Square Inc. (SQ) will report their Q3 results tomorrow after the close. The options market is implying about a $3.60 move between now and Friday’s close, or about 10% in either direction which is about in line with the average one-day post-earnings move following the last seven quarterly reports since going public in 2015.

Shares of SQ are up 171% ytd, enjoying the tailwind of one of the most massive shifts in payments in decades towards digital and peer to peer.

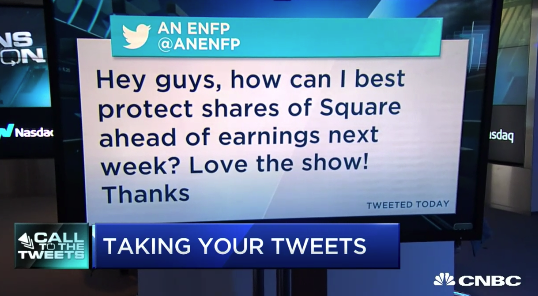

On Friday’s Options Action on CNBC a viewer asked the following (click the image to watch):

My thought at the time was to consider a overlaying a collar to long stock (selling an out of the money call and using the premium from the call sale to buy and out of the money put) as a way to define one’s risk to the downside, but also allowing for a certain amount of further gains in the event the stock goes higher. There are a couple reasons an investor might consider a collar on a position that they have large gains on. First, defining one’s risk after a monster run in the stock without paying much or anything to do it. Secondly, rather than just selling the stock and having a large tax liability this year, this overlay helps you hold onto the stock (with defined risk) giving you the option to sell in the new year, one where capital gains taxes might be lower. A third consideration is that the investor is knowingly giving up potential upside for defined risk to the downside. If you are the sort of investor who likes to put in limit orders, both for profit-taking and risk moderation, then this strategy makes perfect sense. And lastly, if the stock were to go through the short call strike you do not have to be called away, especially if you don’t want to pay taxes, you could always buy back the short call for a loss.

So in response to the question above from Friday’s show… here is a zero cost collar that looks attractive to me for long holders who worry about potential downside following tomorrow’s earnings, but importantly are willing to give up a certain amount of upside for a certain amount of downside protection.

Hedge against 100 shares of SQ long at $37: Buy Nov 34 / 40 collar for even money

-Sell to open 1 Nov 40 call at 65 cents

-Buy to open 1 Nov 34 put for 65 cents

Break-even on Nov expiration:

Profits of the stock up to $40, or up 8% placing the stock up 179% on the year

Losses down to $34, or down 8%, protected below.

Alternatively, maybe the stock is just getting going, see Nvidia (NVDA) last year’s 250% gains into this year’s 100% gains, now sporting a market cap of $127 billion! And its comments like these that are likely to keep investor’s reaching for stories like this, until the company miss-fires:

Oh and SQ’s market cap is only $14 billion, and despite only being mildly profitable, and sales just shy of $1 billion making any acquisition very expensive, the company could easily be in play given its relative small size to the likes of PayPal (PYPL) at $90 billion.

If you are a raging bull, and you think the stock’s run is not done then it might make sense to create a trade structure that offers a little leeway on a long entry, while allowing for healthy participation to the upside over the coming months.

Consider a call spread risk reversal, selling an out of the money put at a strike where you would be willing to get long in the event the stock were to decline over the life of the trade, and using the proceeds of the put sale to purchase an out of the money call spread of the same expiration.

For instance: SQ ($37) Sell the Jan 33 call to Buy the Jan 40 / 46 call spread for even money

-Sell to open 1 Jan 33 put at 1.25

-Buy to open 1 Jan 40 call for 1.80

-Sell to open 1 Jan 46 call at 55 cents

Break-even on Jan expiration:

Profits of up to $6 between $40 and $46 with max gain of $6, or 16% above $46

Neutral: no gains or losses if the stock is between $33 and $40

Losses of the stock as if long 100 shares at $33 or below, down about 12% from the trading level.

This position will have mark to market losses as the stock declines and approaches the short put strike, and will have gains as the stock approaches the long call strike. If the stock were below the short put strike on Jan expiration the trader would need to make a decision the stay short the put and be put 100 shares per contract short, or cover the short put and book a loss.