Tonight after the close Oracle Corp (ORCL) will report their fiscal Q3 results. The options market is implying about a 5.5% one day move tomorrow which is shy of its average of about 7% one day move following the last four quarterly reports but in line with its 10-year average.

On Friday’s Options Action on CNBC my friend Carter Worth of CornerStone Research laid out a very compelling case that earnings might serve as a bullish catalyst for the stock (watch video here).

Carter who I view as the best technician on the Street see’s the stock’s recent breakout above the five-year range, and ‘check-back’ to and bounce off of the breakout level as very constructive:

Carter also makes the case that not only has ORCL done that on a five-year basis, but also on a twenty-year basis, which further makes the case for higher highs:

My other Options Action friend Mike Khouw offered a fairly simple way to play for new highs with defined risk, merely buying the ORCL April 52.50 calls for 1.45 (vs stock $52.25) which has a break-even of $53.95 on April expiration, up 3.25%.

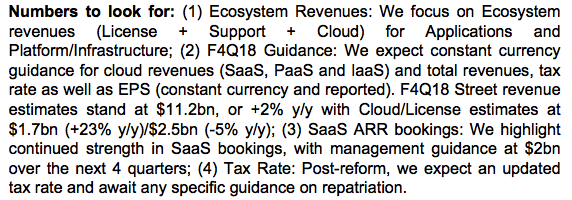

Credit Suisse who rates the stock a Buy, highlighted the following data points to look for in tonight’s print:

Shares of ORCL have declined following the last two quarterly results (down 3.8% post fQ2 and down 7.7% post fQ1 results) as the company in each instance guided the out quarter lower as cloud sales growth is decelerating with lower margin licensing sales making up a greater part of their sales mix. Based on current sentiment and expectations for an acceleration for cloud sales the company might do what they have done of late, meet already lowered expectations and guide lower. The stock is cheap at 16.5x f2019 eps growth of 8% on 4% sales growth, but unlike some of its large cap tech peers its leverage ratio ain’t great, $71 billion in cash but $61 in debt might limit the size of acquisitions it can make.

Oh, and I want to highlight one more fundamental point from earlier in the year that might weigh on cloud expectations:

Shares of Oracle got off to a bad start on the first trading day of the year as tech publication The Information reported (on Jan 2nd) In Major Shift, Amazon, Salesforce Move Away From Oracle:

Amazon, which began exploring Oracle alternatives in the early 2000s, is further along. Its retail unit has switched two internal databases that underpin its massive e-commerce operation from Oracle to NoSQL, a type of open-source database software, said two people with knowledge of the change. These include Customer Master, Amazon’s database for retail customer data such as names, mailing addresses, emails and authentication data; and Order Master, which handles data about customer orders, items and shipments, the people said.

Salesforce, which uses Oracle’s database in its customer management and marketing automation software, also is moving away from Oracle. Salesforce has been developing an Oracle database replacement, code-named Sayonara, Japanese for “goodbye,” and now is ready to deploy it internally, according to a former Salesforce employee with knowledge of the matter. Salesforce expects to be completely off Oracle by 2023, this person said. Fortune first reported on the Sayonara project in May 2016. A Salesforce spokeswoman said the company doesn’t comment on rumors.

While I generally leave the technicals to Carter… and I see what he sees too, but very near term I see something different when coupled with the potential disappointment on the fundamental front, I see the stock failed last week at short-term resistance:

So What’s the Trade? For a hedge, or If you are inclined to play for a post earnings decline in line or greater than the implied move, with follow though in the coming weeks, you might consider the following defined risk trade idea:

ORCL ($51.72) Buy April 52 / 47 Put Spread for $1.50

-Buy to open 1 April 52 put for 1.95

-Sell to open 1 April 47 put at 45 cents

Break-even on April expiration:

Profits of up to 3.50 between 50.50 and 47 with max gain of 3.50 at 47 or lower

Losses of up to 1.50 between 50.50 and 52 with max loss of 1.50 above 52

Rationale: this trade idea is already 28 cents in the money, offering a break-even down 2.35%, offering max gain down about 9% from current levels, placing the stock unchanged on the year and just above the February lows.