The VIX (the S&P Volatility Index) s up 33% today while the S&P 500 (SPX) is down about 1%, down less than 2% from its all time highs made earlier in the week.That’s kind of weird. Yeah the VIX is coming off a record low base exacerbating the percentage move after a prolonged period of low volatility with the stock market making records for record highs in 2017. All this despite the backdrop of the most hectic seven month period I can remember as it relates to our nation’s politics. This connection is important to me because I also can’t remember a time since the financial crisis where politics have the potential to influence our economy, and thus financial markets. In this case it’s geo-politics that have been this week’s trigger for pop in volatility. If this vol spike in equities is the start of a prolonged selloff, then searching now for cheapish vol while it’s still historically low makes sense.

Gold has caught a slight bid today, but up less than 1% which is surprising when you consider the big move in the VIX. But the gold miners etf, GDX is up nearly 3x that of the GLD (the etf that tracks gold). The chart of the GDX is less than stellar, with a series of lower highs over the last year, but the lows in March, May and July all around $21 might represent a triple bottom as the etf is now threatening a breakout of the downtrend:

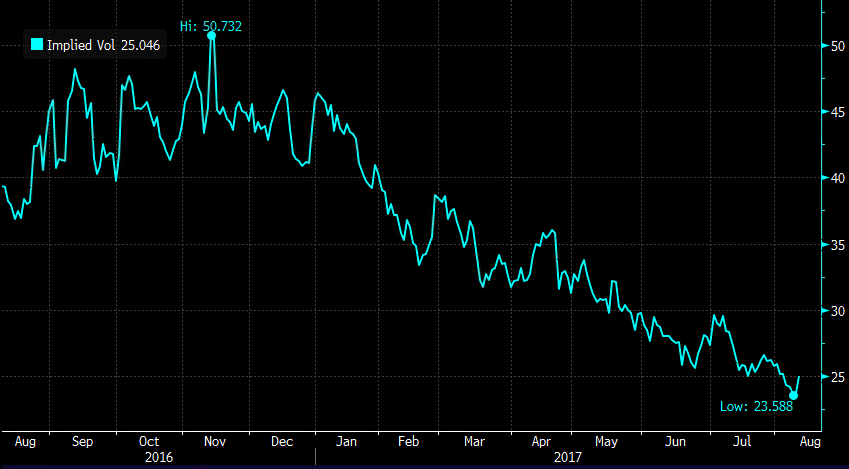

Short dated options prices are cheap as chips in GDX relative to its history, down 50% from its 52-week highs in November, but with 3o day at the money implied volatility at 25%, nearly double that of GLD’s 12%, investors are expecting daily moves of 2 to 3%. The margin for error owning that sort of premium is not great if the etf were to settle down:

But for those looking for cheapish vol to own in the event of a market correction in the near term might consider playing GDX for a move back towards $26.

So what’s the trade?

Bullish

GDX (23) Buy the Oct 24/28 – 21 call spread risk reversal for .30

- Sell to open 1 Oct 21 put at .35

- Buy to open 1 Oct 24 call for .75

- Sell to open 1 Oct 28 call at .10

Breakeven on Oct expiration – This trade breaks even on the upside at 24.30, risking .30 between 21 and 24. Below 21 it has risk like buying the ETF itself (plus .30). above 24.30 it can make up to 3.70 if the etf is at or above 28 on October expiration. To define downside risk the short put can be turned into a short put spread by buying the Oct 19 puts, adding .10 to the overall cost of the trade.

Rationale – This trade is low cost defined risk as long as the etf is above 21. Below that it has risk like the stock itself. Reward to the upside is good and looks for a breakout above recent resistance.