In case you missed it, Facebook (FB) the company is in a world of shit with no obvious quick fix to the mounting headwinds and scrutiny regarding their inability to suppress a 2015 data leak. Their lack of disclosure of said breach and lastly what they plan to do to avoid further breaches.

As you might expect, the issues for the company have caused the stock to decline 20% from its all-time highs made on February 1st, placing the stock down 10% on the year. Investors in the shares have a tough decision to make as it is fairly clear that the scrutiny of the company’s privacy policies will only intensify as Founder and CEO Mark Zuckerberg is expected to testify next week in front of Congress.

In an interview the other day, Zuckerberg said they have not seen any “material impact” from the scandal, but I think it is safe to say that assessment might be a little premature. If Zuck is right, and 2018 estimates for 20% eps growth on 36% sales growth (reaching $55.3 billion) then the stock is extremely cheap trading less than 22x this year and 18x next. But that’s a big if as investors forget despite the secular shift towards mobile ads, the ad business is very cyclical, let alone prone to consumer boycotts.

It might also be worth taking a look at the technical set up in the stock as it appears it is nearing important near and long-term technical support.

First, the one year chart, the gap level from last month to $170 should serve as near-term resistance and obvious bounce level, but I am hard-pressed to see a gap-fill back above 180 as there is not likely to be a resolution to the issues facing the company anytime soon. On the downside, $150, a level the stock has bounced off of a few times in the last ten days, is key near-term support:

Back the chart out to its IPO in 2013, and you can see that $150 is very important as it is also its long-term uptrend:

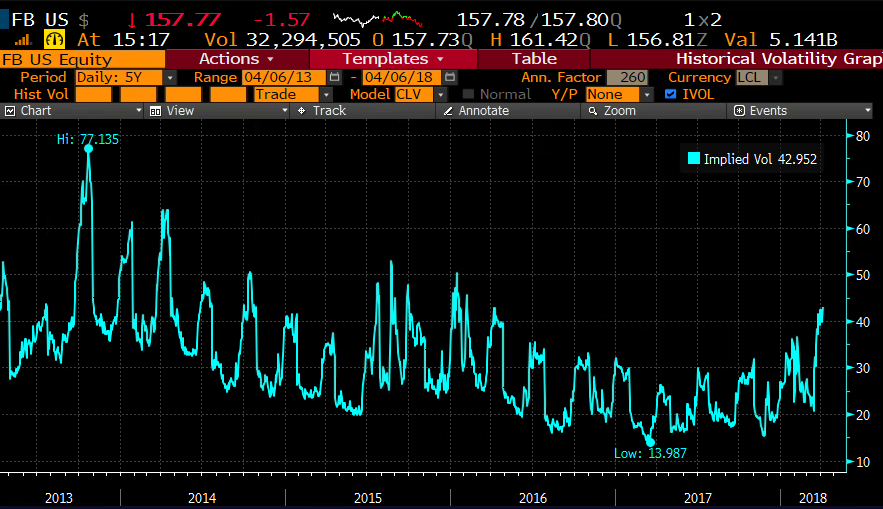

If I were long the stock, did not want to sell, but looking to add some dollar cheap protection for the coming months as this shakes out I might consider an options overlay called a collar. The idea of a collar is to sell an out of the money call vs long stock position and use the proceeds to buy a protective put. You might do this for a few reasons, you want to hold onto your position, but you don’t want to pay much for protection, especially in periods like now where options prices are elevated. Lastly, you are willing to give up some potential upside for defined risk to the downside. Short-dated options prices are at 52 week and multi-year highs, with 30 day at the money implied vol at 43%, making protective puts very expensive:

So what’s the trade? Long June Collar….

vs 100 shares of FB ($160) Buy June 170 / 150 collar for even money

-Sell to open 1 June 170 call at $5

-Buy to open 1 June 150 put for $5

Break-even on June expiration:

Profits of stock up to 170, stock called away at 170, but can always buy back short call to keep the stock position in place

Losses of stock down to 150, protected below

Rationale: If want to hold onto your stock, but are still very worried about any more unforeseen headlines that could cause the stock to make a new 52 week low below 140, this collar protects against that with the trade-off being a short call not too far from here at 170. But the thing with the collar is that if the stock were able to stop its decline and reverse towards that strike, the hedge could be taken off at any time, simply losing its mark to market losses. But if the stock were to breakdown further from here, losses would be capped below.