Bloomberg says McDonald’s is down 3.3% today because of the recent storms in the U.S. south??

Aside from maybe terrorism, investors, for the most part, are willing to give company’s a pass for ‘Acts of God’ like 100-year storms, let alone back to back in two weeks. The pressure on the stock for storm reasons is likely to be temporary. But what’s particularly interesting about MCD’s largest one-day decline since July 2016 is that it is coming from yesterday’s all time high, which marked gains of a little over 30% on the year. In other words the storm effects may be simply serving as an excuse for profit taking. The one year chart below shows the convergence of the uptrend from the stock’s 52-week lows, at the Oct/Nov double bottom near $110, and what might be viewed as technical support near the nice round number of $150:

If the stock were to continue lower and break below the mild near term support at $150 I suspect there is a room down to the low $140s near the stock’s Q1 earnings gap.

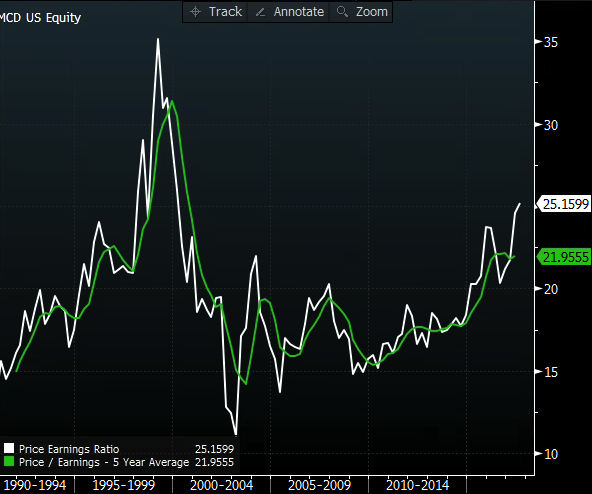

While investors have been geeked up about a massive menu revamp, a renewed focus on quality, healthy options and investment in tech for ordering, this excitement is reflected int he stock’s P/E multiple of 24x this year’s expected earnings growth, and 22x next year’s expected eps growth of a meaningfully decelerated 7%. The stock is priced for perfection, with P/E multiples at levels not seen since the dot-com bubble burst:

We are in a market where winners continue to have an underlying bid under them, with little concern for lofty valuations, while losers that are cheap make lower lows. The point here is that I would not short MCD on the storms, or valuation, but the ferocity in which the stock has sold off today on what I deem to be a BS headline might speak to a sentiment shift in the stock.

The next identifiable catalyst for MCD will be its Q3 results on October 24th before the market open. One way to play for a post earnings breakdown below near-term support might be to buy and out of the money put calendar.

For instance with the stock at $156 you could sell 1 Oct 20th (regular) expiration 150 put at 90 cents and buy 1 of the Oct 27th (weekly) 150 puts for 1.40. The idea here is the stock moves towards 150 between now and Oct 20th, and if the stock is 150 or higher the Oct regular puts expire worthless leaving you long the Oct 27th 150 puts for only 50 cents… at which point, depending upon how much they appreciated you could look to turn into a vertical put spread by selling a lower strike put of the same expiration, therefore reducing your premium at risk.