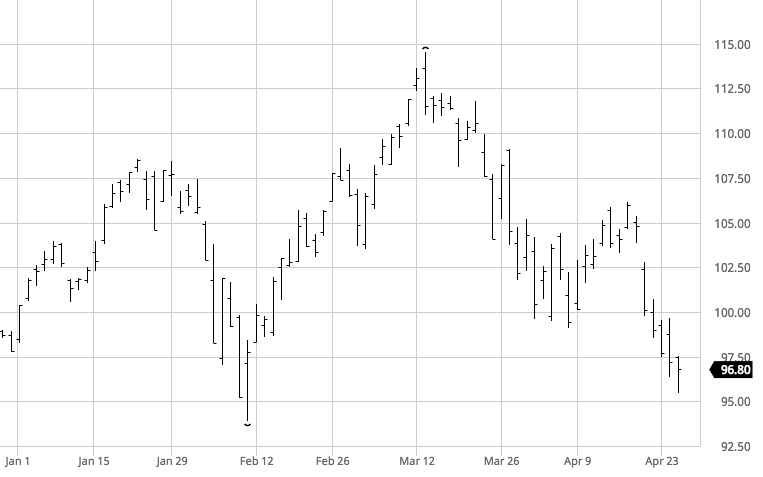

In late March we took a look at the outperformance Semiconductor stocks. Despite being down with the broader market on the February selloff, the SMH was still up 10% ytd vs the SPX which had gone red. We detailed a bearish defined risk position looking out to May: Here’s the original trade idea, from March 23rd:

SMH $106 BUY MAY 105 / 95 PUT SPREAD FOR $2.50

-Buy 1 May 105 put for $4

-Sell 1 May 95 Put at $1.50

We checked back in on the trade on April 2nd and updated with these thoughts:

With SMH now $100 and at the midpoint of the spread, this trade is worth $4.00 versus the initial $2.50 at risk. Intrinsically it is worth $5 (if the stock closed here on May expiration) so it has extrinsic value yet to be realized. I think it makes sense to stay patient on this trade. The SMH is still outperforming the SPX, the broader market is at or below the lows it put in in February, while SMH is still $5 above its lows from Feb. This trade targets those Feb lows and this could turn into a pretty nice trade if that were to follow through on the downside.

That patience has paid off as the SMH is now lower and time has passed, both helping the overall profits.

With SMH 96.70 today, the May put spread is worth about 6.20 versus the initial 2.50 at risk. So more than a double. Intrinsically it is worth 8.30, so there is still some premium yet to be realized, but I think for those looking for this move as a quick directional win it probably makes sense to take the profits and move on, rather than risk a bounce in the market which could take SMH back up towards 100 and risking these nice gains.