Spotify (SPOT) will report their first quarter tonight after the close as a publicly traded company. The options market is implying about a $14 or 8% move in either direction tomorrow. This comes as the stock, just one month after its direct listing at a reference price of $132.50 is trading at a new all-time high, above the highs made on its debut, before settling in a bit:

The trade setup into the print is challenging to say the least, with a market cap of $30 billion, well north or where many analysts thought it could trade on its direct listing and a day when the last high-profile internet service company SNAP is trading down 20% after whiffing on its earnings last night, making a new all-time low just a little more than a year after its IPO. SNAP’s short history as a publicly traded company with a founder, much like SNAP’s Spiegel, who has a fairly obvious disdain for the processes associated with being publicly traded company should give investors reason to curb their enthusiasm into the print. That said, if the company were to beat on all metrics, despite unprofitability, the stock will be headed straight to the nice round number of $200 in the company days/weeks.

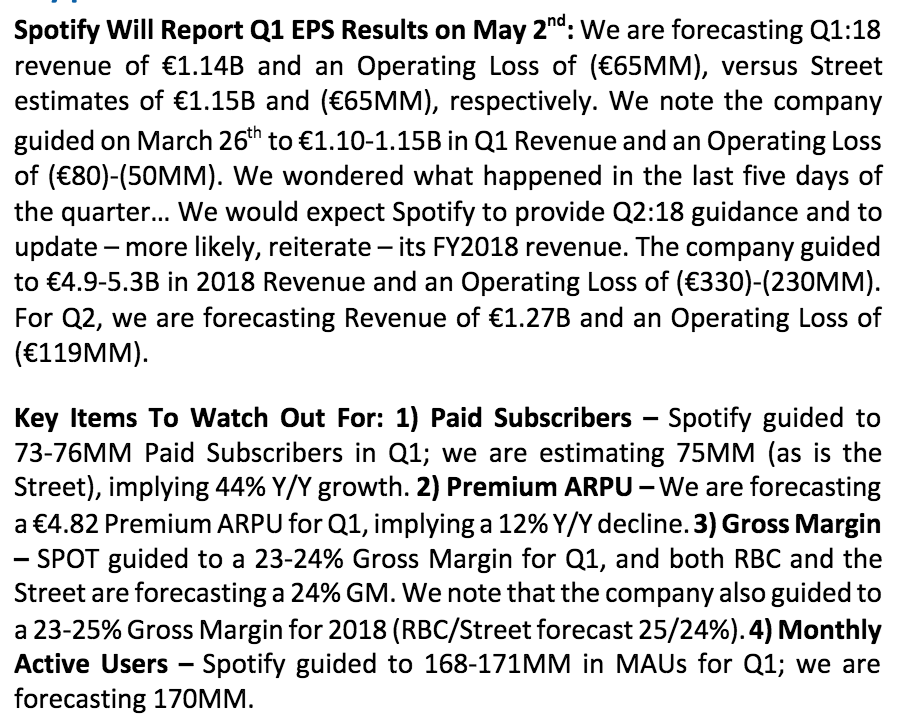

RBC’s star internet analyst Mark Mahaney who rates shares of SPOT a Buy with a 12-month price target of $220 highlights the following key points to look for in tonight’s report:

As you can see the metrics that investors and analysts are focused on are very similar to those that we obsess over with Netflix, Twitter and Facebook, tomorrow’s reaction in the stock market will set the tone for which will be most important in the near future.

But I think it is important to consider what SPOT CEO Daniel Ek recently stated in a blog post on the eve of their direct listing:

I suspect he is not too concerned about which metrics that investors and analysts want to obsess about on a short-term basis.

Its worth noting that with a $30 billion market cap, SPOT trades at about 22% of the value of Netflix which consensus sees raking in nearly $16 billion in sales in 2018, up 35% year over year, with over 120 million paid subs, wth GAAP net income of ~$1.3 billion. The main takeaway here is that NFLX is expected to have gross margins close to 38%, far greater than SPOT’s 24%. NFLX may prove to be a very tough comp for SPOT.

SO what’s the trade? I really have no clue how the company will conduct themselves given their non-traditional approach to going public. Most companies that go through the process of an IPO roadshow hold dear the age-old practice of beating on your first quarter out of the gate, those that don’t get punished (see Facebook in 2012 and Snap Inc last year). DId these guys hold something back, or will they set a more cautious tone about near-term growth given the stock’s very strong performance out of the gate?

So i’ll lay out a couple long premium directional ideas if I were convicted one way or the other.

Bearish Trade Idea:

SPOT ($169) Buy May 165 / 150 / 135 put butterfly for $3

-Buy to open 1 May SPOT 165 put for 6.30

-Sell to open 2 May SPOT 150 puts at 1.85 each or 3.70 total

-Buy to open 1 May SPOT 135 put for 40 cents

Break-Even on May Expiration:

Profits of up to 12 between 162 and 138 with max gain of 12 at 150

Losses of up to 3 between 165 and 162 & between 135 and 138 with max loss of 3 below 135 or above 165

Rationale: This trade idea risks less than 2% of the stock price to make a near-term bearish bet that is profitable on a very wide range to the downside in the next two weeks. The butterfly trade structure helps offset what is unusually high options premiums.

OR

Bullish Trade Idea:

SPOT ($169.) Buy May 172.50 / 200 call spread for 6.50

-Buy to open 1 May SPOT 172.50 call for $7.50

-Sell to open 1 May SPOT 200 call at $1

Break-Even on May Expiration:

Profits of up to 21 between 179 and 200 with max gain of 21 at 200 or higher

Losses of up to 6.50 between 172.50 and 179 with max loss of 6.50 below 172.50

Rationale: This trade idea risks a little less than 4% of the stock price to make a near-term bullish bet that stock continues to make new highs in the coming weeks. Risking 4% to maybe make 12.5% seems like a fair bet at best, but I guess its all a matter or conviction.

MY FINAL TAKE: I’ll offer our normal disclaimer for long premium bets into events like earnings, it takes a lot of things to go right to just break-even, first and foremost direction, then magnitude of the move and importantly timing. Without strong conviction, either one of these trade ideas would just be foolish.

I think it is safe to say that the way management handles this call will set the stage for years to come with earnings events that might prove to be a lot easier to try to trade then the first one out of the gate.