Shares of Pepsi (PEP) have underperformed the broad market in 2017, up 12% vs the S&P 500’s (SPX) 18% ytd gains, yet in line with the ytd performance of peer Coca-Cola (KO) and the XLP, the Consumer Staples etf. PEP has been very volatile of late, especially vs peer KO, which has had a more stable rise to its 12% ytd gains compared to PEP which saw an 11% peak to trough decline from its all-time highs made in mid-August to its early October lows, before recovering.

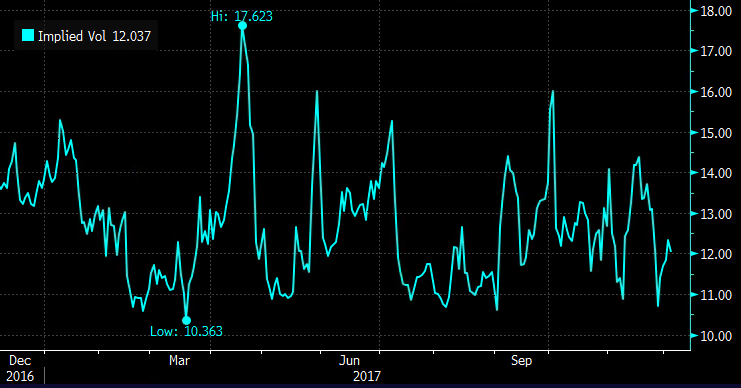

Despite the stock’s recent volatility, short-dated option prices have been relatively low making long premium directional trades attractive.

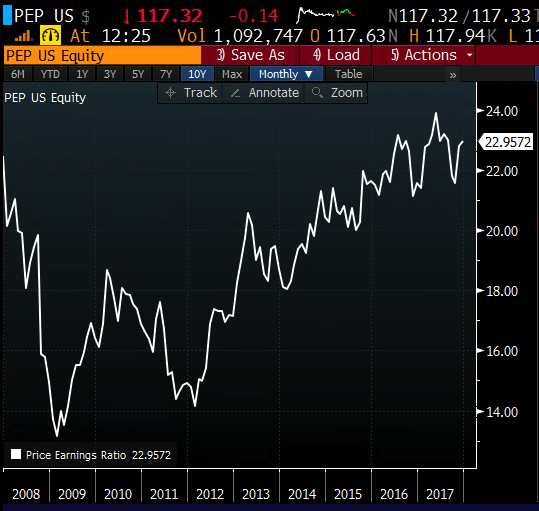

Shares of PEP trade at 21x expected 2018 eps growth of 7% on the largest expected sales increase since 2011 of 3%. On a trailing basis shares of PEP trade near 23x, just off of a recent 10 year high.

Aside from the August 2015 flash crash, shares of PEP have bounced off of the long-term uptrend, and approaching the prior all-time high from August:

As far as approaching that recent high, the stock could be approaching important near-term technical resistance:

Given the stock’s ytd underperformance, recent strength, high valuations, and relatively cheap options prices it might make sense to fade the recent move and target a pullback towards the October lows just above 105, eyeing their Q4 results (should fall in mid-Feb) as one catalyst.

So what’s the Trade? Well, there are a couple ways to play in my opinion from the bearish side…

if you think the stock consolidates into year end…. then it makes sense to sell short-dated put premium in PEP to help finance longer dated put premium.

Trade Idea #1: PEP ($117.30) Buy Dec 29th weekly / March 115 put calendar for $2.15

-Sell to open 1 Dec 29th 115 put at 55 cents

-Buy to open 1 March 115 put for 2.70

Break-Even on Dec 29th:

This trade performs best with a gradual move towards the 115 strike over the next few weeks. If PEP is at or above 115 on Dec 29th weekly expiration the short Dec 29th 115 put will expire worthless and the and the trade will be left naked long the March 115 put. If PEP is close to $115 then the March 115 put should have appreciated as it will have picked up deltas. At that point it might make sense to further reduce the premium at risk by selling a lower strike put in March turning the trade into a vertical put spread. The max risk of this trade is the $2.15 premium paid, and would be at risk with a large move above the current level, or well below the 115 strike.

Or Outrighht Bearish: If you don’t want to get too cute trying to game near term moves…

Trade Idea #2: PEP ($117.30) Buy March 115 / 105 Put spread for $2

-Buy to open 1 March 115 put for 2.70

-Sell to open 1 March 105 put at 70 cents

Break-Even on March Expiration:

Profits of up to 8 between 113 and 105, with max gain below 105

Losses of up to 2 between 113 and 115

Rationale: this trade idea offers defined risk bearish potential of a little less than 2% for the next 3 months in PEP playing for a move back to the Oct lows.