strike call in Oct, further reducing the premium at risk.