In early August we checked in on consumer staples etf XLP and offered a way to play for some downward pressure into year end. We did that by financing December puts with the sale of September puts, a put calendar. Here was the trade idea, from Aug 7th:

Buy the XLP (55.36) Sept/Dec 54 put calendar for .75

- Sell 1 Sept 54 put at .28

- Buy 1 Dec 54 put for 1.03

The trade had a net debit of .75 and the September puts are now expired, meaning the position is now simply a Dec 54 put at a cost of .75. With the move lower today in XLP, now trading 54.35, those Dec puts are now worth about 1.00 vs the .75 cost.

From a trade management standpoint it makes sense to again reduce premium at risk by re-establishing a spread.

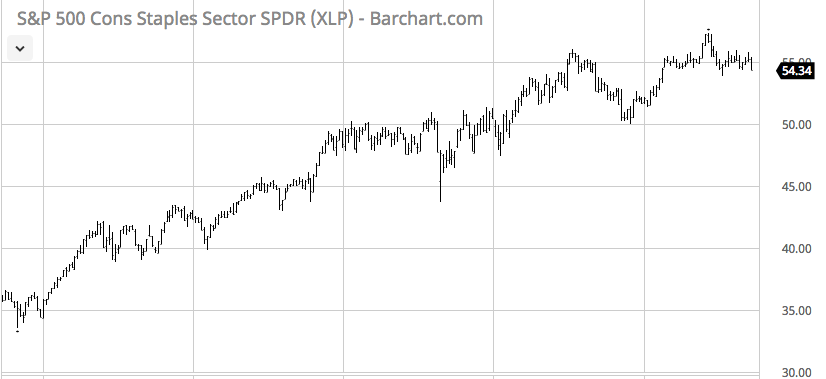

On the 5 year chart, any breakdown from this area is likely to find support around the $50 level:

That makes the 50 puts in Dec a good sale to reduce risk:

ACTION – Sell to open the XLP (54.35) Dec 50 puts at .20

New Position: Long the XLP Dec 54 / 50 put spread for .55 (currently worth .80)

Breakeven/Rationale/Management – Our new breakeven is 53.45 and that is a good level to watch for trade management purposes. If the stock remains above that it may make sense to take profits at some point, if it goes below that level patience is in order as it can be worth up to $4 with the etf at or below $50.