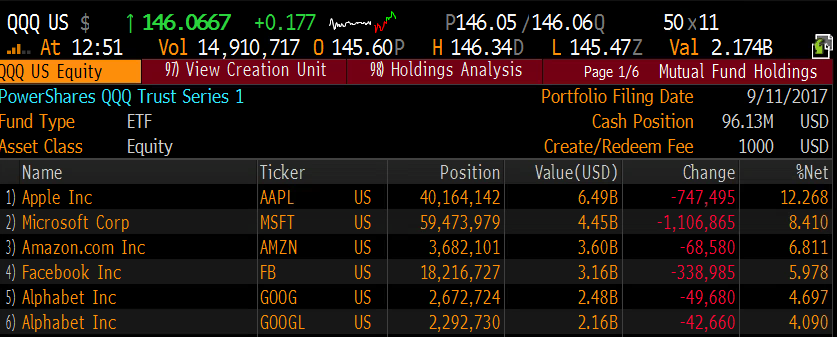

The top 5 holdings in the etf that tracks the Nasdaq 100 (NDX), the QQQ makeup 42% of its weight, or roughly $3 trillion in market cap of the almost $7 trillion in total market cap of the NDX.

The QQQ’s 24% year to date gains dwarfs the S&P 500’s (SPX) 13% ytd gains and outperforms the Nasdaq’s 21% ytd gains largely due to the significant ytd outperformance of the 5 stocks listed above:

Apple (AAPL) up 32.6%,

Amazon (AMZN) up 28.6%.

Alphabet (GOOGL) up 22.55%,

Facebook (FB) up 48% and

Microsoft (MSFT) up 20%.

What’s interesting to me is that in the lead up to Q3 earnings season, the SPX makes new highs daily, and the QQQ is less than 1% from its recent all-time highs, while the five stocks listed above are well below their recent 52 week and all-time highs with AMZN down the most: 11%, AAPL down 7%, FB & GOOGL down ~3.5% and MSFT down nearly 2.5%.

The point about earnings is important in my mind because investors reaction to results and guidance in this leadership group, that has lagged of late, might prove to be the key to how the Nasdaq closes the year.

No matter what your directional view, short-dated options prices appear to be dollar cheap in the Nasdaq 100, vs $146 in the Nov 17th 146 straddle (the call premium + the put premium) is offered at about $5 or about 3.5% of the etf price. If you bought that, and thus the implied move of the QQQ over the next 5 weeks, $151 or higher or $141 or lower to make money. What’s also important about the choice of Nov expiration to measure this movement is that most of the Nasdaq 100 will have reported their calendar Q3 results.

Since mid-July (Q2 reporting season) the QQQ has been fairly range bound:

If AAPL, AMZN, FB, GOOGL and MSFT were to make new highs into or out of earnings (or just a few of them) I think it would be a safe bet that the QQQ will breakout to new all-time highs.

So here are the earnings dates the big dogs:

- FB – 10/25 (estimated)

- AMZN – 10/26

- GOOGL – 10/26

- MSFT – 10/26

- AAPL – 11/2

That clustering of dates, after Oct expiration, but before Nov offers an opportunity to finance a breakout call by selling the same strike call before they all report:

So What’s The Trade? If you are inclined to think that positive earnings and guidance will serve as the catalyst for tech leaders to retest, or possibly make new highs, then you might want to consider financing Nov upside calls in the QQQ by selling shorted dated calls of the same strike

Buy 1 QQQ (145.90) Oct/Nov 148 call calendar for 1.10

- Sell 1 Oct 148 call at .43

- Buy 1 Nov 148 call for 1.53

Breakevens – This trade profits if the stock is close to 148 on Oct expiration, then has a chance to profit even more after Oct expiration if the index goes higher afterwards. It loses money of the index goes much lower in the near term or rips higher through the strike without the ability to adjust before Oct expiration.

Rationale – This trade idea plays for further near-term consolidation, limits risk to just 1.10 (less than 1% of the etf price) and sets up for a breakout in late Oct / early Nov.