Exactly two weeks ago today, shares of Facebook (FB) had their worst trading of 2017, closing down 4% on the session, but in a year that it is up a whopping 50%:

The stock has since recovered, and this morning was threatening a new all-time closing high (from its post Q2 earnings reaction in late July). The one year chart might be a work of art, holding the uptrend like a boss, shrugging off negative fundamental news, and now basing at highs prior to its next identifiable catalyst, Q3 earnings confirmed on November 1st.

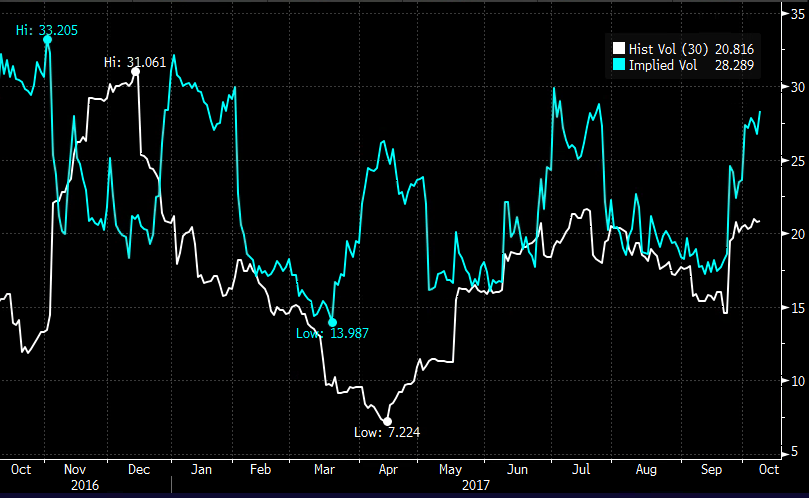

The options market is implying about an $11 move (or about 6.3%) between now and the close on November 3rd, which has essentially been its average one-day post-earnings move since its 2012 ipo, but also capturing nearly a month of possible movement before the event itself. Although it’s still well above the 2.8% average over the last four quarters. And while the implied movement over the next few weeks seems pretty cheap, it’s important to remember that’s vs a sub 10 VIX with FB 30 day at the money implied volatility (blue line below, the price of options) rising fast, and at a nearly 8 point premium to its 30 day realized volatility (white line below, how much the stock has been moving). So the market is pricing a move, but most of it is on the event itself, not before.

For traders who think Q3 earnings could be the catalyst for the stock to breakout to new highs and start a new leg higher after months of consolidation it might make sense to look to sell short-dated calls to finance the purchase of longer dated ones that catch earnings:

Bullish

For instance, with FB at $173 the Oct/Nov 3rd call calendar is 2.50, selling the Oct 177.5 calls at .85 and buying the Nov3rd weekly (that capture earnings) calls for 3.35. The most that can be lost on that trade is 2.50, and following Oct expiration that risk can be reduced further if the Oct 177.5 calls expire worthless and the Nov 3rd calls are spread into a vertical into the event.

If you are considering protection against a long into the Q3 earnings print, or considering an outright bearish bet, it might make sense to do the reverse of the trade idea above and consider a put calendar.

Bearish

For instance with FB at $173 the Oct/Nov3rd 167.50 put spread is 2.25, selling the Oct 167.50 puts at .75 and buying the Nov 3rd 167.50 puts for 3.00. This is the same factors as the call calendar but a little different if it is against long stock because it’s not a perfect hedge until after Oct expiration, before then a large gap lower (below 167.50) and the protection is lost. But that’s not likely to happen (a gap) and any weakness into earnings towards that strike the trade could be adjusted to provide more outright protection.